Interview with Mr. Mike Grundy, CEO & Cofounder | Amazon-Papyrus Chemicals Limited

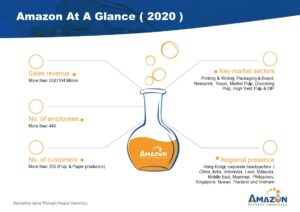

Amazon Papyrus is a leading specialty chemical and process solution provider to the pulp and paper industry in Asia. In this interview, Mike Grundy, CEO & Co-founder, gives us an overview of its markets and strategy.

Script of Interview

Interviewee Mr. Mike Grundy (MG)

Position Co-Founder & CEO

Company name Amazon-Papyrus Chemical Limited (APC)

Company website URL https://www.amazon-papyrus.com/en

Interviewer John D. Evans, CFA (JE)

Date of Interview: 20 September 2021

About Mike Grundy

JE Okay, good afternoon to the viewers for this episode of SEIML Ventures interview series. Today, we have Mr. Mike Grundy, who is the CEO of Amazon-Papyrus Chemicals Limited, which is headquartered in Hong Kong. This is the first time we’ve had a discussion with someone who runs a company in the chemicals sector. So, I think this should have a lot of new and interesting information. We’ll follow a four-section format. We’ll start off talking a little bit about Mike and learning his personal and other background. Then we’ll focus on talking about the company, how its setup, structured, etc., etc. Then we’ll talk about the chemicals industry. And then finally close off with Mike is giving his near-term outlook about sort of the key things to achieve maybe between now and the end of the year. So that will be our agenda for today. And we hope you find this interesting and informative. So good afternoon, Mike. Nice to have you here.

MG Thanks John.

JE Okay, so let’s kick things off. Let’s combine the first two talking points about yourself and give the viewers a brief overview of yourself personally, where you grew up, etc. And you’re studying and training to prepare you for a career in this industry in the chemicals business.

MG Okay, so I’ve worked my whole life in the pulp and paper industry. I studied pulp and paper science back in Scotland many, many years ago. And following that I worked in a paper mill on the production side. It would affect all the way through from production through to the finishing end with paper. I had a number of years on the production side, and then I changed companies and moved to the chemical side, supplying what’s called process chemicals to the pulp and paper industry. And I was based in England, covering southeast of England. As I moved on in my career, I then eventually became responsible for the whole of the United Kingdom. And then I moved to take responsibility for Northern Europe which covered Belgium and Holland, as well as the UK. And then in the year 1996, I moved to Singapore, with the same company to take over the regional responsibility for Asia Pacific. I was a very interesting move, really fascinating time with the industry growing very rapidly. However, our company was taken over by another American company in 1998. And soon after that, I decided to leave and set up my own company along with my sales director. So, in 2000, the year 2000, we set up Amazon-Papyrus Chemicals, and we have just celebrated our 21st birthday. In that time, we have grown from just four people, very, very small staff, not a lot of money. Today, we have about 440 people spread over 12 countries that we are selling into.

JE Right now, you’re in Hong Kong. So, you made a decision when the previous company was purchased to not only set up your own company, but to headquarter it in Hong Kong as opposed to Singapore?

MG Yes. Two reasons. One is, as I said, I set this up with my business partner he’s Hong Kong-Chinese and was not very keen on moving. But actually, Hong Kong is a very good place. You know, we’re looking at our markets in Taiwan, in China, in Philippines, Malaysia, and Thailand. So, this was quite Central. So, from that point of view, it’s very easy. And the Hong Kong government make it very business friendly and setting up businesses is very easy over here. So, if it was a little bit personal with my business partner, but also from proper business reasons we set up in Hong Kong.

JE Okay, so you were the Founder, or at least the co-founder of this company. So, you’ve been there from the very beginning. Okay, okay. Is Amazon your complete focus? Or do you have any sort of other business interests, directorships or things of that nature?

MG Well, I have done some angel investing. And I’ve tried to help some small companies get started. But Amazon absolutely is sort of 95% of my focus.

About Amazon-Papyrus Chemicals Limited

JE Okay, super. Okay. So, let’s turn now and talk about the company about Amazon-Papyrus Chemicals Limited, abbreviated APC. So, you’ve told us how it came to be and your association with it? How did you choose the name Amazon?

MG Okay, it’s, it’s an interesting story really, in that you got to understand, we had nothing, we had no money. And we say we only had four people. And we wanted to make the company sound bigger than it was. On the biggest rivers in the world is the is the Amazon. Everyone’s heard of the Amazon River. And you use a lot of water in making paper. And, and that’s how the Amazon came about. And the Papyrus part is the Egyptian word for paper. So very simple, nothing to do with amazon.com.

JE Okay, and you don’t have any offices in Brazil?

MG That’s right. Yes.

JE Okay. So that’s interesting. So, you, you set it up from scratch with your former sales director? What were the first two or three critical milestones that that made you believe this was going to be long term success for you?

MG I mean, at an early stage, the critical issue is always cash. And, of course, you know, we went through, as many small companies and start-up companies go through is very, very difficult cash times. So, the critical issue is whether we get paid and when we get paid. And we would have internal discussions and arguments about who is our best customer. And we have a very large customer, for instance, in Indonesia, that would pay us in 45, 50 days. On the other hand, we have a smaller customer in China, that would pay us in 15 days. And the reality was getting paid in 15 days was absolutely vital, at that time. So, in the first two, three years, it really was cash, cash, cash, making sure that we were on top of our receivables. And making sure that you know, we, we if anyone was slipping behind, we collected that money in. And make no mistake, we played the small business card where you know, we need your we need your help for pay us. So, we didn’t get put into the big, massive companies that were left to be paid in 60 or 80 days, we really chase people, pleaded to get our money, get our bills paid.

JE Interesting, it reminds me of my very first job in a bank, in a commercial lending branch, dealing with SMEs. And the whole critical review of the bank manager when he met with the principals was evaluating the accounts receivable and the inventory. How overdue were they were? It took me back when you said that

MG It is absolutely true. There was a period whereas a company grew, our P&L showed we were making money. But where’s the cash? Where is the cash? And actually, I hired a consultant to come in and say, Where is it? And of course, he broke it down and looked at our inventories, looked at our receivables and broke those down to the areas where we had too much stock or so we were looking at an average stock level, which may have looked okay, but within that average, we had some items that were very high stock levels. So yeah, it’s a question of the learning curve that we went through. Absolutely.

JE Okay. How long did it take you before the company became profitable?

MG Well, if I say from a P&L point of view, we were profitable, probably within the first nine months to a year. But we were very vulnerable to you know, most, most small companies die through lack of cash, not through profitability. So, it was really good two to three years before we really were on top of the cash cycle. And of course, the problem is we were growing quite fast. And what happens to your cash when you grow fast, it just gets consumed. So that’s, I see it like children’s seesaw, where, for a long time, it was out of balance and we didn’t have the cash and then it became a little bit more balanced. And eventually once it tipped over and when we had free flow of cash, we never went back.

JE Congratulations. Good, good. Now you’ve, you’ve mentioned the pulp and paper industry, which you started out in. And you’ve mentioned the chemicals that are now being sold to the pulp and paper. For those of us who don’t have this sort of technical background, describe what your main product or main service offering is in sort of non-chemical terms.

MG Okay, so as we’re talking about a typical paper mill making, printing, writing, copier people that everybody uses. If you want to build one of those, you’ve got to start thinking of 250 million US dollars. So, it’s their huge capital-intensive projects. If it’s a pulp mill, you could be talking of a billion dollars quite easily. So, it’s vital that they run consistently, and the quality is good, and it doesn’t break down. Because every time your shut, you’re losing money. So, and these machines, some of these machines are running 60-70 miles an hour, if you think something like a tissue machine, it runs so fast, you can barely see it. So, if there’s any contamination in there, the paper will break, or the paper will be contaminated. If you have a break, if you’re lucky, you just lose about 20 minutes of production. And it can be a lot worse than that. So, these machines have what is called a contribution cost when they’re running. If they’re not running, then there’s no contribution, the contribution could be 15 thousand dollars an hour. So, if they shut for 20 minutes, you’ve lost $5,000. So, what do we do? One of our core products is controlling the microbiological activity, stopping bacteria growing in the system. So, I look at it to papermill system has a huge volume of water that’s going around, it’s nice and warm, and there’s foodstuff for the bacteria like starch, it’s a little bit like holiday in the Bermuda for the bacteria, they love it. And if you allow the bacteria to grow, a slime will develop and will eventually break away. And you either get a black mark in the paper or you’ll break for paper. So, controlling that bacteria is the growth is absolutely vital. Without it the machine will be shutting, you know, several times a day to clear up the mess. But with that sort of treatment, then we can control the bacteria. And then we’re back to the finances, we’re looking at a return on investment to the customer. So, if the customer is having five breaks a day, and each break is costing $5,000 a day, that’s $25,000. If we can reduce the breaks by two, we’ve saved him $10,000 a day. And the treatment costs might be $1,000. So there the customer that’s it’s an IRR is getting about a 10 to one payback. So, we look at it when we’re talking to the customer as much as we can about the return on investment that we are giving to the customer. For now, let me give you one more example is when you when you are making paper, you put it through a press what’s called a press section to squeeze out the water. And the paper goes between two huge rollers. And there’s a felt that is put between the rollers that carries the water away when it’s squeezed out of the paper. So again, if the if that felt gets dirty, it cannot carry as much water. And then the paper has more moisture when it goes to the drying section of the paper machine. And, pure physics, it costs 10 times more to dry the paper using energy, steam or whatever compared to pressing the pressing the moisture out. So, we’re back to our return on investment. If we can, if the customer is spending a certain amount on our chemicals to keep those felts clean, we can measure what the return is by the amount of energy that he saves. So those are those are two examples where we are providing a return on investment to the customer. So, the chemicals we are supplying are very niche and low volume. We’re talking generally in parts per million. So, we’re not we’re not sending tanker loads of chemicals, the addition rate is relatively low. And then the other side of the equation is the service and support. So, my analogy is very much like a doctor, if you’re not feeling well, you may go to the doctor, he will do tests, he will take samples, he will come back and recommend some medicine. And then once you’ve once you’re taking your medicine, then he’ll say, I want to see you once a month and see how you’re doing. And he may change the medicine or modify the dose. That’s what we’re doing with paper machines. We do our survey, we look at the problem, we look at their systems, we look at the most appropriate chemical treatment program. And once that’s up and running, we measure the performance and monitor it and adjust it over time.

JE Okay, so the chemicals that you are selling to your customers, do you produce all of them, or are some of them purchased from other chemical producers and you on sell?

MG Okay, so about 75% of what we sell our own formulations. And we have two chemical plants of our own one in India, one in Thailand. And so, we’re producing our own in our own plants. And we also produce in what we call toll blenders or subcontractors to make up the volume that we need. Because our plants can’t cope with the volume at the moment, we are looking to put a new plant currently into China. And then about 25% is technology that is not our capability of manufacturing, but it adds to the portfolio of products that we have. So, we can give a complete service to the customer. And that is bought in from other suppliers.

JE I would imagine that the chemical manufacturing plants, the two that you have, they must be fairly capital-intensive industries as well.

MG No, they’re not too much. Because when we’re not talking about reaction chemistry, we’re talking about generally just blending with a bit of heating and cooling. So, it needs to be controlled, but we’re not dealing with very high temperatures and pressures and things like that.

JE Okay, so it’s not nearly as capital intensive as when you were describing pulp and paper business before. Okay. Very interesting. So, does that mean you don’t have a very high level of fixed costs, I guess, by definition, if you say your capital costs are not extremely high, then you don’t have a high fixed costs, and you have ability to control your costs in relationship to swings in revenue?

MG No, we have we do have a very high fixed cost. So come back to what I said. We need to monitor the chemical applications on an ongoing basis. So, one of the key points is the service that we’re providing. So, we have a frontline team that includes technical support and sales and service people about 330 people. So that’s a very, very high fixed cost. And we have to have that. Go back to my point about the paper machine. If the paper machine has a problem. They want you there now. Saying you will be there a week on Tuesday does not work. Put it in perspective on a couple of our biggest customer sites, we have 12 to 14 people based there full time. These are huge industrial complexes, one that I’m thinking of in Indonesia, they have about 12,000 staff on site.

JE So that is an interesting approach to the business because when I took my first cost accounting class, people had a very narrow definition of fixed costs and variable costs and labor costs people are always considered variable because you could just get rid of them but you’re saying their core, essential to your product. So even though they’re not a manufactured product, like the chemical, you still see that is so key to your business, that you’re these people are your fixed costs.

MG Absolutely, totally. We are not selling chemicals. We’re selling performance. We’re selling reduce steam consumption, we’re selling increased quality. We’re selling increased productivity. We’re not we’re not selling a chemical. This chemical is a means to an end and the chemical on its own without this service will not work without understanding their system, their process, understand the reaction with our chemicals, the best place to add the chemical, the best process to add it, you know, so come back to what I said about microbiological control. We don’t add that on a continual basis, we add it on a, on a shot basis. So how I look at it in my very basic terms, as the bacteria start to grow and then we give them a hit on the jaw with a chemical, and it knocks them back down. And they take a while to recover. And when they’re about to recover, again, we hit them again. So, understanding the growth cycle of the bacteria in that particular system, and therefore the addition rate is absolutely key. So just sending a drum of chemical to a customer site does not work.

JE Okay. Okay. Now, you’ve said the two manufacturing plants, one in India, one in Thailand. But looking at your website, it seems like your customer base is a much larger region, you’re selling into a lot of different countries.

MG Yeah, so as I said, those are the plants we’ve got at the minute. We also have subcontractors who make for us. So, we have companies in Singapore, and also in China. So, they can make to our formulations. Obviously, we have non-disclosure agreements in place, but they manufacture that product for us. So, it’s closer to that marketplace. And those locations. So, Singapore is easy to get to, for instance, down to our customers in Indonesia. Thailand, we can send over to India. Yes, as I said, we’re, we’re looking to start building a plant in China. We’re working on that at the minute. We’re just going through the approval stage.

JE Okay. Okay. So, you’ve mentioned the pulp and paper. But are there other segments other industries that are large customer segment for you? Or is it really the pulp and paper industry is the vast majority.

MG We’ve been very, very focused on the pulp and paper industry. And I think it’s having that focus has helped us to grow the business quite rapidly, because we’ve got to understand the industry very well. And we got to greater depth in that industry. But we’re now at the point where we’re starting to stretch out a little bit. So, we’re working in the viscose industry, where they use cellulose pulp that goes to a viscose plant to make rayon which is turned into clothes. So, we’re working there. We’re also working in the wallboard, cement-wallboard industry, where they’re using again woodfibre cellulose as a as an outer barrier and outer layer for cement for building walls and things like that. So, we’re starting, we’re spreading out into areas where the pulp for the chemical fiber and the cellulose fiber is still a main component where a lot of our technology and our understanding can still be used. We’re also now looking very strongly at the molded pulp board industry. sort of thing where you make the make egg boxes, medical trays, food trays, and we see this as an area that is going to grow very, very rapidly now, particularly with the real demand to move away from plastic, single use plastic. So, there’s certain requirements. If you’re going to replace a food container, that’s plastic, we’re going to replace it with a molded fiber one that needs to be some barrier coatings and other things. But we see that as a very high growth sector. Which still now I’ll still say it’s under the umbrella all those of pulp and paper but maybe with a slightly wider focus than we’ve had before.

JE Well, then I’m going to interject with the last bullet point that was in the industry, but you’ve, you’ve referred to it a couple of times. I mean with all of this talk about digital media. I mean, is the pulp and paper industry still a growth industry or is it in a state of decline?

MG It’s a question I get asked so often. So. I’ve answered like this when you talk about pulp and paper industry. People talk about generally the whole thing now we need to break it down. If you look at newsprint as one segment, yes, it is in serious decline. I still like to read a newspaper, but my children probably have never bought a newspaper in their lives, they get all their information on their tablets and their phones, etc. The printing and writing globally, is growing at maybe one or 2% a year. We all have, we all operate on email. But so many offices have printers and many printers. And people still like to print documents out particularly complicated documents. And so, the overall, that type of paper is growing but much slower. But in the part of the world where we are here, the growth rate is quite high. So, if you look globally is one or 2%. But within the Asia Pacific region, it’s significantly higher than that. Move on to tissue, tissue is growing quite rapidly. As people grow in their economic wealth, and move into the middle class, tissue that previously was maybe a luxury becomes a necessity. Whether it’s facial tissue, serviettes in rich restaurants, toilet tissue, whatever, it becomes a becomes a necessity. And the other big area, thanks to the digital revolution is packaging. internet shopping has absolutely grown out of proportion, and even more so during the period of COVID. So, the demand for packaging, you know, your corrugated boxes, or all types of packaging, has really grown very, very fast. So, the short answer is the pulp and paper industry is not in decline. It is growing. And it is particularly growing in the part of the world where we are.

JE It’s interesting when you talk about those segments, because when I think of pulp and paper, I just think newspaper. But now I realize packaging, even when you go by yourself to the store, there’s a huge amount that’s being spent on packaging, plastic, cardboard, whatever that’s, that is not the industry in decline, I can certainly understand.

MG And when you add to that the real global pressure to move away from single use plastic on too much of that can be replaced with cellulose fiber, you know, whether it’s straws, or packaging, we’re looking into this and I saw an interesting picture of a bottle of Bacardi that is a molded fiber. So, imagine that buying your bottle of Bacardi in a paper bottle. And it’s not, it’s not that difficult to think about when you know, we all buy milk now, in what’s called liquid packaging board. I’m old enough to remember my milk coming in glass bottles. The replacement of plastic is I think is going to be a very interesting dynamic for our industry.

JE Okay, let’s finish off on the two bullet points about the company because they’re a little bit different. Your company has an association with something called the Longreach Group, tell us who they are and what they do.

MG Okay, so the Longreach Group is a private equity company. So, they look for companies where they see good opportunities for growth, I think they see a good stable management. And they see that with their expertise added to the company, they can help to accelerate that growth. And therefore, they as a private equity company have invested into our company and are working very closely with us to accelerate our growth. So, they are an investor. And behind them, they have what they call limited partners, LPs, partners. And there’s generally a cycle that you go through, which is about sort of, typically a five-year cycle where they would help us to grow and then look to sell the company on.

JE So, you’ve been with the company for 21 years now. What are your plans for staying with the company? And are you starting to think about succession plans with the investors.

MG We’re not we’re not starting we’ve been planning succession for some time. This is something you have to really think through and take steps is not something that you can just hand over a weekend or something like that. So no, we have a succession plan in place. I have stated that I will, I want to work for another three years. And in that three years, we will steadily hand over the reins of the company. And if you think about it, you know, if someone was looking in the future to acquire the company, they need to see a younger management sitting there. If they see an elderly man still sitting there holding the reins, the big question is, well, what’s going to happen? You know, when, when you’re going to stop work. So, what we need to show is that the next exit, as it’s called, that someone else is sitting in this chair, even if I’m behind the scenes, you know, a little bit so as in the chairman role or something like that. But there should be someone else here, that is running the company on a day-to-day basis, and not just a sudden change, they should have been in, in the chair for some time, to give stability and, and confidence to those people. And the other thing also is, is in terms of our staff, we always think about, what’s the best thing for the staff in our company. They need to know that there is a succession plan in place, that this thing doesn’t all stop when, when Mike Grundy retires or something like that. So, we need to show our staff that we are planning for succession, and it’s not going to be a sudden process. It will be it will take place over a period of time.

JE Interesting, but you started the company, in three years’ time he will have been there 24 years? Will it be a little bit difficult letting go?

MG Of course, it will. Of course, it will. So, we’ve just had our 21st birthday. And I did a talk for the whole company. And I said in in western terms. 21 is when you’re grown up, you’re counted as an adult. So, I said, I think now we can say that our company is an adult? Well, continuing that analogy, there’s a time when you got to let go of your child, and let them grow up and let them go in a direction that you’re not controlling. As a parent, you control it, and maybe at some point, you have to let go. So, it’s part of life. And yes, and that I have to I have to let go. So yes, I’m sure it’ll be difficult. But as I say, it may not be 100% disappeared, never to be seen again. It may be there, I may be there on an advisory role or something like that.

About the Chemicals Industry

JE Okay, that’s interesting. Now, just a little bit about sort of more generalities about the industry, you’ve dealt with the first point about the very specific focus you have in terms of your product. Let’s talk about the industry and competition. Who is the competition? Are they big companies, small companies, lots of companies, small number of companies?

MG Okay, the first the first point is going back to what I said at the beginning about our customers are huge industrial complexes, costing many hundreds of millions of dollars. So, they do not just let anybody in to treat their machines, it’s all a question of building confidence and trust, they have to understand that you do have the experience and that you know what you’re talking about. So, our competitors, generally, are big international companies, most of them are, you know, 3, 4, 7 billion dollar turnover type size companies. So, for us, we are a small player, but with got on a global stage. But within this region in the area that we’re working, we would argue we’re number one. So, we’ve created we’ve carved out a big market share in the Asia Pacific region. But we’re playing against big global players. So, we don’t we don’t we long way behind them in terms of size because they’re operating in North America, Latin America, Europe, etc. where we are not. So, we’ve got a strong position here. And those are our main competitors. There are a number of small local players, particularly in China and the business they tend to get is I would argue on the periphery of the customer. Something which may not necessarily affect the production must go back to we use a lot of water so they could be helping on the treatment of the influent water or the effluent water. But the real heart of the pulp and paper mill, on the production process side, they’re normally not there. So, they may have a little bit of business around the outside, but not at the heart of the process. So that’s a quick summary of the competitors. So, yeah, we’re fighting with the big, big, mainly big American companies.

JE Can the big can the big conglomerates provide sort of the custom oversight that you do? Or are they just more sort of interested in selling the chemicals Do they have a slightly different business model than yours, which is very customer focused with a lot of people on site.

MG I think to survive in this business, you’ve got to be you’ve got to be customer focused, to know we’re all operating. In the similar way. When we set up the company, we were very clear that we cannot compete on purely on technology, because we haven’t got hundreds of millions of dollars to invest in r&d. If we treated if we if we tried to compete on price, we would struggle, and we would not last very long. So, we absolutely made it our focus to be the best service provider to the industry out here. And that’s what we’ve done. So that has been our focus, I think we’ve achieved that. I think it’s one of the key reasons we’ve been successful. But we must not get complacent, you know, the other companies have been very good, good technology, they’ve got good people, we just have to try to stay one step ahead. And we’re looking at other things. We’re looking at an example, at digitalization, how we can remotely monitor some of the systems, both our chemical systems and their system. So that if something’s starting to go wrong, we can see the data. And we can take action before it has an impact on production. So, things like that are ways in which we need to move forward. Another way is very important in this day and age is ES and G, we’ve got to look at the environmental side, the social side and the governance. And we’re in a position go back to what I said we can do in terms of saving energy, reducing water consumption. So that can help to meet some of these big customer demands for their ESG requirements. And I think that’s if we can be seen as an ESG partner, with our customers, that that’s also going to help us to stay ahead of our competitors. So now we’re not just talking about we save you X amount of dollars. We’re talking about how we’re reducing your carbon footprint, because we’ve reduced the demand for heat, heat energy to dry the paper. And this is a very hot topic at the moment.

JE That sort of walks us into the very next point, which is about regulation. So is your business either on the manufacturing or your customers business, highly regulated, and even if it’s not, will this move to higher ESG standards mean that it’s likely to become more regulated in the future?

MG Well, yes, both ends of the spectrum. So first of all, on the production side, I said we’re in the process of trying to get a plant up and running in China. We have to overcome certain hurdles on health and safety on effluent and on emissions, and things like that. So absolutely at the production end, it’s monitored closely. Then our customers at the paper mills generally are selling on a global basis. So, depending on which country they’re selling into, they will need to meet certain regulatory demands. In Europe, there’s REACH, there’s GFR we even have to be aware of Halal what requirements for Indonesia and Middle East to ensure that our chemicals if they’re going into the paper are Halal compliant. So, there’s a number of these different registrations that we need to ensure that our products are fully compliant for that.

JE Okay, so the next point is about your revenue model. Now, you’re not just selling chemicals. There’s a long-term relationship, a lot of oversight. So, what is the general nature of the contract is it almost like a consultancy contract where the cost of chemicals is just another item added into.

MG We have a number of customers where we do have a contract. But the reality is, if we were not performing, the contract is worthless. So, we are there based on the merits of our performance. If we have a contract and we weren’t performing, and they said, well, we’re finishing the contract early. Are we going to sue the customer? No, of course, we’re not. We would fight like hell to improve the performance and to assure they don’t change. But we were not in a position where we can sue the customer. So generally, it’s not, we’re not, we do have contracts but we can’t say that’s it, we’ve got a two-year contract, we are protected, now no one can attack us for two years. It doesn’t work like that. And then the other point on this is, generally we are working quite often with these contracts on a treatment cost per ton. So, some places we are selling the chemical when it’s so much per kilogram. And in other places, we take over the monitoring control, and we invoice based on a certain cost per ton of paper that they produce. So that’s like a, like a package arrangement. But yes, the contracts are not something that gives us protection. We have to perform as I say, if a paint if we’re not performing in the paper machine has to shut the loss of money mounts very, very rapidly.

JE Okay. Now, just a couple of points before you talked about digitalization and monitoring, and I work with industry 4.0, but only in discrete manufacturing. So, I don’t know about sort of the AI or the performance monitoring in the fluids area. Is that something that you your company needs to invest in? Or would that be something that the pulp and paper company would invest in, who’s going to make that investment?

MG So, the control systems we would invest in, the key point is the sensors. So, what are you monitoring, and some of the paper mills have sensors already in place that we can, we can tap into, but other ones we need to put our own sensors in. So generally, it’s going to be at our cost. If we can improve the performance for the customer, then that makes that investment very worthwhile, because the customer is going to be happy is going to be a long-term, long-term business. And we can spread that cost of that investment over a period of time. And there also may be opportunities, come back to your earlier point about the fixed costs, there may be opportunities to reduce some of our service costs. In my, in my early days in the industry, I can remember driving two hours to see a customer because I was worried that the container, the chemical container was nearly empty. Nowadays, what we’re looking to do is to have a situation where we can monitor that. And we can see on the screen, what the tank level is. And okay, we know we got five days or two weeks of supply. So that there’s an area there where we should be able to get a return on investment from reducing some of that service costs.

JE Would that be a big capital expenditure for the company? Is that something you would need to raise outside financing? Or can that be just covered by your general operating cash flow

MG Each individual one isn’t a particularly big investment, but we have 350 customers. So, when you multiply it up, it can be quite a sizable number. And we’re having to manage that very carefully and choose the accounts where we think the best return would be

JE Okay. So, introduce them gradually, prioritize them, as opposed to making a big upfront expenditure and having to raise outside money. Okay.

MG And ironically, there may be a bigger return on the smaller accounts and account for a customer where we may only visit once a week. So that might give a better return to us than the customer where we’ve already got 12 people on site.

Key Future Goals

JE Okay, so to close things off, Mike, let’s just look at what are the key goals for you in the short term, either the remainder of this calendar year or whatever your budget period is?

MG Well, the short-term goal is to achieve our budget this year, but it’s really too short. We’re looking for more medium term and we’re looking to accelerate the growth of the business. As I said earlier, we’ve been very focused on pure pulp and paper, we’re now flexing our wings to move outside, as I said, into things like molded pulp and cement board, and things like that. So, pushing outside the traditional pulp and paper is going to be a driver for us going forward. At the same time, we’re looking to expand the geography as well. We’re particularly looking at Cambodia where one of our customers is going to put a big plant, and also established markets in South Africa. And a third point I’ve made is we’re looking for other technologies that we think are going to be required, as an example is barrier coating for paper and for molded pulp. So those three things can all add to our overall growth. We still believe the core business has substantial growth ahead in the coming years. But if we can add a few more percent to that growth, it has a big impact on the overall business, by these other initiatives

JE It is very interesting. I think the one takeaway I get from this is that looking at everything you’ve talked about, whenever you look at a successful company, regardless of what industry they’re in, it always seems to be a focus on customer service, whatever the underlying thing being sold is, and you’ve reinforced that in my mind today.

MG Yes, it’s absolutely key, absolutely key. And it is this traditional thing, you know, if you go somewhere and have bad service, doesn’t matter what it is, whether it’s industrial or if it’s personal, you don’t forget it and you don’t go back.

JE Okay. Well, on that note, I’ll thank you for your time today. It’s been very interesting for me to listen and learn about an industry I don’t know a lot of but he certainly helped put things into perspective. And we look forward to presenting this on the venture interview series very soon. Thanks for your time, Mike.

MG Yep. John, thank you. I mean, anyone who’s running a business loves to talk about it. So, I appreciate the opportunity.

JE Okay. Have a good day. Cheers.

MG Thank you. Bye bye.

End.