We have gone through over a dozen years of very high economic growth and massive market appreciation; some would argue, largely debt-fueled. But with several big ‘shocks to the system’, zero-COVID policies, Russian invasion of Ukraine, Brexit and, now, Fed tightening, could it be that we are entering a sustained period of recession? Time to revisit ‘the bezzle’.

There are a variety of views on this topic, so I summarize a few of these taken from different reports, referenced by the article link.

“In a famous passage from his book The Great Crash 1929, John Kenneth Galbraith introduced the term bezzle, an important concept that should be far better known among economists than it is. The word is derived from embezzlement, which Galbraith called “the most interesting of crimes.”

“Unfortunately, the bezzle is temporary, Galbraith goes on to observe, and at some point, investors realize that they have been conned and thus are less wealthy than they had assumed. When this happens, perceived wealth decreases until it once again approximates real wealth. The effect of the bezzle, then, is to push total recorded wealth up temporarily before knocking it down to or below its original level. The bezzle collectively feels great at first and can set off higher-than-usual spending until reality sets in, after which it feels terrible and can cause spending to crash.”

“Yet another way the bezzle can confound GDP calculations is by artificially lowering the cost of capital. When equity or debt has been bid to higher prices than will ultimately be justified by future returns, this reduces the cost of capital for businesses by effectively transferring a portion of the cost to owners of equity or debt. These lower capital costs encourage more commercial activity—including investment that otherwise would not be considered productive—than might otherwise be justified. Such lower capital costs also feed into higher business profits, which in turn boost the value-added component of GDP calculations.”

https://blogs.cfainstitute.org/investor/2019/09/12/the-bezzle-and-the-central-banks/

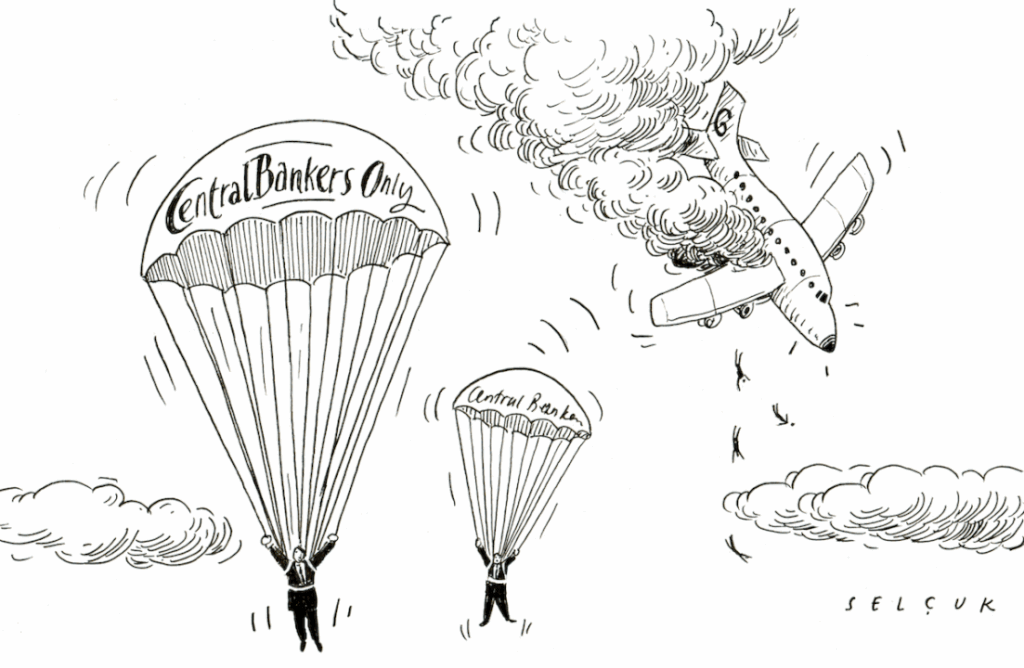

“The bezzle of the current bull market isn’t stocked with Ponzi schemes and outright frauds in my view. Rather it is built on the notion that risky assets have become practically risk-free thanks to central bank policies.”

https://www.axios.com/2022/05/09/bull-market-bezzle-end

“Bull markets engender trust that verges on complacency, or even gullibility. When they start to drop — as they are doing right now — there is a sharp rise in mistrust, as frauds are uncovered and shady dealings condemned.

Why it matters: Regulators have signaled they’re more serious about cracking down on financial criminals than they have been in decades. Such activity is unlikely to be hard to find.

Driving the news: Federal prosecutors in New York last month charged hedge fund manager Bill Hwang with federal racketeering charges that could send him to prison for the rest of his life. The Department of Justice is reportedly using big banks as its informants on Wall Street. And the SEC is doubling the size of its division devoted to prosecuting crypto fraud.”

Concluding comment:

‘The Bezzle’: is it about fraud, is it about runaway monetary policy, is it about investor naivete, inadequate regulation of our markets? Or is it a combination of all of the above? Whatever, the next few years are going to be both interesting and challenging. Secondo me.

John D. Evans, CFA

Benny曾在中国金融市场工作,聚焦于固定收益、货币和资产负债管理。 他目前是宁波一家中型私募基金管理公司量利资本的副总裁。 公司的策略包括各种类型的固定收益投资组合管理和可转换债券投资组合管理。 此外,Benny 还为证券公司母基金、企业投资者和高净值个人等专业投资者提供金融投资服务。

Benny 还一直活跃在证券业务的商业领域,管理客户业务发展战略、营销计划和路演,并为中小型银行和其他金融机构开发和提供金融市场培训计划。

Benny 精通普通话、英语和日语。

自 2014 年春从法国攻读研究生回到中国以来,Jina一直致力于电商领域及其在金融、娱乐和汽车行业的应用。 她是一位多功能人才,能说流利的普通话、英语和法语。

Jina 是 SEIML 在外国客户和中国行政机构之间的主要关系经理,曾多次负责与在中国运营的国际公司和管理人员打交道。 因此,她负责管理公司与客户的所有业务流程外包(BPO)活动。

她拥有经济学研究生学位,并完成了特许金融分析师协会(CFA Institute)颁发的投资基础证书,因此具备协助外国公司进行中国市场研究的知识,包括对潜在客户、供应商或其他第三方进行审查。 她在使用中国社交媒体方面也颇有心得。

Jina 精通普通话、英语和法语。

John 职业生涯的前 24 年是在投资银行度过的,先是在多伦多,后来短暂去了纽约和伦敦。 他曾为欧洲、中东和非洲地区的大型基金提供债务资本市场(DCM)、股权资本市场(ECM) 和战略投资咨询。

2004 年,他转入学术界,在英国和中国的大学设计并开设了投资管理硕士课程。 在英国大学就读期间,他还创建并管理着欧洲一家规模较大的金融专业培训机构(该机构是培训公司的合资伙伴)。

2016 年,John 重返行业,与初创企业以及各种平台和生态体系合作,为这些处于早期和中期阶段的公司提供支持。 起初,他在上海地区开展这项业务,但后于 2024 年迁至香港,以便在东南亚地区建立 SEIML 的足迹。 John 还是香港创始人协会(FI)生态体系的董事和 创始人协会东盟金融科技加速器的项目总监。