Introduction

This is our eleventh Article and looks at how to value a company using the discounted cash flow (DCF) model. Our last four articles all related to specific areas of company financial analysis whereas this ‘puts it all together’ to give us a final (or intrinsic) value for the common shares of a company. We can then use this theoretical value to compare to where we can buy the stock in the market to determine whether it is a good investment to buy or sell.

Again, to conclude our approach to valuation, we will continue to use the common-form representation of the financial statements of Alibaba Group Holding Limited, which is registered with the Securities and Exchange Commission (SEC) in America. These statements have been shown in full in Schedule I of the previous four articles.

The steps to building the model

In today’s article, we will build the DCF valuation using four steps, all of which we have done before. These are:

The above four steps will then give us a theoretical (intrinsic) value for the company. Though the DCF model is a fundamentally correct model to value a company, it is highly dependent on a few key assumptions we make (and will highlight in our analysis). Thus, as a second step, we will look at other valuation indicators to test our DCF value for ‘reasonableness’.

Step 1: historical analysis and ratio analysis

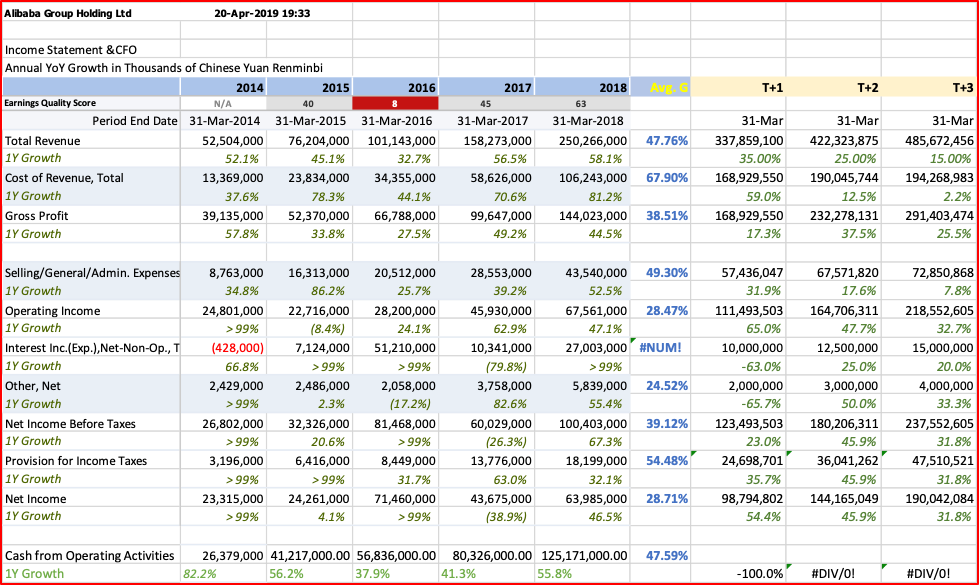

The past won’t allow you to predict the future with certainty, but past trends are a good starting point for any analysis. This is particularly true with larger, established companies where financial trends are likely to continue barring any major ‘disruption’ in its industry. To start this analysis, we have taken the Income Statement and added to the bottom of it the cashflow from operations (CFO). We have talked in article 9. About ‘timing differences’ and why ‘profit’ is not the same thing as ‘cashflow’ and it is CFO that we want to project into the future.

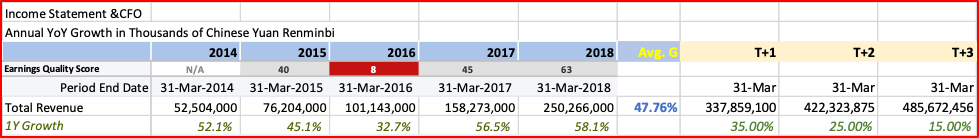

The first thing we want to understood is the growth in total revenue, which is the key starting point for so many aspects of business. We see here in row Total Revenue that revenue has grown over the last five years at a per annum growth rate of 47.76%, which is very high and much higher than the economy that is just growing above 6.0%. Over the longer term, growth rates of companies tend to converge to the growth rates of the markets that they operate in. So, we would expect to the 47% rate to start moving more towards 6%, but over what time and how will it decline. This is a critical question for companies that currently have very high growth rates of revenue.

Revenue forecast

To address this key issue, I have made two assumptions:

A lot of analysis and thought would have to go into the selection of these variables. My purpose here, in this article, is to illustrate the process of creating the DCF model, not to write a thesis justifying each number I chose for each particular variable.

Gross profit and gross margin

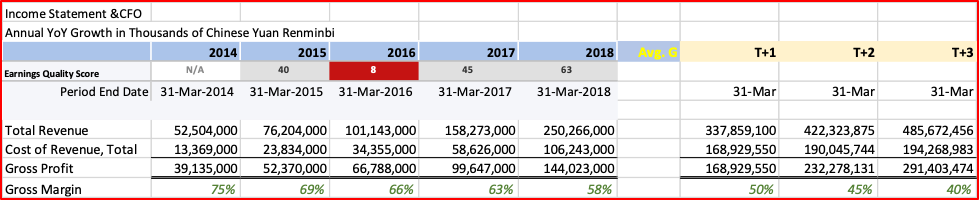

This is the first indicator of profitability we look at. The Cost-of-Goods-Sold or COGS (called Cost of Revenue in this model) looks at the ‘margin’ of profits you earn when you deduct these variable costs from total revenue.

The trend here is very clear: the gross margin of Alibaba is steadily declining. That is not surprising as even at 58% its gross margin is far above what most internet providers achieve. So, its profit margin is reverting to somewhere closer to the industry average, which for domestic or international firms would be between 25% and 40%. I assume that Alibaba, given its dominant market position in China, will remain a market leader domestically and its profit margin will converge to the high end of the industry range (40%) in the near-term (3 year) forecast period.

Overhead costs (fixed costs)

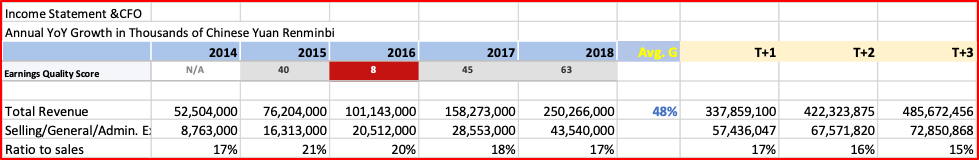

In addition to the variable costs of COGS, the company has many costs that are not directly related to sales volume; we say they are fixed in the short term. This is the company’s overhead and referred to by accountants as Selling, General & Administrative (S,G&A) costs.

For Alibaba, we see the 5-year growth of S,G&A has been 49.3% or about the same (slightly higher) than the growth rate of revenue. I find that unusual as I would expect in a business like Ali’s there are good economies of scale and so this growth rate should be less than the variable revenue (and cost) items. Perhaps, it is that the company is investing heavily in creating more capacity for its future expansion.

I believe that the company will start achieving some economies of scale and I have decreased the ratioto-sales to converge to 15% in year 3.

Those are the major categories for analysis. There are a few other smaller groups (‘Other Income’, etc.) but I will not go through every variable. I will add that I did converge the income tax rate to a standard 25% going forward. From this we are able to work down and calculate Net Income for the forecast period. But, we want cashflow as the value to discount and deriving that forecast from the forecast of Net Income is the next challenge.

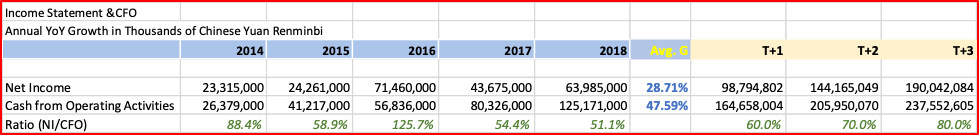

Net Income to Cashflow

This is one of the most difficult variables to forecast. The differences between the two items are timing differences in the recognition of expenses and revenues. Over the long term, they should be roughly equal in amount. But, in the short term, they can vary greatly. I have studied in detail the CFA in the Alibaba financial statements and it is my view they will slowly start converging. My explanation for this one matter would take at least on full article to answer and so I will just state it so we can complete the illustration. In the graph below, you see that Net Income gets closer to 100% of cash flow; the items are converging.

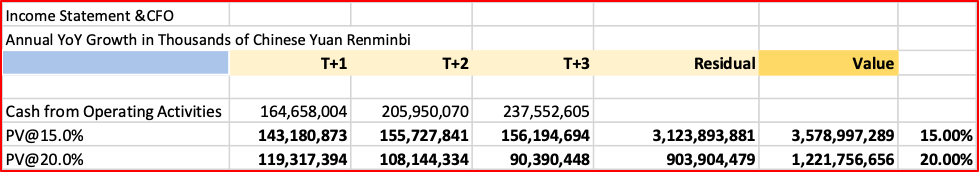

The Residual

We have only done a detailed cash forecast for three years, but we know (or expect) the company will exist for a very long time. It would probably not be worth the effort to try and do a detailed cashflow forecast for 100 years. How can anyone predict any specific value or ratio that far in the future. So, in DCF valuation, we make a simplifying assumption. That is, we assume that cashflow will grow at some constant rate indefinitely. As we stated at the beginning of the article, we will assume cashflow grows at 10.0%, which is still higher than the economy is expected to grow but well below current growth rates. This is actually a reasonable approach as a value in 100 years (using this residual valuation method) is tiny in present value (PV) terms and so it does not matter as much as it might appear at first reading.

The residual is determined by the following formula: Value = Cashflow/(r – g)

Where: r = discount rate and g = growth rate (here, we chose 10.0%)

Next, we have to determine our final variable, the discount rate to use to present value all the future cashflows.

Discount rate for Alibaba

In Article 10 we introduced this concept in the sub-heading ‘Risk Assessment to discount rate’ and highlighted several factors we would consider in determining this rate:

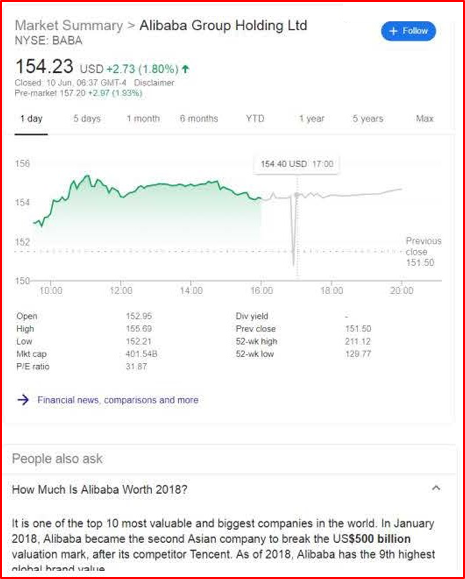

We saw that the relevant index had yielded 10.97% in recent years and the Alibab Beta varied (by analyst) between 1.6 and 2.0, roughly equating to rates between 15.0 and 20.0%. Let us value the company using both 15.0% and 20.0% to determine a range of value for the stock. Note that the discount rate is used both for the individual year discounts and an input into the residual.

The values above are in CNY and the current exchange rate USD:CNY is today (10 June 2019) 6.93155. That means the value of the above in USD would be between USD 516.3 and 176.3 billion. As we can see below from the NASDAQ data, as of 10 June 2019 Alibaba was valued at USD 401.54 Billion – within our suggested range. This would equate to discounting our forecasts at about 16.5%.

Concluding remark to valuation

Having a systematic approach to financial analysis and investing is important, it ensures consistency in analysis and decision making. There is a great amount of information in the market but taking the approach in this article (and the previous four articles) gives you a way to manage all this information and synthesize it in an effective way. Yes, financial analysis can be difficult and time-consuming, but there are no easy ways to make good decisions in complex situations. It requires a sound method, time and experience.

John D. Evans, CFA (author) has over 24 years’ experience in the international capital markets working with issuers of securities and investors around the world. He has designed and taught Master’s programmes in investment management at universities in the UK and China. He was most recently Professor of Investment Management at XJTLU in Suzhou. He now manages SEIML, a consultancy to early-stage companies in China.

Jina Zhu (translator) did her Master’s in Economics in France and is fluent in Mandarin, English and French. She also works at SEIML supporting early-stage companies grow and raise capital in China.

18 June 2019

*********

Schedule I – Combined Income and Cashflow statement (with forecast)

Benny曾在中国金融市场工作,聚焦于固定收益、货币和资产负债管理。 他目前是宁波一家中型私募基金管理公司量利资本的副总裁。 公司的策略包括各种类型的固定收益投资组合管理和可转换债券投资组合管理。 此外,Benny 还为证券公司母基金、企业投资者和高净值个人等专业投资者提供金融投资服务。

Benny 还一直活跃在证券业务的商业领域,管理客户业务发展战略、营销计划和路演,并为中小型银行和其他金融机构开发和提供金融市场培训计划。

Benny 精通普通话、英语和日语。

自 2014 年春从法国攻读研究生回到中国以来,Jina一直致力于电商领域及其在金融、娱乐和汽车行业的应用。 她是一位多功能人才,能说流利的普通话、英语和法语。

Jina 是 SEIML 在外国客户和中国行政机构之间的主要关系经理,曾多次负责与在中国运营的国际公司和管理人员打交道。 因此,她负责管理公司与客户的所有业务流程外包(BPO)活动。

她拥有经济学研究生学位,并完成了特许金融分析师协会(CFA Institute)颁发的投资基础证书,因此具备协助外国公司进行中国市场研究的知识,包括对潜在客户、供应商或其他第三方进行审查。 她在使用中国社交媒体方面也颇有心得。

Jina 精通普通话、英语和法语。

John 职业生涯的前 24 年是在投资银行度过的,先是在多伦多,后来短暂去了纽约和伦敦。 他曾为欧洲、中东和非洲地区的大型基金提供债务资本市场(DCM)、股权资本市场(ECM) 和战略投资咨询。

2004 年,他转入学术界,在英国和中国的大学设计并开设了投资管理硕士课程。 在英国大学就读期间,他还创建并管理着欧洲一家规模较大的金融专业培训机构(该机构是培训公司的合资伙伴)。

2016 年,John 重返行业,与初创企业以及各种平台和生态体系合作,为这些处于早期和中期阶段的公司提供支持。 起初,他在上海地区开展这项业务,但后于 2024 年迁至香港,以便在东南亚地区建立 SEIML 的足迹。 John 还是香港创始人协会(FI)生态体系的董事和 创始人协会东盟金融科技加速器的项目总监。