Introduction

This is our thirteenth Article and the first of five of a ‘mini-series’ on bond markets. In China, individual investors tend to prefer to invest in equities and real estate. But the bond market is a sector that we expect to grow in the coming years along with bond funds so that more individuals will invest in this sector. This first article of five, is intended to give an overview of bond markets in general and will be followed with four more specific articles:

14. Valuing Bonds and Money Market Instruments

15. Understanding the Yield Curve

16. Credit Risk and Corporate Bonds

17. Structured Securities

Characteristics of Debt Securities

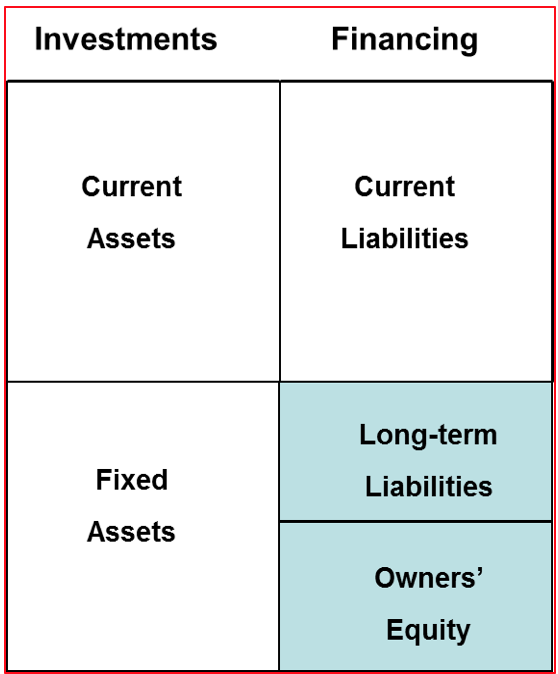

There are a great many sources of financing to a corporation, but they largely fall into one of two categories: debt and equity. This can be illustrated by looking at the Balance Sheet of a corporation (Figure below). The left-facing column lists the assets (investments) of a company and the right column lists the sources of financing. Sources of financing may include bank loans and trade credit provided by suppliers. However, debt and equity securities are two very important long-term sources of financing. There are, however, some key differences between debt and equity from the perspective of both the issuer of securities and its investor. Both are financial assets or securities, but they have two, key differentiating characteristics. From the perspective of debt, we can say:

1. Debt has a “promise to pay”, a legal commitment to meet some payment schedule in a timely manner and failure to meet a payment has serious legal consequences, such as the company going into bankruptcy. Payments under equity, however, are completely discretionary; management decides at the end of the fiscal year whether or not they will declare a dividend. Although management may have a desire to pay dividends there is no legal consequence to not paying them. As a consequence, equity provides a corporation with much greater financial flexibility, but this translates into greater uncertainty and risk to the investor.

2. Debt has a repayment of principal. As the value of any security is simply applying time-value-ofmoney calculations to forecasted or promised future cash flows, repayment of principal greatly adds to the certainty of valuing debt, relative to equity and dividends.

The above two characteristics are what make the risk and return of debt versus equity very different. The discretionary nature of dividends allows management to greatly reduce its financial risk but this translates into a source of higher risk to the investor, for which they demand a higher expected return. The payment schedules committed to by issuers of debt at launch also greatly reduce the uncertainty in the discounting of the cash flows. There may, as we will see in Article 16, be credit risk; the issuer may not be able to meet its promise to pay. But putting that aside we have amounts and dates to work with making the valuation process much less uncertain. That is why bond valuation models appear to be so much more quantitative than the “simpler” equity valuation models. In equity, there is less value in trying to forecast dividends and payment dates with the same level of detail as the uncertainty makes the exercise not worth the additional effort.

“Plain vanilla” bullet bonds

A bond is a debt obligation. The investor who buys a bond is a lender and the organization that issues the bond is a borrower. The debt obligation is securitized so that the bond can be traded on the capital markets (securitized in that it is a legally transferable instrument). When contrasting equity and debt above we are implicitly looking at a debt instrument that we refer to as a “bullet bond”, in that coupons are paid based on fixed amounts and principal is repaid at par at maturity. We know that not all bonds are bullet bonds where all cash flows are specified in money terms. Some bonds will index the payments (coupon and principal) to some public index such as the price of oil, a stock index value or an index of inflation (this example is looked at in Article 17). Here the “promise to pay” is not made in cash terms but adjusted by a formula. Note that payment dates will likely remain fixed.

We also know that some bonds are “hybrid” in that they come with an option embedded in them.

The most common example is the callable bond (covered in Article 17) where the issuer of the debt has the right to call the bond under prescribed terms. And we know that there are “perpetual” bonds that have been issued and don’t have a maturity date and so make no commitment to return principal.

Although we can find exceptions to the two key characteristics of debt as introduced above, it is nevertheless, the case that the bullet bond is the most common form of debt, for corporations and governments and is the best starting point for studying fixed income securities. Clearly, when this area of study is mastered then turning to the various hybrid and structured securities is important, but we find the basic principles remain the same.

Bond markets are based on ‘conventions’ or rules about how to calculate values of accrued interest. There will be ‘day-count conventions’ that stipulate the actual way you will calculate interest and, thus, price and your investment return. We will defer this detailed mathematical discussion for Article 14.

Money Market and Bond Market

The asset class of “debt” actually encompasses many different types of financing. It can be short-term credit provided by a supplier or bank. It can be a leasing arrangement of a capital good purchased. But our focus is on financial securities, those financial contracts that are actively traded between investors around the world.

We find two very different areas within debt securities: money market and the bond market.

The money market and the bond market are two markets that have been segmented by convention and regulation. The 12-month cut-off probably originates from annual corporate statements being based upon a year and the accounting convention of short-term (≤1 year) versus long-term (>1 year).

However, some material practical distinctions exist between these two markets, the most important one being discount versus coupon bearing instruments. Day count conventions also may differ between money and bond markets in the same country or currency. For example, bond interest is calculated using an “actual/actual” basis whereas money market instruments use an “actual/360” convention. It is not worthwhile to try and understand why different conventions have come about; they are simply a product of history.

Discount versus coupon bearing instrument

This is an important distinction between the two sectors that impacts the valuation formula. As we will see later, the concept of “reinvestment” is very important in bond valuation. It means that during the life of the security there will be interim payments that can be invested to earn additional return. This is the case with most bonds and hence valuation models need to take the reinvestment into consideration. Money market securities typically don’t pay interim payments and so the issue of reinvestment is not relevant. When reinvestment is not present and for periods of less than one year, we can then apply a concept of simple interest (i.e. no compounding) in calculating a price or rate of return. These differing conventions will be fully explained and illustrated in Article 14.

OTC and exchange traded markets

A market is a mechanism for buyers and sellers to interact in a convenient and cost-effective manner. Markets have several important characteristics:

Two important market structures have traditionally been exchanges and over-the-counter (OTC) markets, although technology today is creating new hybrid markets that don’t fall neatly into either one of these two definitions. These different structures have an impact on how the market functions in terms of price transparency and, also, settlement.

Bonds and OTC markets

Although in some jurisdictions bonds have to be listed on an exchange for an investor to purchase them, most bonds are traded OTC. By not following the more detailed rules laid down by exchanges, market participants sometimes assert that OTC market are less regulated, which encourages a freer flow of capital. OTC markets are certainly less standardized than exchanges with their many rules for market size, trading limits and trading days. Yet the trade-off is often price transparency; when markets become illiquid finding a “market price” may become more difficult.

The lack of a centralised clearing house (CH) certainly increases counterparty settlement risk. Although a CH can, of course, default they are usually well capitalised entities with good credit ratings. The one benefit they do provide is that a market participant only need concern itself with the credit assessment of one counterparty, the CH, and not the great many they might deal with in an OTC market. Thus, all other things equal, settlement risk is likely to be higher in the bond market that is largely OTC.

China’s Bond Markets

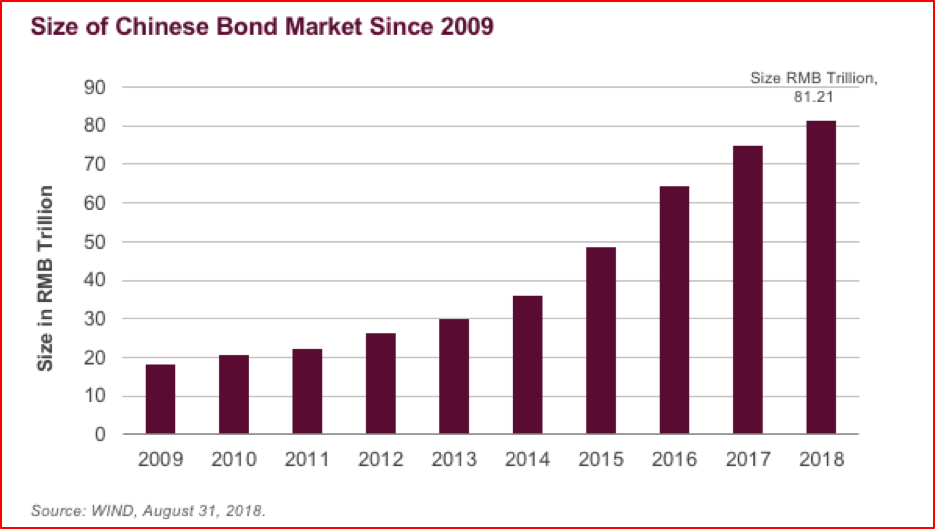

The bond markets in China have grown greatly over the last ten years, in line with the high level of economic growth. China’s overall bond market (for all types of issuers) is now the second largest in the world, after America. Unlike equities, bonds are issued by both private corporations and government entities. The China Government Bond (CGB) market has, in particular, grown very large over this period. That is why I believe individual investors will get more involved in bond market investing in the future.

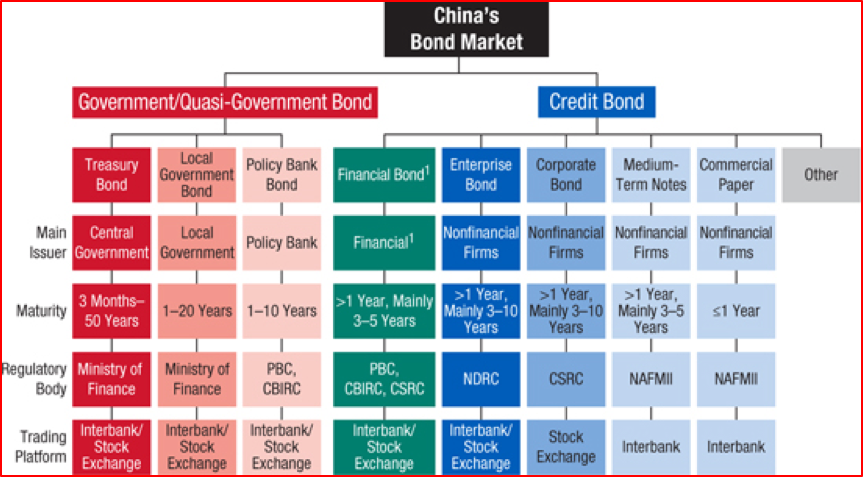

We can also see there are a diversity of issuers of CNY bonds in the domestic market and different platforms for trading these instruments. (Note that ‘interbank’ is largely meaning ‘OTC’).

The market has been designated into two major categories:

We see that the trading convention can be Interbank (OTC) or via the Stock Exchange (SSE or SzSE). We also see the regulatory body is different for different classes of issuers. Lastly, we see a column for money-market instruments (commercial paper). This market structure is quite similar to the market structure in other major bond markets around the world.

In Conclusion

Individual investors in China have not invested in bonds as much as they have in stocks or real estate. But bond markets are growing and give you a chance to diversify your investments. With this introductory article and the following four, more technical articles, we hope this gives you the interest and confidence to look at bonds as a potential investment opportunity and source of diversification.

John D. Evans, CFA (author) has over 24 years’ experience in the international capital markets working with issuers of securities and investors around the world. He has designed and taught Master’s programmes in investment management at universities in the UK and China. He was most recently Professor of Investment Management at XJTLU in Suzhou. He now manages SEIML, a consultancy to early-stage companies in China.

Jina Zhu (translator) did her Master’s in Economics in France and is fluent in Mandarin, English and French. She also works at SEIML supporting early-stage companies grow and raise capital in China.

1 August 2019

Benny曾在中国金融市场工作,聚焦于固定收益、货币和资产负债管理。 他目前是宁波一家中型私募基金管理公司量利资本的副总裁。 公司的策略包括各种类型的固定收益投资组合管理和可转换债券投资组合管理。 此外,Benny 还为证券公司母基金、企业投资者和高净值个人等专业投资者提供金融投资服务。

Benny 还一直活跃在证券业务的商业领域,管理客户业务发展战略、营销计划和路演,并为中小型银行和其他金融机构开发和提供金融市场培训计划。

Benny 精通普通话、英语和日语。

自 2014 年春从法国攻读研究生回到中国以来,Jina一直致力于电商领域及其在金融、娱乐和汽车行业的应用。 她是一位多功能人才,能说流利的普通话、英语和法语。

Jina 是 SEIML 在外国客户和中国行政机构之间的主要关系经理,曾多次负责与在中国运营的国际公司和管理人员打交道。 因此,她负责管理公司与客户的所有业务流程外包(BPO)活动。

她拥有经济学研究生学位,并完成了特许金融分析师协会(CFA Institute)颁发的投资基础证书,因此具备协助外国公司进行中国市场研究的知识,包括对潜在客户、供应商或其他第三方进行审查。 她在使用中国社交媒体方面也颇有心得。

Jina 精通普通话、英语和法语。

John 职业生涯的前 24 年是在投资银行度过的,先是在多伦多,后来短暂去了纽约和伦敦。 他曾为欧洲、中东和非洲地区的大型基金提供债务资本市场(DCM)、股权资本市场(ECM) 和战略投资咨询。

2004 年,他转入学术界,在英国和中国的大学设计并开设了投资管理硕士课程。 在英国大学就读期间,他还创建并管理着欧洲一家规模较大的金融专业培训机构(该机构是培训公司的合资伙伴)。

2016 年,John 重返行业,与初创企业以及各种平台和生态体系合作,为这些处于早期和中期阶段的公司提供支持。 起初,他在上海地区开展这项业务,但后于 2024 年迁至香港,以便在东南亚地区建立 SEIML 的足迹。 John 还是香港创始人协会(FI)生态体系的董事和 创始人协会东盟金融科技加速器的项目总监。