Social Green Mobility (SGM) | Crowdfunding Sept 2021

SGM is taking a very innovative approach in using a funding round to also be a promotion of its business to all stakeholders. An interesting concept for any start-up in the B2C sector.

You can see the first interview with SGM here: https://seiml.com/venture/interview-with-mr-riccardo-campanile-co-founder-chairman-social-green-mobility/

Script of Interview

Interviewee Mr. Riccardo Campanile (RC)

Position Co-founder & CEO

Company name Social Green Mobility

Company website URL https://socialgreenmobility.com/

Interviewer John D. Evans, CFA (JE)

Interview conducted on 31 August 2021

Update since April

JE Okay, good afternoon to this episode of SEIML Ventures, we’re back for the second time with Riccardo Campanili, who is the co-founder and CEO of Social Green Mobility. We did an initial interview with Riccardo back in April of this year. And viewers of this video will be able to see the link back to that if they want to go back and get the basics about the company and how it started. But today, we’ve got a separate topic, a little bit of an update, because it’s been several months since we last spoke. But importantly, we have an important event, a fundraising coming up for Social Green Mobility and it’s a very interesting structure. So, I thought it would be a good thing to talk about. And it might give some other companies that are in the fundraising market some ideas. And then we’ll just close off with a brief look at the what’s left to do in the year to end. Okay, so Riccardo, welcome back. Let’s just kick off and give the viewers a bit of an update. Since our first interview on the 16th of April, what has happened then, and just bring us up to date before we talk about the fundraising.

RC Yep, actually, the current situation of SGM is that we are going to install the first bicycle on the on the favor of the host, some touristic area. And we faced some problem with the custom actually to import components, but the company is going on well. Financially speaking, we are quite safe because the Italian government granted as some support. So currently, we are quite safe. And, let’s say, what we can face as an issue is the shortage of components from China, but the company is, is going on. I’m fully committed to follow and to run this company. So, it’s, we are quite happy. We are thinking about to develop other markets, but we are still focusing on our previous and prime business scope. So, to rent a bicycle, let’s say on consignment stock to host in order to let them ride the bike is the main business we want to focus and not to compete against the giants of the other bicycle, electric bicycle market that’s mainly the point.

JE Just update me. You said the government recently gave you some financial support. What was that actually?

RC There are some tools through banks, which are aiming to support innovative companies and not only to get some loans, let’s say so it’s a loan, it’s not a gift. But they granted us quite an interesting amount of money. And with this we can we already use it then we are we are using it to develop new technology about the docking station and to order new and the second batch of bicycle. This is an application that any company can do in Italy. It’s not new to the pandemic is just a tool given to let’s say trustworthy companies, let’s say so.

JE So this is a bank loan. But is it a preferential interest rate guaranteed by the government?

RC Yeah, it’s, it’s guaranteed by the government. In fact, we had to provide a lot of documents, a lot of applications starting from who are we and then then what is what is doing the company, the business plan and whatever. And then the government is granting this loan through a bank a main National Bank. And then we have to declare, what is the scope to get this money. And then we go ahead, yes, it’s quite, quite interesting, not easy to get. Because as I mentioned, we have to provide a lot of documents, a lot of we have to show our that we deserve trust from the bank and from the government. But we got it.

The Crowdfunding

JE Okay, that’s very interesting. I don’t speak to too many startups who say we, we’ve got too much money. It’s an enviable position to be in. So, but having said that, let’s move forward, because the key topic for today is the equity fundraising, through the crowdfunding, which I believe is likely to start sometime in September, is that still expected? Or does this bank loan make you push that equity funding back?

RC Yeah, the second you said, Because actually, now financially speaking, we are strong, and we don’t need immediately, a lot of money. It means that we can delay a little bit, but not that much, the fundraising through crowdfunding, just because we don’t need money now. But as we will, we will talk about it later, the crowdfunding is a part of our communication strategy. So, it’s not only a way to collect money, but it’s also a way to communicate to the world, at least that’s the Italian world.

JE Okay, now I’ve got your pitchbook. And I know, as one example, on slide six, there’s a general overview of the crowdfunding. But just give us the broad overview of the crowdfunding the structure who you’re working with, etc. for the viewers who are listening.

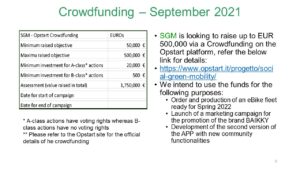

RC Yeah, actually, the crowdfunding is made through an Italian company specialized and is the first one ranking in this business in Italy. And we cooperate with also another company, which is helping us to push the launch of this fundraising. The company, the main company is ‘Opstart’, which performed very well, last year in Italy, where there was a boom of crowdfunding. Opstart is being asked to collect, first, the first the first money, and then the target is to achieve that we have to add, we might we want to achieve a target of 500,000 euros. And we have to start at least with 50,000, Euro through friends, and smaller investors. So usually, this kind of crowdfunding launch are based on a say, a small amount of money, which gives you the possibility to start. Usually, it’s 10% of the total amount that we are, we are going to achieve.

JE So here you have a minimum requirement to raise at least 50,000, which I don’t expect will be difficult. But is the 500,000 cap, is that a maximum? Or if there was very large interest could you take more?

RC Actually, if we overcome that, that target that we can relaunch and overcome that the target so it’s there is actually no limit, but we have to launch a second, a second campaign.

JE It’s not automatic, and that might be at a different valuation.

RC Could be okay. Okay.

JE So the opportunity to get in at this price is limited to 500,000 euros. Now, I see there’s two different classes of shares. There’s an A class, and there’s a B class. Just give us a little bit of background about that.

RC Yeah, actually, we divided we split the investor classes in two, because there is a let’s say, as a minimum level of investment which gives to the investor there the right to get profit in case, but no, no right have a vote. In the second class is instead given to the investor the possibility to vote. And of course, to get the profit in case, this is the reason why we divide, we split into classes the investors.

JE Okay, so the A-class, which has a minimum investment of 20,000 euros has voting rights, yes, whereas the B-class, which has a very low minimum investment of just 500 euros doesn’t have voting rights. But at least that that low amount allows a lot of people to get an investment at quite a small amount of money.

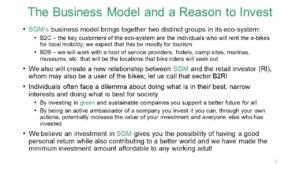

RC Yep, that’s the core of our strategy, just allowing people to invest a very, very few money in this action, allow us to say reach many, many, many potential investors and accordingly investors, very young people very, which we believe we do believe in even though we are quite old, as, as the Founders, we do believe that the young people are very sensitive to the green economy, to the sustainability of the economy. So, we would like to let them invest a very few money but take part of this interesting action. We do believe that the bicycle, particularly the electric ones, are a very good solution for Italy for two reasons, which is, I think, I think I’m right, the only one natural resource of Italy. So, we have to take advantage about it and push it to help and to say, to spread the culture of tourism and sustainable tourism. And the electric bicycle is the right, the right way to, to achieve it. Just because of the geography of Italy. We have no flatland, so to peddle in Italy is quite, let’s say fatiguing, it’s quite difficult. But electric bicycle is giving anyone the possibility to ride around Italy without any effort.

JE Okay, so moving along to the next bullet point. Why did you choose to go the crowdfunding route, as opposed to more traditional venture capital funding?

RC Yeah, that’s a very interesting question. Actually, it’s the crowdfunding launch is part of our communication strategy, if we can call it that way. Actually, the big difference between the traditional venture capital companies is that you can collect money from, let’s say, medium to big investors, which aims to invest quite a lot of money, but they don’t care so much. Instead, when you launch a fundraising to a crowdfunding, you reach a lot of people, a lot of younger investors, people who maybe never thought to be investors. But they can be our shareholders for a very, very little amount of money, they can take part of this adventure, and this this challenge, and be our ambassadors to meet our let’s say, Ambassador in the largest sense, that means that they can persuade, they can push their friends their family to join this big family. So, the big difference between the traditional venture capitalist is that one, is actually our crowdfunding is, is more is not only a way to collect money, but it’s mainly a way to communicate to a large amount of people about our idea and about our targets. And since we do believe that young people are very sensitive to this topic, the green mobility and whatever it’s green, we do think that it’s a good way to reach them in this way, rather than focusing just on big investors.

JE Okay, funding and, and business development, all in one activity. So, tell us a little bit about Opstart, why you chose that particular company and what exactly do they provide to you and in terms of services?

RC Yeah, we do choose the Opstart. Actually, as any small company, we are made by personal contacts and our Italian partner, Mr. Fabio was already a friend, a good friend of people working at Opstart because they already worked together. But of course, we did choose Opstart because the company is performing quite well in the last year, was ranking as the first one in Italy. It’s not a huge company, is not a multinational company, is just focusing on the Italian market, but it’s quite active and energetic and then we are quite happy to work with them. That’s why we choose Opstart first mainly acquaintances, let’s say so and second, the good results they got last year.

JE So they provide administrative services in terms of managing the process, recording people who invest and all of that, but do they do marketing and business development? Do they help you also find new investors?

RC Yeah, of course, as a crowdfunding company, they have a lot of let’s say, followers. And in this world made by followers, of course, even in this case, the followers of Opstart are looking at and take part of the action of the activity of this company. So, they get information directly, and they have a large number of people following them and then automatically they will be all informed by Opstart about this activity. For instance, I am a part of this family and I weakly receive information about similar activities for other companies. So, if you take part of a big family, on one side, small and medium investors, by the other side, more than and medium companies that wants to collect money or share their idea and collect money.

JE Okay, so you started off the video by telling us you got the bank loan, and so you had more cash than then you needed right at this precise moment. So, do you have an estimate of when you will likely start the crowdfunding with Opstart, September or later in the year?

RC Actually, the plan was starting in September the seventh, but since we nowadays we are facing, not only us but even GM is facing this, but as you know, to get the components from China, any kind of components, is quite demanding. So, in this moment the delivery of bicycle parts is quite slow. So, it’s mainly useless to collect money in this month, if we can get the parts next year. So, since we have already the money to place the order now and to get the goods in the first month of 2022 we are thinking to postpone the crowdfunding to maybe October or November, but not later because there is a limit. And the moreover, as mentioned, it’s not only a matter of money, sooner we do it the sooner we can communicate about this idea.

JE So, definitely it is happening this year.

RC Yeah. This year, we are going to install bicycles in some, let’s say, touristic area, we are choosing the touristic area according to their opening time. Unfortunately, it is following some strange time in south of Italy if you go after 15 of September everything is closed. And then maybe it’s easier to find the open touristic organization in in north of Italy or in centre of Italy. So, we are focusing on that area. And once we have installed the first batch, we are still collecting data from the users. We are testing the apps because our business is based on App, an ‘APP’ and then they must be tested. So, we are let’s say starting very soon. By the other side what we are going to do is to study to design more, let’s say smart docking stations. The docking station is where you can load the battery, charge the batteries of the bicycle, but also you can find all the consumable, you need to take the bike without, without giving any trouble to the host. So, it means the helmet, the helmet and this kind of the small locker, a charger in case you take the bikes for a long time. But this is what we have to do and maybe something with some power supplied. So, we have our bicycle, it is fixed. But the docking station is still on process, though we are investing some money on this technology to me to be a little bit smarter.

Italian Investor VISA

JE Very interesting. Now there is a different another different angle in this whole fundraising. We’ve talked about the Class A and the class B shares. But there’s actually a third potential type of investor. And this is someone who is not resident in the EU, and by investing a certain amount of money can potentially get Italian residency, the investor visa. Give us a little bit of overview about that because for the people here in China, or in my home country of the UK, this sounds very interesting.

RC Yeah, actually, this is definitely a choice of our government, which instead of promoting the real estate, as the other countries are doing, is promoting to the investor to invest in innovative companies. And since SGM, Social Green Mobility is an innovative company, innovative startup, let’s say we can welcome funds from foreign investors. And if they reach the amount of 250,000 euro, they are allowed, they are granted, the government can grant the residence permit. In this moment, I guess it’s quite interesting because of the difficulties to travel and to have a residence permit for instance, as I got for China. It might be very interesting. Of course, the amount is not a small amount, but it allows many people to think about it.

JE So, it’s not a small amount, it’s 250,000 euros. But for many outside of the EU, who are desiring a residency, it’s not an extraordinarily high amount. And when we put the video out, will show that slide and the link where people can research more and find out the details about this. So just to be clear, for anyone who sees this video, Social Green Mobility has been officially declared by the government of Italy as meeting the requirements of an innovative startup. And therefore, if someone outside of the EU, and also I believe outside Switzerland, is interested in making that size of investment, they qualify to apply for Italian residency. Obviously, they would need to do some independent legal review about, but it’s still a very, very interesting proposition in this day and age and, and, and not a huge amount for many people around the world because there’s a lot of wealth out there.

RC Yeah, correct.

Looking Forward

JE Okay, so you’ve given us an update. We’ve talked about all the salient features of the fundraising and the crowdfunding, which may not happen now in September, but will certainly happen before the end of the year. So, let’s just close off, you’ve already touched upon it, but what are the other key things you want to conclude in terms of business operations, or anything, before the end of this calendar year?

RC Actually, what we are doing now is to find a way to sustain SGM, which is not only the BAIKKY project, but also LOCAXY it’s our, let’s say, lateral business about the selling and the selling of services and, and about the product devices of GPS trackers, which is a very promising market and not yet developed in Italy. There are very few players in Italy and in Europe as well. The opposite of the US, for instance, where the GPS tracker is used everywhere. So, we have this proposition and the website is almost ready. And this is a collateral business, which is running parallel to BAIKKY business. So, by one side, we provide bicycle to hosts, to rent them, by the other side, we can sell GPS trackers, which is just a device for services. For instance, if someone wants to use our GPS tracker, and our APP, this APP can be customized on their use and their wishes. So, this is another business, collateral business, which has been born because I have to remind you that all of our bicycle contains a GPS. So, we know where the bicycle is, how fast is traveling, and whatever, in any moment of their life. So, this is, since we adopted this technology, which is a fact kind of IoT, we did the same, we gave the same customer the same opportunity to use the devices and the services they add. So, this is a very promising business too, I do believe that will help the SGM develop.

JE It also sounds like a very interesting topic for a third video sometime in the future when it’s launched. So, I think you’ve just given us something to make a diary note for. Okay, so that concludes our talk for today. We look forward to when the formal launch of the crowdfunding comes out. So let us know about that and we can make a formal update to this tape. We’ll talk to some people who may be interested in the investor residency, which is very, very interesting, and I’m sure interesting to lots of people in different parts of the world. So, thanks for taking the time today. I look forward to presenting this video. And it sounds like things are progressing along very well in Italy for Social Green Mobility. So, congratulations for that Riccardo.

RC Thank you very much. My thanks to you there, John. And let’s see, let’s update when the crowdfunding will be on the launch.

End.