Article 6: The hidden world of Private Equity (PE)

English

Introduction

This is our sixth Article and looks at private equity (PE) – as opposed to public equity, which is listed on exchange and subject to various public disclosure requirements. PE is a large and growing part of the China market but has great differences to public markets that investors must understand if they are to make PE investments.

The company life-cycle

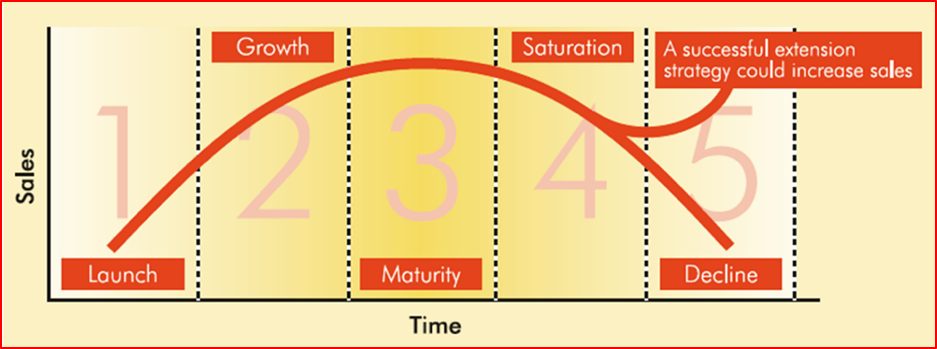

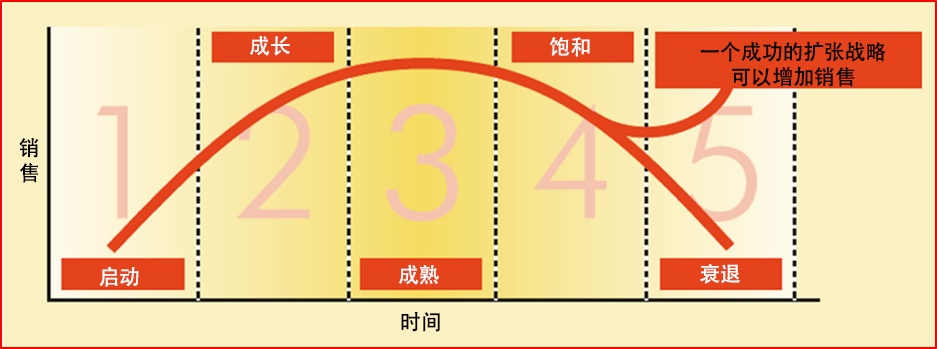

An important starting point in understanding the difference between private equity and public equity is to understand the company life cycle. A new company comes into existence when a person decides they want to Launch a new business. It may start off with just a few persons and an idea. But, if successful, it will grow large, hire more staff, invest in property and equipment and might even become international in its operations. Successful new companies will be Growth companies, but as they get larger their growth will slow down. Growth is an important input into equity value and so companies growing quickly (but only if they are profitable) will see there share price grow more quickly than slowgrowth companies. These companies are pictured in categories 1 and 2 below.

But, over time and as a company gets larger, its growth will slow down due to increased competition and other factors. The company moves into the Maturity phase and its share price may be high but not increasing much anymore. Some companies eventually become unprofitable and Decline because new technology comes along and disrupts their business model.

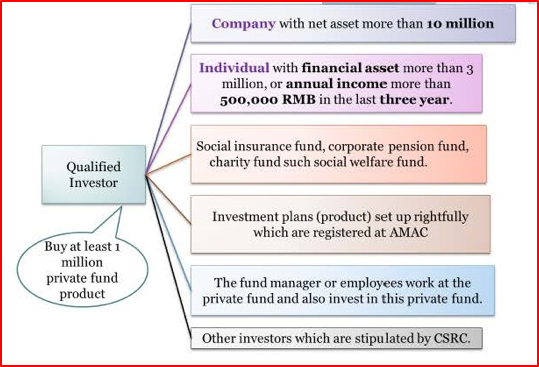

The above company life cycle is looking at the business operations (sales) of a company. But, another important aspect of the business is how it finances itself. A very small number of companies are started by wealthy people and they do not need to raise external financing. However, most new companies will search out investors to support the Launch and Growth of their business. External finance is where the distinction of private and public equity exists. Companies with a long history of profitability and listed on a stock exchange (thus providing regular financial reports reviewed by the exchange) are invested by a large number of individual investors. But, companies in the Launch stage do not have a long track record and will not meet the criteria for listing on an exchange. So, these early stage companies will have to seek other, private sources of external financing or private equity. In China, individuals are not allowed to invest in PE funds unless they are classified as ‘Qualified Investors’. Individuals are allowed, however, to invest their money directly (not via a fund) into another company as PE and so understanding this market is important for all investors. Also, sometimes companies in the Launch phase will give staff equity options or actual equity in exchange for accepting a low salary. This is also PE and so these employees must know the risks and rewards of PE to make a good choice about what company to work for and the compensation package.

The Start-up Life Cycle

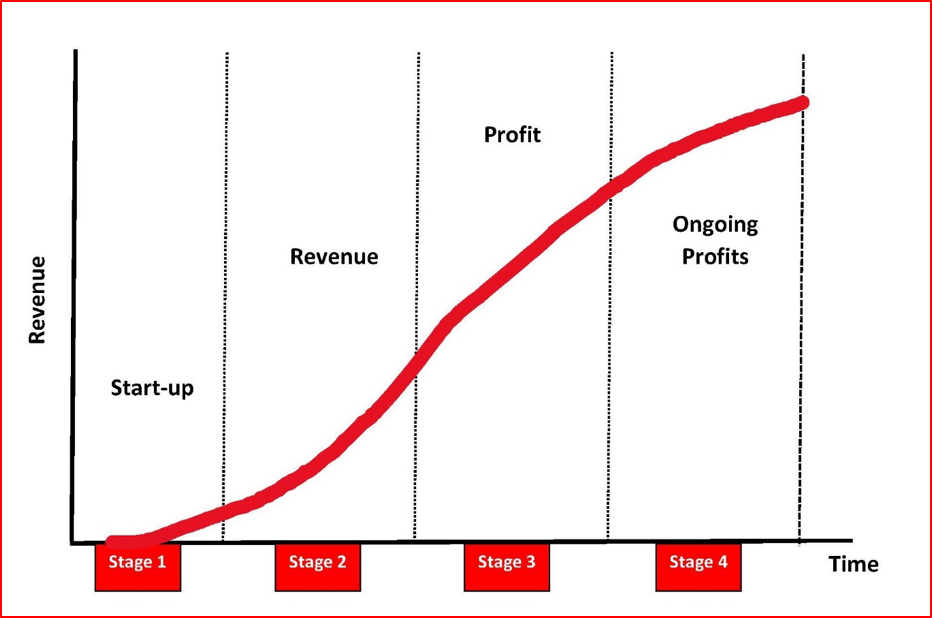

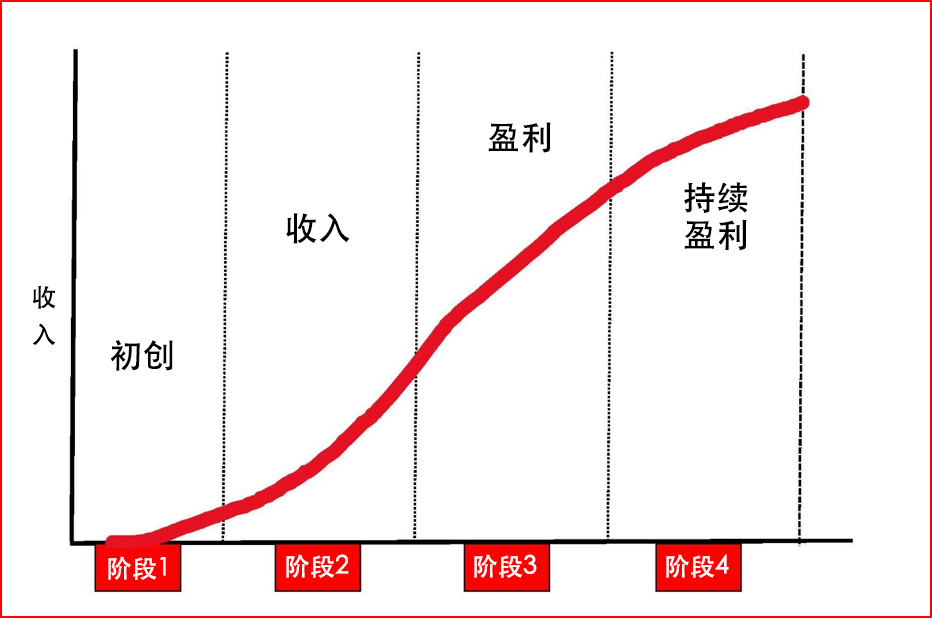

In our teaching and business consulting to start-up companies, we break the Launch phase down into four subcategories; things change quickly for new companies.

- Start-up: this is where Founders get together to plan their concept and strategy. Tasks include registering a LLC, hiring an accountant, finding an office, etc. The company has not yet started operations and has no revenue. This is a very high risk stage to invest in – you are investing only on a concept and this is where Angel Investors participate.

- Revenue: this is where you find if there is demand for your product and is the first critical financial hurdle of the company. This is Round A private equity funding stage.

- Profit: you show you can sell your good and profitably and in 4. have proven you can do that for a longer period (say, three years) as this will be required to IPO. This is round B, C,… private equity funding stage.

The company that successfully reaches Stage 4 (Ongoing Profits) will then look to exit the private equity market, either by an initial public offering (IPO) on a stock exchange or by being acquired by a strategic investor. If it IPO’s it then moves into the public equity market.

The risks of Private Equity

I refer back to Article 1 – Understanding Financial Markets and Investing and the sub-section where we talked about return and risk. If you own an equity investment (private or public) you have two sources of return:

- If the company is very profitable it will pay a dividend (income)

- If the company is very profitable the value of the share you own will increase (capital gain)

So, we can see that one aspect of risk is that the company does not become profitable and cannot pay you a dividend and the value of your investment declines or, perhaps, gets wiped out if the company goes bankrupt. This risk applies equally to private and public equity.

But there is another big risk we face in the securities market – liquidity risk. Simply put, liquidity is the ability to sell a common share quickly and at a price close to its true market value. Large companies listed on major stock exchanges see many of their shares traded each day. This allows investors to know exactly what their share is worth at a point-in-time and if that is a price they want to sell at. Unless they are selling a huge number of shares they are quite likely to sell at a price that the share most recently traded at.

A common share is worth absolutely nothing if you cannot sell it.

In private equity, liquidity – or the lack of it – is another very big risk, sometimes as big as the basic business risk of the company. Firstly, PE is not listed on exchange and so it is almost impossible to know what the shares might sell at. Secondly, it is easy to find buyers on an exchange as there are many brokers at the exchange each day trading for clients. Who might be interested in buying the private common share you own might be very difficult to ascertain. Thirdly, many private companies are Limited Liability Companies (LLC’s) and not a Company Limited by Shares (CLS). LLC’s provide a percentage ownership to investors (or staff who receive equity in place of compensation) and that is much more difficult to transfer than shares (even private equity shares of CLS’s).

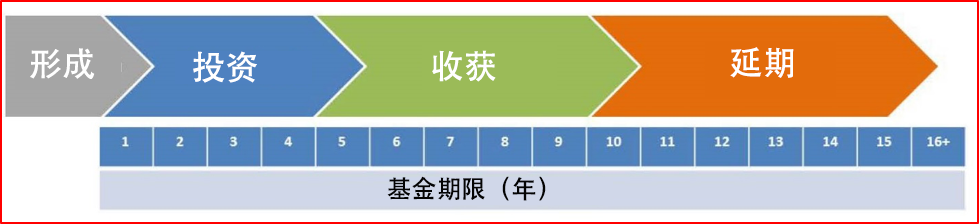

Private equity (PE) is a ‘long term hold’, perhaps as much as ten years, before you can exit your investment.

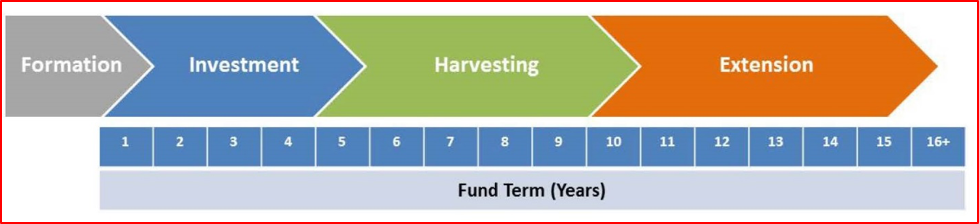

A PE fund is typically a closed-end (fixed term) fund with the most common maturity being ten years, though extensions can be made. New companies are financed by the PE fund as part of the fund’s Formation phase. During the Investment phase the fund managers will provide assistance and consultancy to the invested firms to help them become successful. When the companies become profitable then the Harvesting phase is when the fund attempts to exit the firms from the fund, either by an initial public offering (IPO) of shares on an exchange or by a strategic acquisition. When owned by the PE fund, the private equity shares of the companies are almost never sold to another party (traded) as they have no liquidity; they are ‘buy and hold’ investments.

Qualified Investors and risk

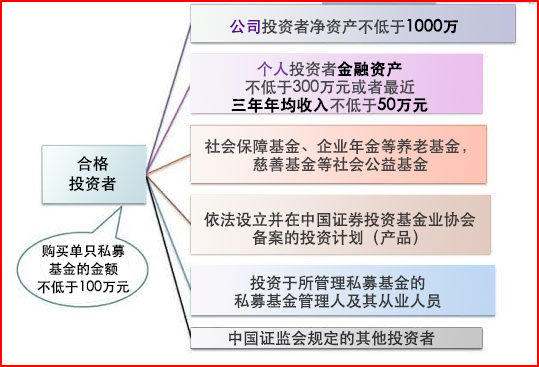

One important objective of regulation of financial markets is to protect the investing public. Government often restricts individuals, without specialized experience, from highly risky investments or ones that are very complex and difficult to assess the risk thereof. Qualified Investors are those individuals or entities allowed to invest in PE funds as they meet certain criteria as summarized below.

We must emphasize, however, that these restrictions and criteria only apply to PE funds, non-qualified investors can still invest directly into private equity and many people do. Also, as mentioned, some employees end up holding private equity as it is given to them as compensation for taking a low salary. But the fact that regulation tries to restrict the general public from PE should be a warning that this is a very risky area in which to invest.

Concluding remarks

There are good reasons to invest in PE. PE is what supports the growth of new businesses and this is essential for the economy to continue to grow. Also, new private sector companies contribute a lot to creating new jobs. Also, if you are starting a company it may be a long-term source of business for you and other founding shareholders. There are lots of good reasons to invest in PE. But, always remember two things: 1. PE is very risky, many new companies fail and the founders lose all their money, 2. PE is a long-term investment, it is not something where you can plan to get your money back on short notice.

*****

Understanding the differences between public and private equity is essential. PE, over the long term, can provide higher returns than the more mature companies listed on stock exchanges. However, anything that has the potential for higher return means – by definition – that it also has greater risks.

John D. Evans, CFA (author) has over 24 years’ experience in the international capital markets working with issuers of securities and investors around the world. He has designed and taught Master’s programmes in investment management at universities in the UK and China. He was most recently Professor of Investment Management at XJTLU in Suzhou. He now manages SEIML, a consultancy to early-stage companies in China.

Jina Zhu (translator) did her Master’s in Economics in France and is fluent in Mandarin, English and French. She also works at SEIML supporting early-stage companies grow and raise capital in China.

27 March 2019

Mandarin

文章 6:私募股权(PE)的隐秘世界

引言

这是我们的第六篇文章,将讨论私募股权(PE),与公募股权(在交易所上市并受各种公开披露 要求约束)不同,私募股权是中国市场一个巨大且不断增长的组成部分,但与公共市场存在着巨 大的差异, 如果投资者需要进行私募股权投资,那么必须对其有所了解。

公司生命周期

理解私募股权和公募股权区别的一个重要起点是了解公司的生命周期。当一个人决定启动新业务 时,新公司成立了,它可能是几个人从一个想法开始。但是,如果成功的话,它将发展壮大,雇 佣更多员工,投资房地产和设备,甚至可能在其运营中成为国际性企业。成功的新公司将是成长 型公司,但随着公司规模的扩大,他们的成长将放缓。成长是对股票价值的重要投入,因此将看 到快速成长(但只在盈利的情况下)公司的股价上升比成长缓慢的公司更快。这些公司如下图中 第 1 和 2 类所示。

但随着时间的推移,随着公司规模的扩大,竞争加剧和其他因素,公司的成长将放缓。公司进入 成熟期,股价可能很高,但不会再大幅上涨。由于新技术的出现,扰乱了他们的商业模式,一些 公司最终会变得无盈利并衰退 。

上述公司生命周期是指公司的业务运营(销售)。但是,企业的另一个重要方面是如何为自己融 资。少数公司是由富裕人士创办的,他们不需要外部融资。而大多数新公司将寻找投资者来支持 其业务的启动和成长。外部融资是私募股权和公募股权的区别所在。长期盈利并在证券交易所上 市的公司(因而提供经交易所审查的定期财务报告)由大量个人投资者投资。但是,处于启动阶段的公司没有长期的历史记录,也不符合在交易所上市的标准。因此,这些早期公司将不得不寻 求外部融资或私募股权的其他私下来源。

在中国,个人不得投资私募股权基金,除非他们被归类为“合格投资者”。然而,允许个人将其 资金直接(而非通过基金)投资于另一家公司作为私募股权,因此了解这个市场对所有投资者都 很重要。此外,有时处于启动阶段的公司会给予员工股票期权或实际股权,以交换接受低工资。 这也是私募股权,因此这些员工必须了解私募股权的风险和回报,以便在选择为哪家公司工作以 及薪酬方案时做出正确的选择。

初创企业生命周期

在我们对初创公司的教学和商业咨询中,我们将启动阶段划分为四个子类别;新公司的情况变化 很快。

- 初创:创始人们聚集在一起规划他们的理念和战略。任务包括注册有限责任公司、聘请会 计师、寻找办公室等。公司还未开始运营,也没有收入。这是一个非常高风险的投资阶段 ——你只是在一个概念上进行投资,而这正是天使投资者参与之处。

- 收入:你发现你的产品有需求,也是公司的第一个关键财务障碍。这是私募股权 A 轮融资 阶段。

- 盈利:你显示了你可以出售你的商品和利润 4. 已经证明你可以在更长的时间内(比如说 ,三年)也做到这一点,因为这将是首次公开发行(IPO)所必需的。这是 B 轮,C 轮… 私募股权融资阶段。

成功达到第 4 阶段(持续盈利)的公司将寻求退出私募股权市场,无论是通过股票交易所的 IPO 还是通过战略投资者收购。如果通过 IPO,那么将进入公募股权市场。

风险和私募股权

回顾一下第一篇文章——了解金融市场和投资中我们讨论了回报和风险。如果你拥有一项股权投 资(私募或公募),你有两个回报来源:

- 如果公司盈利,它将支付股息(收入)

- 如果公司盈利,你所拥有股份的价值将上升(资本收益)

因此,我们可以看到,有风险的一面是,公司没有盈利,无法支付股息,你的投资价值会下降, 或甚至如果公司破产可能会消失。这种风险同样适用于私募和公募股权。

但我们在证券市场面临另一个巨大的风险——流动性风险。简而言之,流动性是指以接近其真实 市场价值的价格快速出售普通股的能力。在主要证券交易所上市的大公司每天都会进行大量股票 交易,这使得投资者能够准确知道他们的股票在某个时间点的价值,判断这是否是他们想要出售 的价格。除非他们出售大量股票,否则他们很可能以最近交易的价格出售。

如果你不能出售普通股,它绝对一文不值。

在私募股权中,流动性(或缺乏流动性)是另一个非常大的风险,程度有时与公司的基本业务风 险齐平。首先,私募股权没有在交易所上市,因此几乎无法知晓这些股票的售价。其次, 很难确 定谁可能有兴趣购买你持有的私人普通股。而在交易所很容易找到买家,因为交易所每天都有大 量经纪人为客户交易。第三,许多私营公司是有限责任公司(LLC),而不是股份有限公司(CLS )。有限责任公司向投资者(或接受股权代替报酬的员工)提供一定比例的所有权,这比股票( 甚至股份有限公司的私募股权)更难转让。

私募股权(PE)是一种“长期持有”,可能长达 10 年,然后你才能退出投资。

私募基金通常是一种封闭式(固定期限)基金,最常见的到期日为 10 年,但可以延期。新公司 由私募基金资助,作为基金形成阶段的一部分。在投资阶段,基金经理将为被投资公司提供协助 和咨询,辅助他们取得成功。当公司盈利后,收获期指当基金试图通过 IPO 或战略收购退出基金公司的阶段。当私募基金拥有时,由于没有流动性,这些公司的私募股权几乎从未出售给另一方 (交易);它们是“买入并持有”投资。

合格投资者和风险

金融市场监管的一个重要目标是保护投资大众。政府经常限制没有专业经验的个人进行高风险投 资,或者限制那些极其复杂且难以评估风险的投资。合格投资者是指那些被允许投资于私募基金 的个人或主体,它们符合以下总结的某些标准。

但我们必须强调的是,这些限制和标准只 适用于私募基金,非合格投资者仍然可以直 接投资于私募股权,许多人也如此做。此外 ,如前所述,因私募股权作为低工资补偿, 一些员工最终持有私募股权。但事实上,监 管机构试图限制普通公众参与 PE,这应该 视作一个提醒,即这是一个风险较大的投资 领域。

结束语

投资 PE 有充分的理由。PE 可支持新企业的成长,这对于经济持续增长至关重要。同时,新的私 营企业为创造新的就业机会作出了巨大贡献。此外,如果你正在创办一家公司,它可能是你和其 他创始股东的长期业务来源。投资私募股权有很多很好的理由,但是,记住两件事:1. PE 风险较 大,许多新公司倒闭,创始人损失了所有的资金。2. PE 是一项长期投资,你无法计划在短时间内 收回你的钱。

*****

了解公募与私募股权之间的差异是至关重要的。从长期来看,私募股权能够提供比在证券交易所 上市的成熟公司更高的回报。然而,任何有可能获得更高回报的东西——从定义上来说——意味 着它也有更大的风险。

John D. Evans, CFA (作者)拥有 24 年与全球证券发行商及投资者打交道的国际资本市场经验。 他设计和教授了中英两地大学投资管理的研究生课程。曾为苏州西交利物浦大学教授,现运营上 海凯文斯投资管理有限公司(SEIML),充当国内早期企业顾问角色。

Jina Zhu(翻译者)在法国完成其经济学硕士,精通中英法三语。现为 SEIML 工作,辅助早期企 业的成长和在华集资。

2019 年 3 月 27 日