Having worked in industry, professional education, academic teaching and now co-leading the Hong Kong chapter of Founder Institute, I am constantly reflecting on what it takes to make a start-up successful. There are, of course, many things and they vary with each situation. But I believe the ‘core competencies’ and time in both development and, also, go to market are critical issues that I want to address here.

Core Competencies

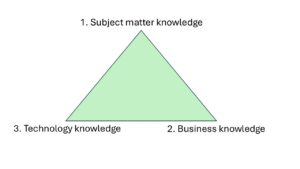

In my previous article in March, I talked about how we focus our training on three areas: business knowledge, subject matter expertise and technology usage. I also think there is a natural order in the focus on these three areas. First, most Founders are focused on some sort of industry invention, subject matter knowledge. Second, as they approach go-to-market, they must have researched and assessed the market potential and their marketing strategy, business knowledge. Third, every company these days needs to know how they can use technology for best advantage. If the technology is core to the offering (as opposed to making the marketing and distribution more effective) then technology might be the second step and business the third.

These core competencies also impact the team and HR development of the firm. In theory, you need all three of these competencies on your team. But you have a choice, at least with the business and technology skills, in that if you don’t have them internally (and maybe don’t have the budget for them currently) then you can outsource and find consultants to fill in the gap. There are pros and cons to outsourcing that I am not going to debate here, only that it is a choice to consider.

When looking at a start-up I tend to break the early stage down into two sub-stages. The first sub-stage is the market research, product/service offering (building the MVP). The second sub-stage is the go-to-market (commercialization) implementation.

When going fast is bad

It is always risky making generalizations, one can always think of exceptions. So, I will simply state what my bias is in these early stages. I believe in taking the time to build a solid foundation; really assessing the market need, researching the prospective buyers, pricing and other key elements. So, in the early R&D stage (before the go-to-market) I prefer to take the extra time to review and plan the strategy in-depth.

At the Hong Kong chapter of Founder Institute, we look to provide early stage Founders with business knowledge through our delivery of our Core Program. In our industry verticals (AI, FinTech, Web3) we look to supplement the business knowledge with subject matter expertise. However, the technology knowledge, which is becoming critical for every company, is newer and more complex. So, some of our Founders will look after graduation to enroll in a more advanced and specialized Incubator focusing just on the technology and there are a growing number of options (some with funding) in this regard.

Also, at this early stage, you are not showing your hand (much) to the market and so there is less chance of having someone imitate your offering and/or beating you to market. I also think that a good amount of testing of your product/solution to ensure you don’t ‘roll out and crash’ is essential as first impressions are very important. If your product launch is a fiasco, then it will be very hard to recover from that.

When going fast is good

In a sense, the more you invest in the first sub-stage the faster you can go in your second, go-to-market, sub-stage. And it is more critical here as now everything you have done and will do becomes public knowledge. So, if you are unable to create a strong moat around your business then you cannot risk going too slow after launch. The imperative to move quickly is further necessary in that you are likely to be in a higher period of cash burn and, these days, to raise external funding you almost have to be revenue generating. In addition, if you can grow your revenue quickly and convince others that this growth is sustainable then that will further impress potential investors and in this post-QE world funding is much more limited than before.

Never lose sight of the long-run goal

Even if you are not thinking about it a lot, your early investors will want to know where you are going in terms of an exit for them. Do you see this as a sustainable long term company (standing alone) that can IPO? Or is it a ‘piece of a bigger puzzle’ meaning that it must one day be acquired by a larger institution? Looking at my focus on financial markets, which are large firms in a global industry, I think most new fintechs without a full service offering must one day be bought out. And given the much more difficult funding market in our post-QE world, being acquired is more likely an outcome for companies than when QE was still roaring.

This is an also important question for the Founders to address early on. If your longer term outcome is an acquisition then looking at potential strategic partners very early, which might also give you a faster track in revenue generation, becomes critical – for both your short-term and your long-term success. Of course, if you start out with two or three key partners then this gives you more choice in the long term and does not make you a ‘captive’ to one in the short term.

Conclusion

Starting a company is a challenge and there is no ‘one way to success’. However, as a matter of personal opinion, I would conclude by saying:

John D. Evans, CFA

Founder & GM, SEIML

If you have thought of operating a business in Asia, or already have one, then do not hesitate to contact us to see how we might be able to help you set up, raise private capital, and manage your company’s local administration.

©2025

Snowdonia Evans Investment Management Limited (SEIML)

Benny has worked in the financial markets of China with an emphasis on fixed income, currency and asset-liability management. He is currently Vice President of Longly Capital, a medium-sized, Ningbo-based private fund management company. The firm’s strategies include various types of fixed income portfolio management and convertible bond portfolio management. In addition, Benny offers financial investment services to professional investors such as Fund of Funds (FoF) of securities companies, enterprise investors and high net worth (HNW) individuals.

Benny has also been active on the commercial side of the securities business managing client business development strategies, marketing programmes and roadshows and developing and delivering financial markets training programmes for small and medium-sized banks and other financial institutions.

Benny is fluent in Mandarin, English and Japanese.

Since returning from graduate studies in France to China in spring of 2014, Jina has been continually working in the field of e-commerce and its applications to the financial, entertainment and automotive industries. She is a multi-functional talent and fluent in Mandarin, English and French.

Jina is SEIML’s key relationship manager between foreign clients and the Chinese administrative authorities and has held many responsibilities dealing with international companies and executives operating in China. As a result, she manages all of the company’s Business Process Outsourcing (BPO) activities with clients

With her graduate degree in economics and completion of the Investment Foundations certificate from CFA Institute, she has the knowledge to assist foreign companies in China market research, including reviews of potential customers, suppliers or other third parties. She is also quite savvy in the use of Chinese social media.

Jina is fluent in Mandarin, English and French.

John spent the first 24 years of his career in investment banking, first in Toronto, briefly in New York and then London. He was involved in DCM, ECM and strategic investment advisory to large funds in EMEA.

In 2004 he moved into academia and designed and ran MSc programs in investment management at universities in the UK and China. He also created and managed one of the larger financial professional training organizations in Europe while at the UK university (that was a JV partner in the training firm).

In 2016, John returned to industry to work with start-ups and various platforms and eco systems to support these early and middle stage companies. Initially he pursued this venture in the Shanghai region but then moved to Hong Kong in 2024 to build SEIML’s footprint in Southeast Asia. John is also a Director of the Hong Kong Founder Institute (FI) eco system and Program Director for the FI ASEAN Fintech accelerator.