Suzhou – Gateway to China’s Fund Town

As someone who has a varied background, part financial markets practitioner and part financial markets professor, China presents a very interesting financial market development for me to observe. Articles about GDP levels, consumerism and technological advances in China have been very well reported on in the international press. But discussions about China’s domestic capital markets are much fewer in number.

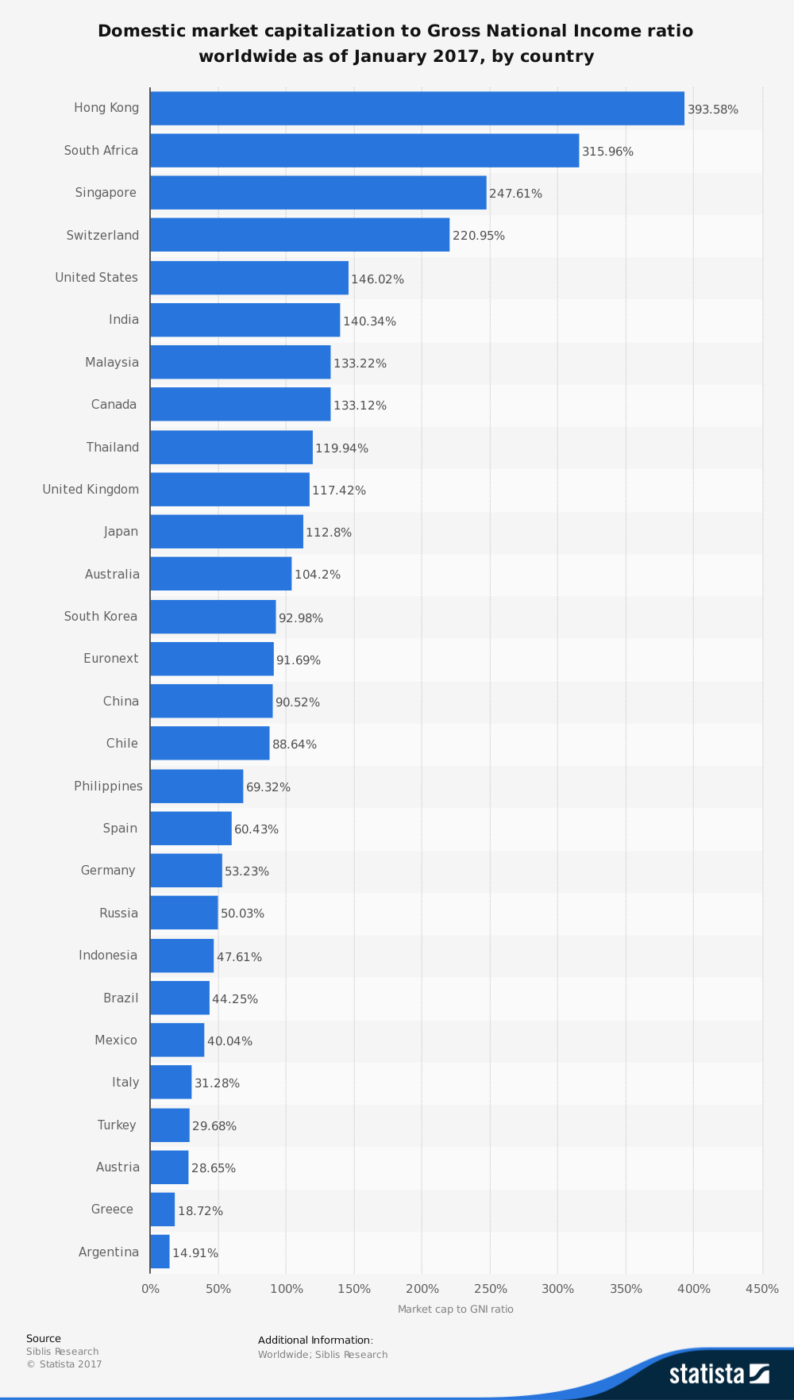

In nominal currency terms, the USA is the largest economy in the world and China is the second largest. However, the composition of the financial markets in these two countries is very different. Though an old study now, a 2010 McKinsey Global Institute study put the share of China’s commercial banking (non-securitised loans outstanding) to GDP to be 45.4% In America the figure was only 9.5% meaning the transition from banking to securities was still under-developed here. Since then, in China, government bond markets have grown greatly but as we can see in the side chart, equity market capitalisation remains well below many industrial countries. In the USA it is about 146% of GNI versus 91% in China.

Many of the older companies in China are SOEs or have SOE ownership or guarantees. This has implications for investors in terms of diversification. However, many of the new industries from AI to Big Data to Cloud Computing (the “ABCs”) and many new Healthcare sectors are being driven by pure private sector companies. In addition, many of these new companies are not large but are small-to-medium sized enterprises (SMEs). For these new industries to grow and prosper, for both the benefit of the overall economy and individual businesses, they will need a greater access to capital markets. I have been observing what is happening in China to address this need for some time now.

In the spring of 2010, I got involved with a new initiative at the Training Center of the NDRC. It had created the Corporate Finance Consultancy certificate program with the aim of retraining commercial bankers in the area of corporate finance. Originally, China had two large equity exchanges, one in Shanghai and the second board in Shenzhen. Then, in 2012, we saw the NEEQ open in Beijing as a “third board”. In the recent past, mainly the last two years, we have seen several provincial or “fourth boards” opening in China. Since this summer, my company, SEIML, has become a Strategic Partner with the Suzhou Equity Exchange (SEE), which was founded in April 2016. Exchanges like the SEE have a mission of supporting the new SMEs that are critical for China’s future growth, while also moving equity financing from the PE sector to “on-exchange”. The objective here is to increase corporate governance, financial transparency and, thus, create greater confidence in public securities markets.

I should clarify a point for those who come from international markets. Some of these 4th boards refer to themselves as ‘OTC markets’ and even in some CSRC documents the phrase ‘private equity’ appears with respect to these exchanges. They do have some differences from the main boards, they are only open to sophisticated, institutional investors (not retail investors) but they are not “over-the-counter” markets – they are on-exchange with all the disclosure and filings one would expect to see on secondary boards in other countries. That also means they are not private equity in the sense we use the term outside of China.

It has been very interesting to see this development in domestic exchanges over the last years and also the national training that was put in place in tandem. There is most definitely ‘a plan’. But there is another element in this plan, which is the creation of the Fund Town and one being built on a large scale here in Suzhou.

Broad ownership of equity investments (and other securities) can bring benefits to the economy and support individuals’ long term savings. Retail ownership of shares is quite widespread in countries like America and the UK. But, as I have written elsewhere, investing requires a certain amount of knowledge and education if ‘retail investors’ are to make informed decisions and not be mis-sold securities that are not suitable for their risk parameters. Bubbles and mis-selling have been the downside to broad retail participation in equity markets elsewhere. Education of the general public is an essential ingredient, but it also takes a long time to put in place. Another important ingredient for a financial center is the development and provision of good quality research for investors and issuers alike. Exploratory talks are underway to build a venture with a major statistics and research firm to focus on industries and companies both within Suzhou and of interest to Suzhou. These developments, research and education, will be driven by the Exchange.

The industrial and financial markets eco-system being built in Suzhou is fascinating to watch. We have had for years now a municipal government policy of attracting many types of industries to Suzhou, much of it through the Suzhou Industrial Park. Part of the newest stage of the industrial strategy is to attract the “ABC industries”, that is AI, Big Data and Cloud Computing, though healthcare and bio-med will also be an important focus. At the center of the issuer – investor eco-system, we have the Exchange being the platform for equity capital raising in Jiangsu Province (companies and institutional investors from outside the province are also eligible to participate on the Exchange). The current mandate is to list common shares, preferred shares and convertible bonds, though this product array may increase in the future.

The first roadshow of SIP’s “pioneer show” project in 2017 was launched at Suzhou Equity Exchange on March 29, with the participation of five quality ABC (artificial intelligence, big data and cloud computing) projects.

There are institutional investors who work directly with the primary issuance that comes through the exchange and with these investors will be the growth of fund managers that can advise the retail investing public on how to invest as these securities are packaged into funds. As an aside, the partnership between SEIML and the Exchange is to create the Suzhou International Board (SIB), a separate asset class on the Exchange where foreign wholly or majority owned SMEs can list and raise capital in CNY. This creates a new asset class for institutional investors in China providing additional diversification benefits.

One of my earliest experiences in the markets was in the 1980’s working at UBS as that bank played a key role in developing the EuroCanadian bond market. I found that a fascinating experience in every way. The growth of securities markets in China is being carried out in a more steady and planned way than the explosion of the Eurobond markets of previous decades. But it is every bit as fascinating to have the opportunity to get involved in building new markets. And despite the bad reputation that investment bankers got post-2008 (some of it deserved), broad, deep and well functioning capital markets are critical for our economic growth and to provide savings for our future.

John D. Evans, CFA

Founder of SEIML

3 January 2018