Introduction

This is our twelfth Article and looks at real estate as an investment, from the perspective of an individual investor as opposed to an institutional investor. We will start off with some background information on the role real estate can potentially play as an investment asset.

The growth of real estate as an investment asset

As we discussed in our first article, investing originally revolved around three ‘traditional’ asset classes:

But, during the late 1970’s, due to the large amount of money being held in institutional investment funds, there was a search for ‘alternative investments’. Some of the more important alternatives are:

Over the last forty years, real estate has become a very large and important part of the investment world. There have been many reasons for this and we discuss a few of the key drivers below.

Real estate and institutional investors

Though our focus will later turn to the individual investor, it is important to understand the role of institutional investors in helping to develop this market. The real estate market can be broken into two segments:

The institutionalization of money; money is now invested more through funds than direct investments by individuals of institutions. This ‘pooling of money’ has made funds very large with a very large investment appetite. As CRE is very expensive, investments are now achievable given the very large scale of investment funds.

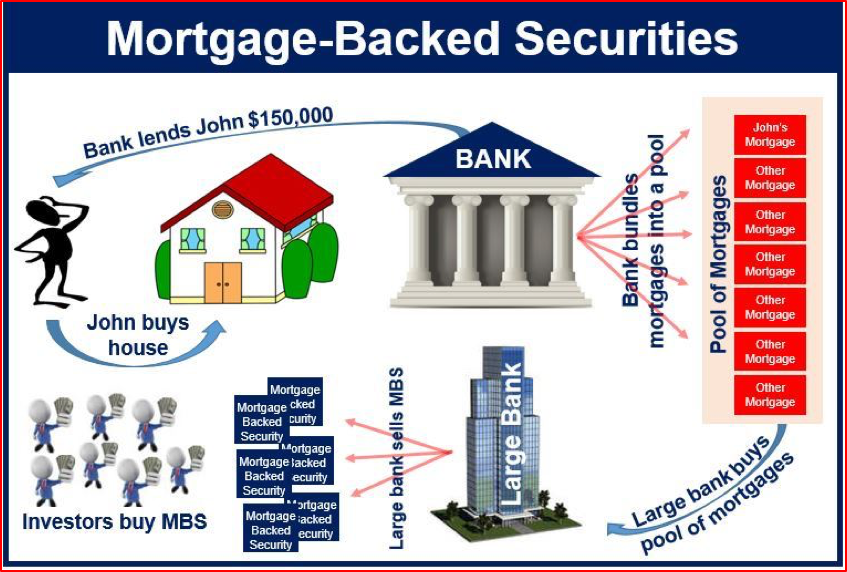

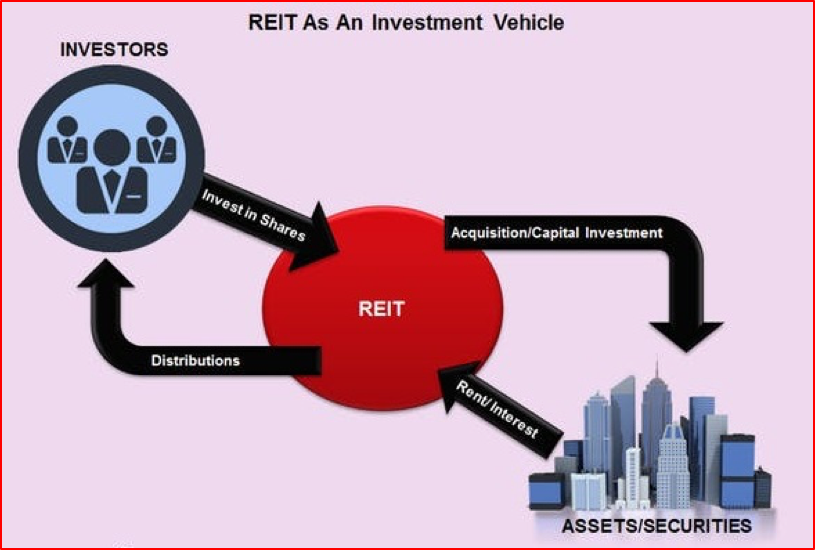

The securitization of assets; as we talked about in earlier articles, both liquidity and diversification are important principles in investing. Securitization allows investors to achieve better liquidity and diversification by making these investments ‘exchange traded’ or at least trade over-the-counter (OTC) and being able to buy small units of the real estate asset (instead of the whole asset) provides diversification. Real Estate Investment Trusts (REITs) achieve these goals for CRE and securitization of RRE helps achieve these goals in this sector.

We have also seen a change in corporate mindset that ‘focuses on its core competencies’. Real estate, which ties up a lot of capital, is not seen as the best focus of industrial or other companies. A classic example here is the hotel industry. In the 1970’s, large hotel chains owned most of their hotels (real estate). Today, hotel chains are mostly hotel management and service companies that rarely, if ever, own the hotels they serve. The individual hotels are owned by institutional investors.

We have also seen a change in corporate mindset that ‘focuses on its core competencies’. Real estate, which ties up a lot of capital, is not seen as the best focus of industrial or other companies. A classic example here is the hotel industry. In the 1970’s, large hotel chains owned most of their hotels (real estate). Today, hotel chains are mostly hotel management and service companies that rarely, if ever, own the hotels they serve. The individual hotels are owned by institutional investors.

Real estate and individual investors

There is a ‘trickle-down-effect’ in new investment trends. These new trends usually start with the institutional investor (who is viewed as the most sophisticated), then they are copied by high net worth (HNW) individuals and then to the population at large. This is particularly the case when wealth is increasing among the general population of a country and there is more savings for investing. However, as CRE is typically of very high capital cost, individual investors (in most countries, not just China) have a preference for RRE. This is also reinforced in China by two further trends: the country’s wealth is growing quickly meaning more people can afford RRE and China has less investment market alternatives than western countries, so real estate is even more of a focus.

Market size rose in 2017. The size of the professionally managed global real estate investment market increased from $7.4 trillion in 2016 to $8.5 trillion in 2017.

(Source: MSCI Real Estate Market Size June 2018)

Even though RRE is much less costly than CRE, it is still often the largest single investment a person or family makes in their lifetime. Thus, making good real estate investment decisions is very important for the population at large. We will examine the two most common real estate investment decisions a person has to make, which are:

These are two very different situations that require a different analysis. We will evaluate the choices using our traditional investment approach: risk versus return and evaluating the constraints of liquidity, tax benefits, etc.

Case 1: The single-family home

All around the world, for the majority of people (who are not super-rich) thinking about buying a home is one of the most important decisions they will have to make. Often, decisions are influenced by emotion and family or social pressure. But, as the investment will likely be the largest in the person’s life, it has to be evaluated in terms of its financial risk and return. On the surface, there seems to be two elements to the decision. First is that a person needs somewhere to live (that term that economists call ‘shelter’). Second, it is a financial investment that you can sell in the future (perhaps at retirement) to ‘take out cash’ when you buy a smaller residence to live in.

From the perspective of ‘shelter’, most developed economies offer two alternatives: first is to buy a home and the second is to rent a home. Many countries have substantial regulation to ensure that renting a home can also give you security (as long as you meet the financial payments). In the last two years, China has introduced new regulations to try and improve the market for rental accommodation. So, let us work on the assumption that a person can either buy or rent.

From a risk and return perspective, the two choices are very different. It is only with ownership that you can gain if the price of the home increases in the future. The last ten years in China have been a decade of high economic growth and increases in the value of real estate. But, as we have seen many times in other parts of the world, real estate prices can go down as well as up. In 2008, some homeowners saw their homes lose 40% of their value and many lost their homes to bank foreclosure. But, risk and return go together, you buy in the hope of it going up in price, but you will also suffer the loss if it goes down in price. Thus, buying (versus renting) is the ‘higher expected return, higher risk’ strategy of these two alternatives.

There are other important financial items in the decision. Liquidity is one and transaction costs are another. ‘Liquidity’ means being able to sell something quickly at what you think is its ‘right price’. It is generally much more easy to end a rental agreement than to sell a property, if you are required to move. Why might you be required to move?

Selling a home can often take a very long time, though times will vary greatly from location-to-location. In ‘hot’ property markets, homes can sometimes be sold within one week. In more remote locations it can sometimes take years to sell a home. So, if you cannot sell your home does that mean you cannot move to take that better job? Or does it mean that you don’t have enough money to buy or rent another property in the new location until you sell your current one. Thus, renting (versus buying) has much superior liquidity.

Many people like to trade, many like to buy and sell real estate. But, many underestimate how much ‘transaction costs’ reduce their investment return. Many homes are sold via real estate agents who charge a commission for each buyer and seller. This can be a lot of money on an expensive home. But, there are many other transaction costs. For a home, there are a great many finishing and furnishing you must pay for. Many of these are unique or attached to a home and cannot be taken to another home. Thus, if you spend a lot to finish and furnish a home, this will (likely) be lost when you move. Frequently (but not always), rental properties are both finished and furnished. It is normal that the owner pays for these costs. Thus, renting (versus buying) will often have lower transaction costs.

There is no ‘right answer’ to buying or renting. Like any investment decision, it depends on your unique circumstances, expectations of future events, and what is best for you.

Case 2: Buying an additional property for pure investment

This is a more simple investment decision than Case 1, it is a pure investment, as it is not somewhere you are going to live. So, you consider buying a home versus buying stocks, bonds or gold. I will just contrast this decision with a few financial variables and comments.

There have been several studies in America and Europe that conclude returns from real estate are quite similar to returns in the stock market, over the longer term. But, there are two caveats here. First, real estate indexes have largely been unlisted (non-REIT) investments and prices are often estimated whereas stock prices are recorded ‘real prices’. Also, real estate has far less liquidity than stocks listed on major exchanges. So, for me, to invest in real estate instead of major listed stocks, I would need to have a much higher return to compensate me for the loss of liquidity.

Then there is the important decision of diversification. If you own a home and your only big, second investment, is going to be another home, then you have all your wealth concentrated in real estate, no diversification. This is a risky strategy and made more risky by the lack of liquidity. Many people who own a second (investment) home rent it out to earn income. But, this means it is not a passive investment (like holding a stock) but an actual business that you have to manage (or pay someone else to manage). So, owning and managing a second home is not a direct comparison to buying stocks or bonds.

In Conclusion

For many individuals (who are not professional investors), decisions about investing in real estate can sometimes be biased with emotions. This is perfectly understandable for the person or family that owns just one home. But, for most, it will be the biggest investment or their life and so the investment (buying) decision has to be based on sound principles – or you are putting your savings at risk. A few final comments to reflect on and leaving you to come to your own conclusion.

There is no right or wrong answer for anyone. Everyone is unique and has to carefully evaluate their own circumstances and make the choice that is right for them and that choice may change over time.

John D. Evans, CFA (author) has over 24 years’ experience in the international capital markets working with issuers of securities and investors around the world. He has designed and taught Master’s programmes in investment management at universities in the UK and China. He was most recently Professor of Investment Management at XJTLU in Suzhou. He now manages SEIML, a consultancy to early-stage companies in China.

Jina Zhu (translator) did her Master’s in Economics in France and is fluent in Mandarin, English and French. She also works at SEIML supporting early-stage companies grow and raise capital in China.

5 July 2019

Benny曾在中国金融市场工作,聚焦于固定收益、货币和资产负债管理。 他目前是宁波一家中型私募基金管理公司量利资本的副总裁。 公司的策略包括各种类型的固定收益投资组合管理和可转换债券投资组合管理。 此外,Benny 还为证券公司母基金、企业投资者和高净值个人等专业投资者提供金融投资服务。

Benny 还一直活跃在证券业务的商业领域,管理客户业务发展战略、营销计划和路演,并为中小型银行和其他金融机构开发和提供金融市场培训计划。

Benny 精通普通话、英语和日语。

自 2014 年春从法国攻读研究生回到中国以来,Jina一直致力于电商领域及其在金融、娱乐和汽车行业的应用。 她是一位多功能人才,能说流利的普通话、英语和法语。

Jina 是 SEIML 在外国客户和中国行政机构之间的主要关系经理,曾多次负责与在中国运营的国际公司和管理人员打交道。 因此,她负责管理公司与客户的所有业务流程外包(BPO)活动。

她拥有经济学研究生学位,并完成了特许金融分析师协会(CFA Institute)颁发的投资基础证书,因此具备协助外国公司进行中国市场研究的知识,包括对潜在客户、供应商或其他第三方进行审查。 她在使用中国社交媒体方面也颇有心得。

Jina 精通普通话、英语和法语。

John 职业生涯的前 24 年是在投资银行度过的,先是在多伦多,后来短暂去了纽约和伦敦。 他曾为欧洲、中东和非洲地区的大型基金提供债务资本市场(DCM)、股权资本市场(ECM) 和战略投资咨询。

2004 年,他转入学术界,在英国和中国的大学设计并开设了投资管理硕士课程。 在英国大学就读期间,他还创建并管理着欧洲一家规模较大的金融专业培训机构(该机构是培训公司的合资伙伴)。

2016 年,John 重返行业,与初创企业以及各种平台和生态体系合作,为这些处于早期和中期阶段的公司提供支持。 起初,他在上海地区开展这项业务,但后于 2024 年迁至香港,以便在东南亚地区建立 SEIML 的足迹。 John 还是香港创始人协会(FI)生态体系的董事和 创始人协会东盟金融科技加速器的项目总监。