Interview with Mr. Enrico Danieletto, Head of International Business | Opstart SrL

Opstart is the first Italian portal for capital raised in 2020.

Script of Interview

Interviewee Mr. Enrico Danieletto (ED)

Position Head of International Business

Company name Opstart Srl

Company website URL https://www.opstart.it/

Interviewer John D. Evans, CFA (JE)

Date of Interview: 6 October 2021

JE Okay, good day to the viewers of SEIML Ventures Interview Series. And today we have our first discussion with Mr. Enrico Danieletto, who is both a shareholder and the Head of International Business at Opstart SrL, which is a crowdfunding platform in Italy. This is our first conversation, and we will do it in four parts. We’ll firstly speak and find out a little bit about Enrico personally and his background. Then secondly, we’ll turn our focus to Opstart and learn about the company, its business model, and its markets. And then we’ll talk a little bit about the crowdfunding industry, which is a sector of the financial industry, sort of new, but it’s growing and will be interesting to learn a bit more of that. And then for the fourth section, we’re going to do something a little bit different today. Normally, we finishe with a case study. But there’s something very interesting in investing in Italian innovative startup and that’s the investor visa. I won’t say any more now, we’ll come back to that at the end, but it’s a very interesting topic. So, in that regard, I’d like to introduce Enrico, welcome today Enrico. Nice to have you on board.

ED Welcome. My pleasure.

About Enrico Danieletto

JE Okay. So, let’s, let’s kick things off and learn a bit about yourself. Maybe we could combine the first two bullet points, give us a brief overview of yourself, your history and also your Professional Studies and experiences prior to Opstart?

ED Yes, I grew up in Italy, in a small town Padua, which is a historical university town, very close to Venice. I have lived in different European cities, especially in Milan, London, and Dublin, and I also spent some time in Munich for a short time a while working at international asset manager based in the Munich. When it comes to my very, very brief professional overview. Just to say I graduated in engineering, almost 30 years ago, was November of 91. And I moved then to Milan, and then to London, and I started working in the banking industry. But soon after, I moved to the fund management industry. Over the years I founded the developments as well have been very successful with many industry awards earned. And then in 2007, I moved to set up my own, regulated asset manager in the UK. Currently, I’m also on the advisory board of a well-known Italian University.

JE Okay, very interesting. So, to summarize, you’ve been in some element of financial markets all your life, you’ve had a European focus, but you’ve been in a lot of different European cities, you’ve moved around a bit. Okay. So just to complete the first start, I think I know the answer to it, but I’ll let you respond to it. I guess Opstart is not your only activity, currently? You have other companies, projects, investments, so what percentage is Opstart of your total work life and what other things are you doing alongside it?

ED Yeah, I’m a partner with Aleph Finance, the UK authorized and regulated company, I founded in 2007, which is active in asset management, wealth management and the capital markets. Aleph Finance is also a Euronext listing sponsor. So, this activity takes quite a while of my time, but I also have time to dedicate to Opstart also because synergy is between the two companies. And obviously, the activity when it comes to crowdfunding is mostly focused and concentrated in when the campaign is ongoing. So, the ongoing campaign, obviously then there is also the selection part and all of the other administrative tasks but I am more involved on the campaigns.

JE Okay, I mean, we’ll come back and we’ll talk a little bit about the industry later on and the connections between crowdfunding and exchanges, but I can see certainly a connect right there. Okay, so let’s turn to the second section now and focus our discussion about Opstart SrL. Give us a brief history of Opstart when it started, who founded it, when did your association start with it? A little bit of a history.

About Opstart SrL

ED Yep. And the company Opstart SrL, which SrL means Limited Company, was founded in 2015, on 22nd of April 2015. And it was funded mainly at the time that the new crowdfunding regulation came into place in Italy. It has been funded by Mr. Giovanpaolo Arioldi, the friend of mine, who is still the largest shareholder with some partners that started him and a few others that joined over time. The company is the leader in the crowdfunding space in Italy, in terms of the assets that are being deployed in different campaigns. And another important characteristic of Opstart is that is pretty diversified in terms of the crowdfunding initiatives that it offers to investors. So not just the equity crowdfunding, which is probably the main topic of this interview, but also the crowdbond. So, the placement of bonds and the Crowdre which is the real estate. So there are a few different sectors where the crowdfunding can be tried, and they are active in all of them. So, it is very interesting for the kinds of different opportunities that it offers.

JE Okay, and you’ve mentioned the shareholding and you’ve said it was you implied it was largely by individuals. So, is there any significant financial institution that is associated with Opstart, a bank an institutional investor or is it really run by the key individuals that you mentioned?

ED Yet, the main financial partner is the holding company that I have set up, which is an Aleph Finance Group plc, and it owns significant shares into the company. Aleph Finance Group PLC is a publicly listed company on the Euronext stock exchange in various European holding company, active in asset management, wealth management and Insurance Brokerage. Aleph Finance group invests in the FinTech space and Opstart is important, holding that really qualify as a true FinTech investment. So, this is the main partner in terms of financial shareholders. Opstart there’s also some other initiative and partners with other financial institution as well.

JE Okay, okay. I guess all aspects of the financial industry or have interconnections? So, it’s, it’s, it’s very difficult to be totally isolated by yourself, so that’s understandable. Let’s talk a little bit about regulation. It’s registered in Italy. So, who regulates Opstart? Is it regulated by an Italian authority, an EU authority, how does the regulation of crowdfunding platforms work in Italy and the EU?

ED Yep. The crowdfunding industry, at least in Europe, mainly started in the UK, which is the largest crowdfunding market where you have the largest players in the funding. When it comes to continental Europe, we have two levels of regulation, we have the European regulation and by the mainly the end of this month, by the October 25, we will have a new European regulation come into place to mainly allow the crowdfunding activities to be performed in a much more coherent and similar way throughout Europe and then we have the local regulator. When it comes to Italian situation that is the financial regulator, which is a Consob, and it has issued a specific directive for regulating the crowdfunding industry. So, the sector is carefully regulated. It’s less heavily regulated than other financial sectors, obviously less than banking, or less than fund management, or financial advisory and management. So, it’s definitely a more benign environment in order to have the start-up to fund themselves and to also help small investors to start with investing into the corporate financial world.

JE Okay, so let’s talk a little bit about the investors who participate on Opstart. I mean, geographically, is it just for Italians, or people in the EU? Or can anyone anywhere in the world invest in companies on Opstart? And secondly, is it just for individuals? Or can institutions invest as well?

ED It’s a very, very large many, everybody can invest, I mean to SMEs or startups through the Opstart platform. So, the main target when you think of crowdfunding, so the main investor target is obviously retail, so individuals, and there is no limitation in terms of individuals that can invest. So, they can be Italian, can be from European Union or outside, there is no limitation. And also, companies can invest themselves into crowdfunding. So, we have seen also holding company, but also some VC that are approaching it. When it comes to the figures, so in terms of funds raised at the moment is mostly individual investors and holding companies. But it’s really enlarging the range of investors that are using the platform that offers obviously some advantages when compared to direct investing into a non-public company.

JE Okay, and that will be very interesting and we’ll return to that in the fourth point when we talk about the Investor Visa. So basically, any person or entity in the world, in theory can invest into companies on the Opstart platform. So very, very wide open. So then let’s turn to the other side of the crowdfunding platform, the companies raising capital, can any company from anywhere in the world do crowdfunding on Opstart or is that more restricted in terms of what geography you come from?

ED Yeah, in this case, we have limitation that they need to be European SMEs, so small and medium enterprises, so a European and SMEs. When we talk about SMEs, dictate captivity is made by micro companies small and medium sized enterprises with up to 250 employees, and an annual turnover not exceeding 50 million euro, or an annual balance sheet total not exceeding 43 million euro. So, it’s a very clear definition a European wide, what can be considered an SME and so European SME can raise capital through a crowdfunding portal. But there’s a chance, but it has to be carefully studied and analyzed, of a non-European company setting up a European company and raising capital through the European say branch or controlled company. But this is pretty uncommon, and so we need to stick to the category of European SMEs.

Below is for illustration only.

JE Okay, so it’s not just for any company within the EU. It’s also restricted by size. So that if you’re a very large company, even though you’re not listed on the stock exchange, you may not qualify because you may have turnover or number of employees. So, it’s really focused in helping the startups and the smaller SMEs. Okay, that’s, that’s interesting. I’m, I’ve been in financial markets and I know one of the issues that regulators always face is how to protect the retail investor. And you said the crowdfunding platform is really more about the retail investor than the institutional investor. So, tell us a little bit about the due diligence process that maybe an average person couldn’t do. Is that the responsibility of an Opstart? How is that due diligence process managed to try to protect these individual retail investors?

ED Yeah, it is obviously very clear that, especially when we talk about startups, we talk about companies with a very limited history, and with a brighter, but uncertain future. So, from this point of view, there is no real, let’s say, strict regulatory limitations about the company is that can access the market once they are the, as we said, the European SMEs. On the other side, I will say that he is, especially in Italy, say some kind of moral suasion from the regulator or an agreed kind of understanding between all the operators, that in order to have the sector to be successful, there’s, say, less or small appetite for the risky outfit. So, there’s any way due diligence that is carried on the usually at least a couple of audited financials or sorry of financials for the last two years. There’s no requirement for audited financials, but obviously, it will be much better but that’s not common for a startup to have them. And the analysis really focuses a lot on the management of the company and the business plan. So, apart from, say, other statutory or regulatory checks that are part of the normal due diligence for the company, but a big focus is on the ability to present a valid investment opportunity. And usually most, most of the opportunities you find in the top are not really just say the, the idea, the concept, as you can find in some other countries, but most of the time are companies that are already having revenues. So, sales, even though not profit, but at least some sales. For the very close expectation to have revenues in the current or next year.

JE If I just make an observation, it, it sounds very similar to me, to the early days of the Eurobond market in the 1980s, where it really relied upon self-regulation, as opposed to heavy amount of government regulation. Because the participants, the intermediaries, needed to protect their relationship with their clients, and it just has a little bit of a similar ring to it. And that’s how I started my life in the market. So, an interesting analogy for me there. So, let’s, let’s turn to the third section now, where we’re talking more about the industry. So, is crowdfunding, sort of an industry sector? To itself? It seems to me, it’s sort of like, it’s a little different from venture capital, but it’s not a listed exchange. How do you characterize the crowdfunding industry? And is it sort of an industry unto itself?

About the Crowdfunding Industry

ED Yes. So, when we look from the regulatory standpoint, as we said before, there are specific regulations. And there are specific also, categories of activities. So, there is specific code of activity for companies that run a crowdfunding platform. So, from both the administrative and legal standpoint, operating a crowdfunding platform is a specific activity with its own regulation. And regulator has been very clear in carving out the regulation for the crowdfunding and making its own kind of regulation. So yes, it’s very separate in terms of what you can do, the work you can look for with the crowdfunding. So, this is from the administrative and regulatory standpoint. When you look at the investors obviously, this is mainly the only chance for investors to invest in public, publicly in public companies, private companies, and a kind of investment that was usually just for VC and private equity, or fore or very high net worth individuals that belong to a club deal kind of investment arrangement both formal or informal clubs for investment. So, this is a kind of democratizing investment into companies and to the so-called real economy. And for us, also from the kind of investors so there’s this difference. And in terms of comparing with venture capital, or private equity or listing on exchanges, that’s quite a difference. Indeed, most of the companies that are in the process of crowdfunding are companies that will probably not qualify yet for a structured venture capital. So, they would qualify for a club deal for family and friends, but for a more structured larger venture capital fund for example, they could still be too early stage or too small. So, in terms of size, in terms of the early stages in the life of the company, this is a sector that is most of the time also before the venture capital. So mainly you are talking about company, you start with the say, yourself or family and friends, and then you have the possibilities to go to kind of club deal but not everybody has the possibility of club deals also because it may mean selling a network of family personal relationship, whereas with a crowdfunding, you can go to the public and say, I have this idea, I have this company, this company is already making some inroads is going to have some revenues. And if you can help me, then I can also grow the company. Then, especially in the UK, we have seen some kind of crowdfunding, which was linked to the manufacturing, and ability to give to investors some kind of specific product, so please give him money, and I’m going to manufacture this device and you will have the chance to have it or to free or to buy a deep discount. So, this is definitely something that is not usually in the core of venture capital or private equity. So, and we also, obviously, from a financial standpoint, we have a very high risk, but high return potential. So, in terms of risk return also isn’t in the foreground of the higher risk – higher return, especially when you compare to, for example, listed companies or large listed companies. And then you have also the potential for crowdfunding charitable initiatives. So not for profit, and which is obviously outside of this industry. And finally, let me say that you can have the chance to find a company or a sector that can be out of favor with the institutional investors. Sometimes there are sectors that are disregarded, because they are not the most appealing or the most sexy for institutional investors, but they can appeal the retail investor. So that’s quite a difference.

JE Okay, and now that’s interesting. And my second bullet point in the industry was sort of a follow up, just find out where crowdfunding really positions itself with venture capital and listing. So, listening to what you said now, venture capitals often look at an IPO listing as an exit for them. I get the impression based on what you’ve just said that crowdfunding with its retail focus and smaller amount is maybe something before a company goes to venture capital, maybe an alternative for an angel investor, or seed investor. And so, the progression might be crowdfunding, venture capital, and then on-exchange, is that is that sort of how it fits into the financial supply chain?

ED Yeah, mainly that’s correct. Indeed. We have seen some venture capitals starting to look into the crowdfunding platforms to source potential deals, and they have the advantage of a company that has already been screened by the platform. They can also have a kind of sense from the public acceptance. Indeed, if you see a small company, a startup that immediately raise raises some important money then you can say oh perhaps this is validated. So also, from investors that can be consumers as well. So, that’s correct, there is just I would say a is small different pattern to this linear progression and that is in particular, something that has been pioneered by Opstart itself which is the Crowdlisting. Crowdlisting is a something that has been invented and the indeed it is also looked to be trademarked because this is let’s say, the combination of the crowdfunding and the listing into an exchange. So, the interesting thing is that when you combine the two, you have many of the advantages that both of the crowdfunding and listing. So, you have the advantages of raising capital in a much more, let’s say, easy, easy way with the ability to get a lot of people interested in early-stage company. But with the listing, you have the ability to also manage all these investors as a publicly listed company, which is much easier for a lot of different reasons. So especially for example, in Italy, some time ago, you had to go only to the notary to do the exchange of the shares. Now you can see if you are listed company you can just trade the shares that you want to buy. So, it gives liquidity gives the ability to manage the investment so with the proper instruments and gives you the ability also for the early investor to have an exit. So, in particular, I’ve been following this process with the first company that went into this process, which is listed in the Euronext Paris, which is Cesynt – Iskilled a company active in the online education market. And it was very, very interesting and it is something that as being also followed by other companies.

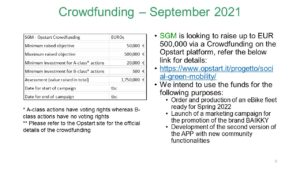

JE That’s very interesting because you know, the one thing that doesn’t exist in venture capital is really any secondary market, so you’re creating a secondary market as a part of a follow up business in Opstart. And you know, we’ve both been in the financial markets for a long time. And if you can provide liquidity to investors that’s, that’s a really great benefit. Very interesting indeed. Let’s try to quantify what the size of this market is for a company. I’m working with one company right now, that’s going to be listing an Opstart they want to raise 500,000 euros. What is the if the if it’s fair to say a typical size or range from small to large, that a company would look to raise at a single time on an Opstart crowdfunding.

ED The figures for the for the industry are in the range of 250,000 euros to 750,000. So, I would say that say half a million is a good estimate of what a company could look to raise for. Sometimes the company itself that has a lower minimum threshold and a maximum price cap as well sometimes so the company position itself in the lower range that we have seen many companies is raising up to north of 2 million euros. So, the potential is really there to raise more money. On the other side what has been also what has happened over the latest years, is that some companies have gone through multiple rounds of fundraising through a crowdfunding for different projects. It’s very interesting different but similar project very interesting for example on Opstart there is a company that is called Forever Bamboo and they bring into the platform new projects that are very similar, mainly to grow bamboo for industrial use. And that could perhaps sound familiar to your audience in China which is the land of bamboo. But also, there are companies that have gone through different rounds and they have been successful perhaps with the or most of the time with a higher valuation at each round so making also happy the initial investors and for in the typical stage for a company that is growing, which is similar to what happens with the round in VC. So, there is no real limit, but the limit in terms of how much you can raise is mostly legal to the company and the management of the business plans. I think that we have rarely seen more than 5 million euro raised, at least in Italy, whereas it has happened in other countries.

JE So Opstart does not set any strict minimum and maximum limits. So, if interest in crowdfunding grows and someone wants to raise a larger amount of money, you just mentioned 5 million, there’s no formal limits on what that amount can be.

ED No, not at this level. So obviously, you need not to go above the regulatory limits, but they are much higher.

JE Okay, okay, that’s very interesting. I’m just going to do a question that wasn’t on the bullet points but I think it’s relevant and I sure you know the answer. You’ve been talking about companies in the EU. Now the UK has left the EU, so does that mean that UK companies can no longer use Opstart?

ED What has happened is that we haven’t seen a UK company coming to raise funding in in Italy or other European markets continental European markets but just because that the UK market is much more developed and much larger. So that’s usually doesn’t happen and it didn’t happen before. I cannot say I have the 100% statistics so for all crowdfunding portals in continental Europe, but I say usually is like as a US companies, you do not list into Europe, unless for very, very specific reason, when you have the largest financial market in the world in the US. So, it’s the same for UK.

JE Okay, so from a technical point of view, they can’t use it. But historically, they’ve not been a user of it anyways. So, in essence, it’s not been a big issue for either the UK or for Opstart. Okay. Let’s go to the fourth and final section, which is very different in this interview. And it follows out of what you talked about, in the second topic about the investor base, where you said that they could come from anywhere in the world. Now there is something called the Investor VISA, which says that, if I understand it correct, if someone invests 250,000 euros in a specially categorized Italian startup, they can apply for Italian residency. Give us a little bit more discussion of what all of that is about. Because that might be very interesting to people in Asia or elsewhere, or maybe even the UK now that it’s exited the EU.

About the Investor VISA

Above is for illustration only.

ED Yeah. So, Italy has joined other European countries with a very long history of investors visa. So, from the UK, but also to smaller island of Malta and the Cyprus we have seen for many years, these investor visa program. So, also Italy, just recently, it’s the last few years, it started with a law of 2014, but it really took off in the last couple of years. As an investor visa program, this investor visa program is for all non-EU investors, individual investors, so there’s no geographic limitation. And it provides four options. 1. So you can either invest 2 million euros into Italian government bonds, which now are safer than in the past, given this EU kind of let’s say agreement or umbrella provided. 2. Half a million in any Italian limited company without a particular issue, or characteristics. 3. 250,000 euros in any Italian, innovative startup or 4. 1 million in philanthropic initiative. So as you said, investing 250,000 into an Italian innovative startup is the cheapest, in some way. So, for sure in terms of the initial that the money to be deployed, invested is the cheapest way to get a two-year visa that can use is almost I would say almost automatically extended with another three years or you have any way other option to extend the visa. So, consider also that you become a resident in Italy and that it gives a lot of advantages. In terms of tax return discounts, or discounts in the tax filing in the taxes you paid the company you’re investing into an innovative start up. But these other minor if you really move and don’t have other income here in Italy. Anyway 250,000 and in doing a notice the top which is very well defined that kind of company and you get the investor visa. Just to say that there is say not another criterion, but you need in advance to obtain a Certificate of No Impediment that can be released online by the visa for Italy committee. And mainly just to simplify requires that they you have no say criminal records or no evidence of criminal record say in your criminal record statement. So, it’s quite simple at the end, especially for an any innovative startup. So, these are the main requirement for to get an investor VISA.

JE Okay, I want to follow up on two points you made because these are very important details. This term ‘innovative startup’ I’m guessing not every company that lists on Opstart is an innovative startup. So, who determines what is an innovative startup? Is there a government department that decrees that and when companies list or apply to Opstart does it say which have the category innovative startup and which don’t?

ED Okay, this is a non-discretionary process and it is a very, very well defined in terms of what an innovative startup is, which companies can qualify. I just give you some or most of the characteristics as bullet points. So, first of all, not older than five years. So, maximum 60 months of life for the company. Obviously an Italian company. It does not to have a turnover bigger than 5 million euros. So, obviously, it’s a small company. it doesn’t pay dividends. The goal and the statutory goal I will say of the company is to develop manufacture and sell innovative product or product with the technological added value. Okay, then it is a company that is started by on its own and not by a spinoff. And at the end you have that at least the r&d expenses are higher than 15% of the all the cost of production or all the turnover. And you will have to employ some people with a degree or doctorate degree into the company. So, you also have to employ people that are higher qualification.

JE So, is there some official government list that says these companies have been classified as innovative startups? Or is it that your platform will do an analysis and advise investors that this qualifies to be an innovative startup?

ED No, the way it happens is that the companies that things think of having these stages I also add the ownership of a patent or the process of owning a patent and to the previous list. But mainly the companies that are believed to be potentially classified as innovative startups, just file an application with the Companies House and in Italy, you have, say the local Companies House and in the timeframe, and that really depends on the Companies House you apply to. Could be if you a couple of weeks or could be a few months, you get to these stages. And then there’s a Public Register of the innovative startups. So, this is very well defined, and it’s not up to the platform to decide or is not the kind of market standard. It’s very, very well regulated also, because, as I anticipated, it gives you a lot of financial incentives. And so, it has this fiscal implication also for the individuals that invest that into positive implications. Individuals, that invest into this company.

JE Okay, so just to summarize that it’s the responsibility of the company to submit an application to get approved that it has qualified as this. And there is also a public registry, that potential investors can check to confirm whether this company has got that grant and therefore, from the foreign investors point of view, to confirm that is a company they could invest in with respect to the investor visa. Okay. That’s very interesting. Okay, that’s, that’s a really different topic to close on. But I think it will be very interesting. And I’m going to add one last question that just sort of ties this together because as you said, your title at Opstart is the head of international business. So, to close things out, what are your key goals in terms of growing this platform internationally? Companies have to be in the EU, but investors can be globally. You got this investor visa? What is your vision? What are you trying to achieve internationally in the years ahead?

ED Yeah, the goals are mainly to have more exchanges of knowledge and financial flows between different areas. So when, when it comes to China, for example, we know that China in some ways the manufacturer of the world, so especially for a lot of startups, a Chinese startup and the technological field having potential Chinese investors or Asian investors, it’s really of high value. It’s a very, very good way to have the chance to be connected to one of the largest economies in the world and it can be on the manufacturing side, but it can be also on the commercial side, ability to open new markets. So, the ability to internationalize to have more say a mix of investors and companies from different parts of the world, even in this time and well say the pandemic, the global tension means some say a smaller say or more as a fractured world and this is not in the interest of investors or in the companies that look at the global world. So, we look to these international investors come into Italy, where there are very, very interesting companies that have most of the time, a lot of technology, a lot of knowledge and a lack of capital. So usually, Italian investors are very cautious and the largest in terms of cash into the accounts or into the bank accounts. And having as a different way or seeing different approach to businesses will be definitely good for international investors. As for the Italian Ministry of Economy website, you can have exposure to one of the world’s top economies and markets, strategic logistic, connecting global markets, key global player in manufacturing and export, highly competitive machinery sector and strong Made in Italy brand, excellence in r&d and innovation. So, I just needed to say that an Italian, just won the Nobel for physics. So that’s a very important statement in the ability also in the r&d. A skilled and competitive workforce. Obviously, a cultural offer, a country brand, and now we also have a strong set of policies and incentives to improve the competitiveness and a new pro-business attitude, especially with this government. And the country is really open to foreign investment, so there’s no real restriction, especially when it comes to small and medium enterprises.

JE That’s very interesting. It’s a global world, capital moves around and I can now after you’ve just presented this, I can now see where Opstart fits into this sort of global financial world of helping the suppliers of capital, deliver the money to the people who need to raise the capital. It’s a very interesting business and who knows, maybe in five or 10 years now, Opstart will be as big as UBS is, because there’s certainly still lots of room for financial flows. So, I wish you the best of luck. And thank you for the time that was really very interesting. It’s a new topic to a lot of people even though you said the regulations have been in place from 2015. People know a lot about venture capital, but I don’t think they know quite as much about crowdfunding. So, I’m sure the viewers will find this very, very interesting. So, thank you for your time today Enrico. That’s the that’s most appreciated.

ED Thank you so much for your interview, and bye to all listeners and viewers. Thank you.

End.