The recent story for me started when attending a ‘smart industry’ conference in Shenzhen November 2019. This was organized for SEIML by the EAChamber and involved industry from China and abroad, with a large section of companies and research entities from Germany (photo below).

I had always been interested in technology and financial markets but quickly realized I had missed how much technology was changing almost everything we do – it was not just the driver for the financial industry.

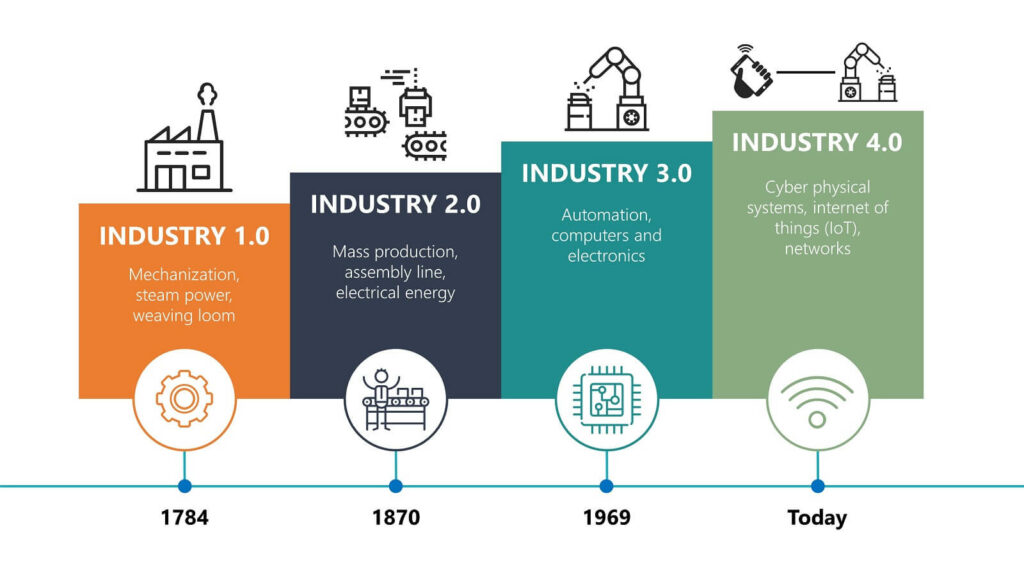

One other thing I learnt, though it may appear obvious to the reader, is that technology for the financial sector is quite different from the technology used in industry that make (manufacture) ‘real things’. The financial sector is a service industry dealing with intangibles, money, securities and other financial contracts, and is largely about data aggregation and analysis. But when you are producing tangible goods, the story is much more complex. Data analysis is important, but so is the technology used to produce, like a 3D printer as just one common example. So, it became clear to me very quickly I had a lot to learn to move from the financial space into the manufacturing industry.

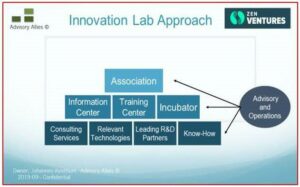

Fast forward to Frankfurt, Germany where I was two weeks ago for a China – Germany industry conference. Within the EU, Germany stands out in two ways. First, is has a very large ‘Mittlestand’ or SME’s focusing on the manufacturing sector. As manufacturing is still a big part of China’s economy, it should be no surprise that Germany has the largest trade/investment with China of any country in the EU. There is also another very important connection. China is trying to ‘upgrade’ its manufacturing, not just in what it produces but also in its production processes; the move to ‘smart manufacturing’. German know-how is well-placed to assist China in this advancement as it has many governmental and industry R&D centers and incubators that assist local German industry in achieving the best production processes using state-of-the-art technology.

Since returning from Germany, we have started working with Johannes Vizethum who is a leading expert in this area, both in Germany and in China. The objective here will be to create ‘smart manufacturing’ Innovation Labs in local municipal cities of China, supported by local government and industry. This will be a center of engineering and technological excellence for the local industry to upgrade its manufacturing processes and for the municipality to be a more attractive location for encouraging industry (both domestic and foreign spin-offs) to set-up in its jurisdiction. With competition for new investment heating-up between cities in China, creating this sort of advanced ‘eco-system’ (R&D lab, incubators, companies that build prototypes for new companies to scale-up), this will become a source of competitive advantage for cities in China that are prepared to make this investment.

Over the course of 2020, we will be working with Johannes on his strategy of setting up these key manufacturing eco-systems in China and also helping German spin-offs to work in partnership with local industry to bring the true ‘smart manufacturing’ to many areas of China.

As trade relations are being redefined globally, this is one area of great promise for collaboration between China and Germany.

John D. Evans, CFA

Founder of SEIML

2 December 2019

If you have thought of operating a business in Asia, or already have one, then do not hesitate to contact us to see how we might be able to help you set up, raise private capital, and manage your company’s local administration.

©2024

Snowdonia Evans Investment Management Limited (SEIML)

Benny has worked in the financial markets of China with an emphasis on fixed income, currency and asset-liability management. He is currently Vice President of Longly Capital, a medium-sized, Ningbo-based private fund management company. The firm’s strategies include various types of fixed income portfolio management and convertible bond portfolio management. In addition, Benny offers financial investment services to professional investors such as Fund of Funds (FoF) of securities companies, enterprise investors and high net worth (HNW) individuals.

Benny has also been active on the commercial side of the securities business managing client business development strategies, marketing programmes and roadshows and developing and delivering financial markets training programmes for small and medium-sized banks and other financial institutions.

Benny is fluent in Mandarin, English and Japanese.

Since returning from graduate studies in France to China in spring of 2014, Jina has been continually working in the field of e-commerce and its applications to the financial, entertainment and automotive industries. She is a multi-functional talent and fluent in Mandarin, English and French.

Jina is SEIML’s key relationship manager between foreign clients and the Chinese administrative authorities and has held many responsibilities dealing with international companies and executives operating in China. As a result, she manages all of the company’s Business Process Outsourcing (BPO) activities with clients

With her graduate degree in economics and completion of the Investment Foundations certificate from CFA Institute, she has the knowledge to assist foreign companies in China market research, including reviews of potential customers, suppliers or other third parties. She is also quite savvy in the use of Chinese social media.

Jina is fluent in Mandarin, English and French.

John spent the first 24 years of his career in investment banking, first in Toronto, briefly in New York and then London. He was involved in DCM, ECM and strategic investment advisory to large funds in EMEA.

In 2004 he moved into academia and designed and ran MSc programs in investment management at universities in the UK and China. He also created and managed one of the larger financial professional training organizations in Europe while at the UK university (that was a JV partner in the training firm).

In 2016, John returned to industry to work with start-ups and various platforms and eco systems to support these early and middle stage companies. Initially he pursued this venture in the Shanghai region but then moved to Hong Kong in 2024 to build SEIML’s footprint in Southeast Asia. John is also a Director of the Hong Kong Founder Institute (FI) eco system and Program Director for the FI ASEAN Fintech accelerator.