Introduction

This is our fourteenth Article and the second of five of a ‘mini-series’ on bond markets. In China, individual investors tend to prefer to invest in equities and real estate. But the bond market is a sector that we expect to grow in the coming years along with bond funds so that more individuals will invest in this sector. This second article of five, is intended to explain and illustrate the valuation methodologies for fixed income investments. The following Article 15 on the yield curve is very important to this topic:

15. Understanding the Yield Curve

16. Credit Risk and Corporate Bonds

17. Structured Securities

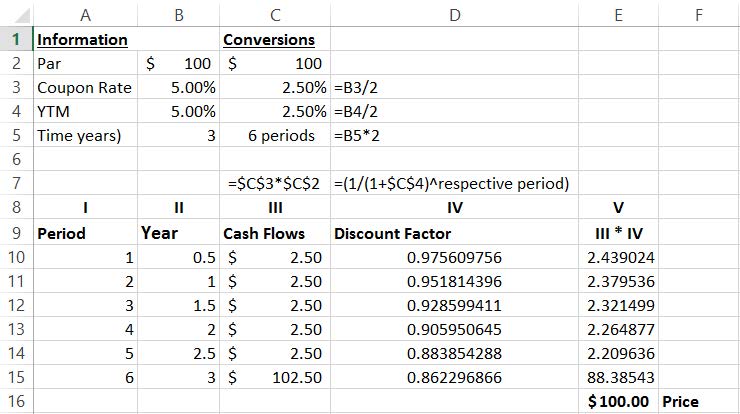

Present Value Calculations

In Article 11, we showed how to value a company using ‘discounted cash flow’ (DCF) method. The concepts of Present Value, Future Value, rates of return, are essential to finance. Bonds and money market instruments apply this concept of present value extensively. Just to review:

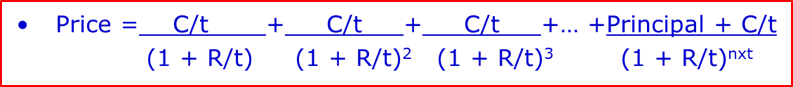

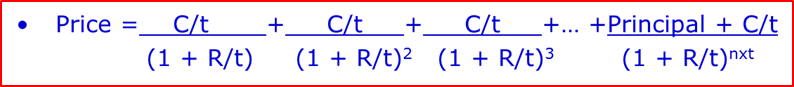

The price (value or present value) of a security is determined by forecasting what future cash flows will be earned, on what date and the appropriate rate of return/interest to discount them back to their current (present) value. Every bond and money market instrument is valued using that exact method. When teaching this in an academic program, tutors often simplify things to ‘whole years’ or ‘half years’, but we cannot do this in the real world.

Bond and money markets are based on ‘conventions’ or rules about how to calculate values of accrued interest. There will be ‘day-count conventions’ that stipulate the actual way you will calculate interest and, thus, price and your investment return. In every market I know about, we have a daily settlement convention. Thus, if you but or sell at 10.53 on a Tuesday, you will calculate the accrued interest in exactly the same way as if you had sold it at 14.12 on that same day. China uses this same-day settlement convention as well.

In illustrating these markets, we will look at three examples:

We will look at corporate bonds and credit risk in Article 16.

Money Market Securities

The money markets include debt instruments with an original maturity of 12 months or less. Interest in the money markets is typically paid in one single “bullet” at maturity. This makes the interest payable a simple-interest (as opposed to compound interest) calculation. The rate on the loan is normally quoted in percentage per annum, so the interest amount payable is pro-rated by the term of the instrument.

Note:

This general formula can be used for either of the two money market instruments described. It is normal for banks to issue ‘certificates of deposit’ (CD) where a depositor (lender) gives the bank Par (100) and on the maturity of the receives bank the principal (Par) plus some additional interest. If it was a 4.0% CD for exactly one year, you would deposit 100 and get back 104 on maturity.

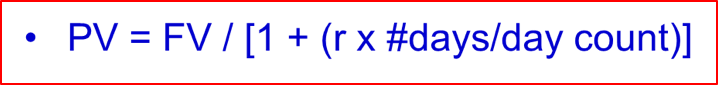

CDs are generally issued in very large amounts and so are not common to individual investors, they are more common with institutional investors. However, if you have invested in a money market fund, chances are that fund will have invested in bank CDs. We illustrate below with two of these instruments issued by the People’s Bank of China.

Using the top security to illustrate, here we see there is an interest-bearing CD that matures on 20 Feb 2020. The initial deposit would have been 100.00 (‘Par’) but on maturity you get repaid your principal (Par) plus a coupon payment of 2.45, or 102.45 in total. There is a second one with a longer maturity of 27 June 2020. Both, when they were first issued, would have had an initial term-to-maturity of one year or less.

We now look at another instrument, issued by the China government that is also short-term in nature but has a slight variation in terms to the bank CD. Refer below to the China government ‘T-bill’.

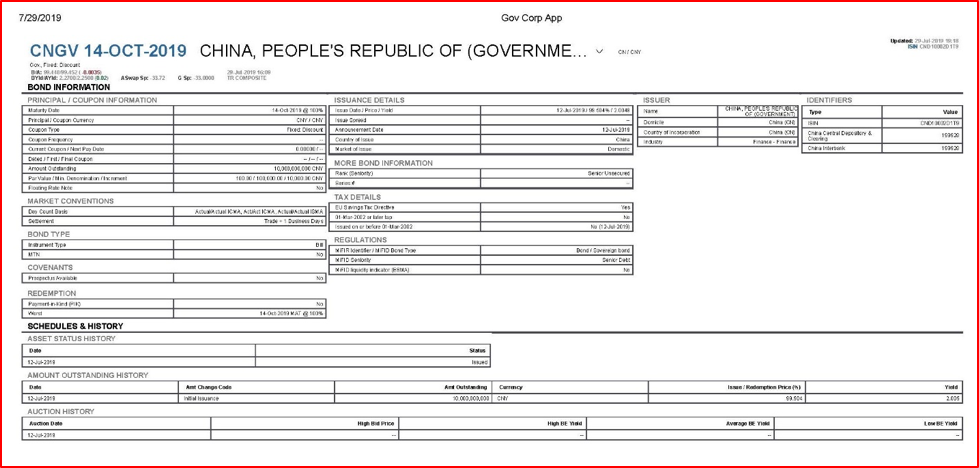

We can see the maturity date is 14-Oct-2019 and it matures at a value of 100 (Par) – there is no additional interest payment. But, if we look beside it, we see it was issued on 12-Jul-2019 at a price of 99.504. Thus, your ‘interest’ is that you are repaid 100 but paid less than that to buy it.

In summary, CDs are purchased (initially) at 100 (Par) and mature and pay a bullet payment that is greater than 100. Bills are bought at a discount to par and mature at par. Note, however, that an interest rate of, say, 5.0% is not the same investment return as a discount of 5.0%.

For historical reasons, financial institutions have offered CDs that are interest bearing and governments have issued (discount) bills. So, both types of instruments are common in most capital markets.

Bond Valuation

Since bonds have an initial term-to-maturity of greater than one year, they are most frequently ‘coupon bearing; there is one or more interim payments prior to the bond maturing. Again, we can use our simple Present Value method but in this case we have to PV a whole series of payments (not just one final payment) and then sum these together to get the value of the ‘bundle’ of cash flows. Though more complicated than money market, the fact that the interim payments (‘coupons’) are made in a consistent manner (annually or semi-annually) means that we can make these values quite quickly with either a calculator or an Excel spreadsheet. We use the example of the CGBs we referred to in Article 13, bonds issued by the China central government.

In the CGB market, bonds with an initial term-to-maturity of less than ten years pay an annual coupon. Bonds with an initial term-to-maturity of ten years or longer pay a semi-annual coupon.

If we look at the five-year benchmark, we see the coupon is 3.19%. This is an annual coupon so each year we discount a cashflow of 3.19 and in the final year a cash flow of 103.19. But, if we look at the ten-year benchmark, we see a coupon of 3.29 but this is paid semi-annually. So, here we would need to discount 19 cash flows of 1.645 (3.29/2) and a final payment of 101.645.

It is important at this point to distinguish between ‘coupon’ and the ‘yield’ of a bond. When a bond is first issued, the coupon should reflect that correct yield to earn on that bond, for that category of issuer and for that maturity. But, after that point-in-time, things may change. The general level of interest rates in the market may go up or go down. We will talk about the ‘yield curve’ in more detail in Article 15. If this was a corporate issuer, its credit rating might go up or down meaning the correct yield for this bond may change, even if the general level of interest rates do not change. We will talk about credit risk and changes in Article 16. What we need to understand now, in general, is how the value of a bond changes when the ‘correct yield’ for that bond changes – the coupon is never changed after issuance.

Two important points follow from the pricing formula developed here:

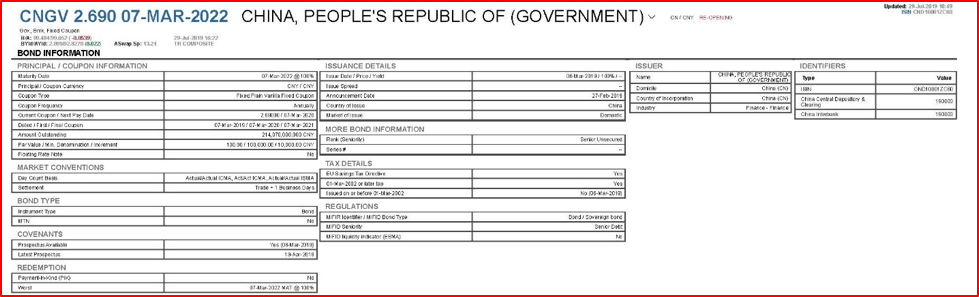

A starting point in bond investing is, thus, for your desired maturity, among similar credit rated issuers, among bonds of similar liquidity, which will provide you with the highest YTM. Just for illustration, I have confirmed the bond yield on the 3-year CGB in the below detailed analysis.

We can see this bond was first issued on 6 March 2019, when the 2.69% annual coupon was set. Now we see it is trading below its issue price at a bid price 99.484, which gives it a YTM of 2.8950%. I don’t believe there was any change in the credit rating of the government, so it appears that interest rates have risen since this bond was issued. Managing interest rate risk is one of the key tasks of investors in bonds.

Clean (Flat) vs. Dirty (Invoice) prices

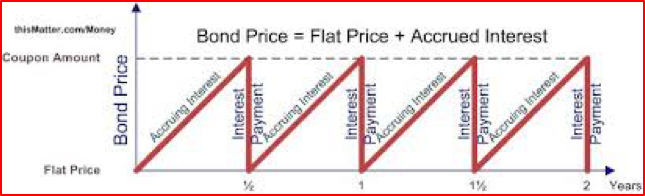

A Clean or Flat price is the price of a bond without including the accrued interest that is due to the seller. Dirty or Invoice price is the legal amount you must pay the seller, which is both the price and accrued interest. Accrued interest is important to understand. As the owner of a bond, you are legally entitled to the accrued interest for all the days you owned the bond. Of course, interest is only paid in periodic coupons (annually for our 3-year example). If you bought this bond at issuance on 6 March 2019 and sold it to me on 29 July 2019, you would be entitled to 145 days of accrued interest and this amount (equal in price to 1.0584) would have to be added to the quoted price of 99.484 (or 100.5424) as proceeds to you. I pay you the accrued interest as you won’t be the holder when the next coupon is paid. The buyer always pays the seller of the bond any accrued interest. But – note- that quoted prices never include accrued interest (99.484), they are the Clean (Flat) prices only. So, why the inconsistency?

Imagine that we hold this bond through the next coupon date, while market conditions remain the same. As the coupon date approaches all the future cash flows get closer, so the present value of the bond rises steadily. Similar price drops would occur every time a coupon is paid.

To eliminate such ‘technical’ price fluctuations the markets quote bond prices on a clean (or flat) basis: they subtract from the bond’s present value the interest amount accrued since the start of the current coupon period (in the figure, the vertical distance between the bond’s present value and the horizontal timeline). Thanks to this technique, other things being equal, there should be no perceptible change in the bond’s quoted price as it goes through a coupon date. The clean price gives investors a measure of market value that is not affected by the payment of a coupon.

In Conclusion

This initial valuation module on bonds shows how different the investment analysis is for high-grade bonds as compared to equity markets. For equity investing there is a lot of fundamental analysis of economics, industry, company strategy and many other variables. For government (high grade) bonds it is a much more quantitative and technical form of analysis.

We will see in Article 16 that when a bond is issued by a very low rated entity, it sometimes takes on ‘equity-like characteristics’. But, always keep in mind the two fundamental differences between a bond and an equity investment as summarized in Article 13.

John D. Evans, CFA (author) has over 24 years’ experience in the international capital markets working with issuers of securities and investors around the world. He has designed and taught Master’s programmes in investment management at universities in the UK and China. He was most recently Professor of Investment Management at XJTLU in Suzhou. He now manages SEIML, a consultancy to early-stage companies in China.

Jina Zhu (translator) did her Master’s in Economics in France and is fluent in Mandarin, English and French. She also works at SEIML supporting early-stage companies grow and raise capital in China.

29 July 2019

Benny曾在中国金融市场工作,聚焦于固定收益、货币和资产负债管理。 他目前是宁波一家中型私募基金管理公司量利资本的副总裁。 公司的策略包括各种类型的固定收益投资组合管理和可转换债券投资组合管理。 此外,Benny 还为证券公司母基金、企业投资者和高净值个人等专业投资者提供金融投资服务。

Benny 还一直活跃在证券业务的商业领域,管理客户业务发展战略、营销计划和路演,并为中小型银行和其他金融机构开发和提供金融市场培训计划。

Benny 精通普通话、英语和日语。

自 2014 年春从法国攻读研究生回到中国以来,Jina一直致力于电商领域及其在金融、娱乐和汽车行业的应用。 她是一位多功能人才,能说流利的普通话、英语和法语。

Jina 是 SEIML 在外国客户和中国行政机构之间的主要关系经理,曾多次负责与在中国运营的国际公司和管理人员打交道。 因此,她负责管理公司与客户的所有业务流程外包(BPO)活动。

她拥有经济学研究生学位,并完成了特许金融分析师协会(CFA Institute)颁发的投资基础证书,因此具备协助外国公司进行中国市场研究的知识,包括对潜在客户、供应商或其他第三方进行审查。 她在使用中国社交媒体方面也颇有心得。

Jina 精通普通话、英语和法语。

John 职业生涯的前 24 年是在投资银行度过的,先是在多伦多,后来短暂去了纽约和伦敦。 他曾为欧洲、中东和非洲地区的大型基金提供债务资本市场(DCM)、股权资本市场(ECM) 和战略投资咨询。

2004 年,他转入学术界,在英国和中国的大学设计并开设了投资管理硕士课程。 在英国大学就读期间,他还创建并管理着欧洲一家规模较大的金融专业培训机构(该机构是培训公司的合资伙伴)。

2016 年,John 重返行业,与初创企业以及各种平台和生态体系合作,为这些处于早期和中期阶段的公司提供支持。 起初,他在上海地区开展这项业务,但后于 2024 年迁至香港,以便在东南亚地区建立 SEIML 的足迹。 John 还是香港创始人协会(FI)生态体系的董事和 创始人协会东盟金融科技加速器的项目总监。