Having worked in industry, professional education, academic teaching and now co-leading the Hong Kong chapter of Founder Institute, I am constantly reflecting on what it takes to make a start-up successful. There are, of course, many things and they vary with each situation. But I believe the ‘core competencies’ and time in both development and, also, go to market are critical issues that I want to address here.

Core Competencies

In my previous article in March, I talked about how we focus our training on three areas: business knowledge, subject matter expertise and technology usage. I also think there is a natural order in the focus on these three areas. First, most Founders are focused on some sort of industry invention, subject matter knowledge. Second, as they approach go-to-market, they must have researched and assessed the market potential and their marketing strategy, business knowledge. Third, every company these days needs to know how they can use technology for best advantage. If the technology is core to the offering (as opposed to making the marketing and distribution more effective) then technology might be the second step and business the third.

These core competencies also impact the team and HR development of the firm. In theory, you need all three of these competencies on your team. But you have a choice, at least with the business and technology skills, in that if you don’t have them internally (and maybe don’t have the budget for them currently) then you can outsource and find consultants to fill in the gap. There are pros and cons to outsourcing that I am not going to debate here, only that it is a choice to consider.

When looking at a start-up I tend to break the early stage down into two sub-stages. The first sub-stage is the market research, product/service offering (building the MVP). The second sub-stage is the go-to-market (commercialization) implementation.

When going fast is bad

It is always risky making generalizations, one can always think of exceptions. So, I will simply state what my bias is in these early stages. I believe in taking the time to build a solid foundation; really assessing the market need, researching the prospective buyers, pricing and other key elements. So, in the early R&D stage (before the go-to-market) I prefer to take the extra time to review and plan the strategy in-depth.

At the Hong Kong chapter of Founder Institute, we look to provide early stage Founders with business knowledge through our delivery of our Core Program. In our industry verticals (AI, FinTech, Web3) we look to supplement the business knowledge with subject matter expertise. However, the technology knowledge, which is becoming critical for every company, is newer and more complex. So, some of our Founders will look after graduation to enroll in a more advanced and specialized Incubator focusing just on the technology and there are a growing number of options (some with funding) in this regard.

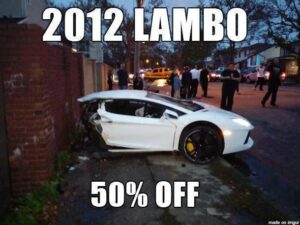

Also, at this early stage, you are not showing your hand (much) to the market and so there is less chance of having someone imitate your offering and/or beating you to market. I also think that a good amount of testing of your product/solution to ensure you don’t ‘roll out and crash’ is essential as first impressions are very important. If your product launch is a fiasco, then it will be very hard to recover from that.

When going fast is good

In a sense, the more you invest in the first sub-stage the faster you can go in your second, go-to-market, sub-stage. And it is more critical here as now everything you have done and will do becomes public knowledge. So, if you are unable to create a strong moat around your business then you cannot risk going too slow after launch. The imperative to move quickly is further necessary in that you are likely to be in a higher period of cash burn and, these days, to raise external funding you almost have to be revenue generating. In addition, if you can grow your revenue quickly and convince others that this growth is sustainable then that will further impress potential investors and in this post-QE world funding is much more limited than before.

Never lose sight of the long-run goal

Even if you are not thinking about it a lot, your early investors will want to know where you are going in terms of an exit for them. Do you see this as a sustainable long term company (standing alone) that can IPO? Or is it a ‘piece of a bigger puzzle’ meaning that it must one day be acquired by a larger institution? Looking at my focus on financial markets, which are large firms in a global industry, I think most new fintechs without a full service offering must one day be bought out. And given the much more difficult funding market in our post-QE world, being acquired is more likely an outcome for companies than when QE was still roaring.

This is an also important question for the Founders to address early on. If your longer term outcome is an acquisition then looking at potential strategic partners very early, which might also give you a faster track in revenue generation, becomes critical – for both your short-term and your long-term success. Of course, if you start out with two or three key partners then this gives you more choice in the long term and does not make you a ‘captive’ to one in the short term.

Conclusion

Starting a company is a challenge and there is no ‘one way to success’. However, as a matter of personal opinion, I would conclude by saying:

John D. Evans, CFA

Founder & GM, SEIML

Benny曾在中国金融市场工作,聚焦于固定收益、货币和资产负债管理。 他目前是宁波一家中型私募基金管理公司量利资本的副总裁。 公司的策略包括各种类型的固定收益投资组合管理和可转换债券投资组合管理。 此外,Benny 还为证券公司母基金、企业投资者和高净值个人等专业投资者提供金融投资服务。

Benny 还一直活跃在证券业务的商业领域,管理客户业务发展战略、营销计划和路演,并为中小型银行和其他金融机构开发和提供金融市场培训计划。

Benny 精通普通话、英语和日语。

自 2014 年春从法国攻读研究生回到中国以来,Jina一直致力于电商领域及其在金融、娱乐和汽车行业的应用。 她是一位多功能人才,能说流利的普通话、英语和法语。

Jina 是 SEIML 在外国客户和中国行政机构之间的主要关系经理,曾多次负责与在中国运营的国际公司和管理人员打交道。 因此,她负责管理公司与客户的所有业务流程外包(BPO)活动。

她拥有经济学研究生学位,并完成了特许金融分析师协会(CFA Institute)颁发的投资基础证书,因此具备协助外国公司进行中国市场研究的知识,包括对潜在客户、供应商或其他第三方进行审查。 她在使用中国社交媒体方面也颇有心得。

Jina 精通普通话、英语和法语。

John 职业生涯的前 24 年是在投资银行度过的,先是在多伦多,后来短暂去了纽约和伦敦。 他曾为欧洲、中东和非洲地区的大型基金提供债务资本市场(DCM)、股权资本市场(ECM) 和战略投资咨询。

2004 年,他转入学术界,在英国和中国的大学设计并开设了投资管理硕士课程。 在英国大学就读期间,他还创建并管理着欧洲一家规模较大的金融专业培训机构(该机构是培训公司的合资伙伴)。

2016 年,John 重返行业,与初创企业以及各种平台和生态体系合作,为这些处于早期和中期阶段的公司提供支持。 起初,他在上海地区开展这项业务,但后于 2024 年迁至香港,以便在东南亚地区建立 SEIML 的足迹。 John 还是香港创始人协会(FI)生态体系的董事和 创始人协会东盟金融科技加速器的项目总监。