Introduction

This is our fifth Article and looks at the operational and technical side of managing a company providing financial services. In addition to describing the core, technical operations of the financial institution, we discuss how technology has integrated the market with regulators, suppliers, customers and others to create today’s ‘Fintech’ companies.

The article summarises a leading book a colleague has done on the subject (both in English and Mandarin), which I reference for below for those who would like to study the subject more in-depth:

What is ‘financial markets operations’?

Financial institutions are unique in some very important ways. First, they are different from a firm that manufactures goods in that all of the activity of a financial firm is in ‘intangibles’ like money or contracts (deposits or securities). Second, they are different from a consultancy firm that provides services in that the consultancy firm ‘sells’ its service like a good, there is no financial repayment back to the customer in the future. When people make deposits or investments, they expect to have some level of capital protection so they can claim the money of their investment back in the future. This then creates the very important distinction in financial institutions between their ‘own funds’ and money held in trust (or in custody) for clients. It is essential the financial institution segregates these two categories of monies.

Financial firms can also be involved in a very large number of transactions making data flows and record keeping of paramount importance. This makes technology very important for the financial industry and its suppliers and customers. This article will look at financial markets operations within two different themes. As a foundation, it will discuss how important technology is within a financial institution to ensure safe and efficient operations of that institution. It will then look at how technology integrates the whole supply chain to create Fintech companies.

Managing a financial institution

For our example, we will look at a financial institution that offers to buy and sell securities (investments) to you, as opposed to a bank that takes deposits and makes loans. This is a more relevant example for readers of this Column who are focused on investments. For this type of investment institution, we are concerned with four general categories of activities:

We should emphasise that we will examine these issues in a conceptual way, at first. Let me explain. Three decades ago, financial transactions were ‘manual’. You would walk or drive to an investment firm, hand cash over a counter to a teller as money to invest and then sit down with a Financial Advisor (FA) to implement your investment strategy. You would be given a number of documents or brochures to read about what types of investments you could purchase but would have to check the prices as they change frequently and the firm could not afford to reprint these documents every day or even more often. If you instructed them to purchase shares of ‘company X’, they would write your order by pen on a piece of paper that would be delivered to another department to purchase that security on your behalf. The record of your transaction would be written or typed on paper and stored in a filing cabinet. The other department would execute your investment by telephone another firm or the stock market and the notice to buy, and confirmation after purchase, would again be paper based with the relevant documents sent by mail or courier to the counterparty.

By the early 1990s, given the development of computers, financial institutions started to automate their business processes. Just to give a few simple examples:

The process of ending paper-based information and transactions was referred to as ‘straight-throughprocessing’ or ‘STP’. It meant that inside the financial institution, all of its processes (and record keeping, research, etc.) were done by electronic means, they were no longer manual or paper based. This allowed the financial institution to benefit in many ways:

Financial instruments, data management and different types of organization

In today’s financial markets there is a vast array of different financial or other instruments one can invest in: deposits, bonds, equities, ETFs, Indexes, real estate, gold, etc. So, to perform the functions of offering, selling and buying of investments, a firm needs to have access to and manage a vast array of data on these instruments.

Data management refers to the governance, oversight and monitoring of data to ensure accuracy and consistency. Information can become redundant and a high degree of manual maintenance is called for. There is the risk that different departments within an organisation might very well be acquiring, maintaining and using the same information. This can lead to information redundancy. Information coming into the organisation needs to be verified for accuracy, which again, calls for a high degree of manual maintenance.

There are three traditional approaches to data management:

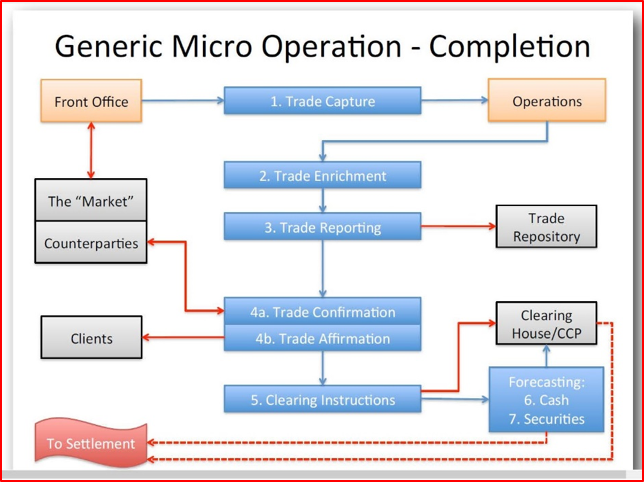

Trade capture, clearing and settlement

The objective of the clearing cycle is to enable all transactions to be settled according to market convention. The macro operation is the transformation of trade details received from the front office through a series of micro operations into a completed (i.e. settled) transaction. These micro operations include the following:

In many jurisdictions, as part of a regulatory authority’s obligations to maintain confidence in the financial markets and reduce financial crime, regulated firms have to send reports of their transactions to the regulator at the earliest possible opportunity (i.e. by close of business on T+1). This helps the regulator detect and investigate suspected incidents of market abuse and/or market manipulation.

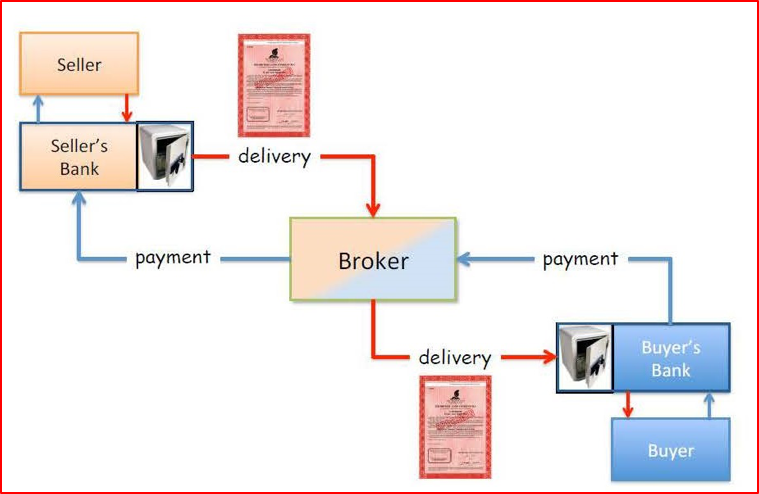

In the days when securities were certificated (i.e. held in physical form), investors would typically arrange for their banks to hold their share and bond certificates in the banks’ own vaults. In order to settle their sales, the investors would instruct their banks to withdraw the appropriate certificates from the vaults. Having done this, the banks would arrange for the buyers’ brokers to collect the certificates, together with any transfer documentation, and in exchange hand a cheque or bank draft to the bank by way of payment.

Today, securities are delivered electronically by book entry transfer. Delivery can be made either or a transaction-by-transaction basis or on a collective basis. The former is known as “Gross Settlement” and the latter “Net Settlement”.

Safekeeping, asset servicing and asset optimization

At its basic level, custody is the safekeeping of securities and other asset classes by a financial institution on behalf of its clients. In much the same way that clearing and settlement takes place centrally, so does the safekeeping (or custody) of securities. Securities issued in one particular domestic market will be held by the relevant local Central Securities Depository.

An important distinction to revisit here is the segregation of the firm’s own-funds and funds held in custody for its clients. Let us illustrate with a recent example of a bike sharing firm that went out-ofbusiness. The bike firm took money from its customers in two ways. First, it took a deposit from the customer and given certain circumstances this deposit would be returned to the customer when the service agreement came to an end. Second, it charged customers for the rental of its bikes, which was revenue to the company and never to be returned to the customer. The second payment gave the company ownership of the money but the first payment did not. In most jurisdictions, that sort of firm would have to clearly segregate money from the two sources, not mix them. This provides a simple but powerful example of the importance of custody when holding clients’ money in trust. Unfortunately, in this case, the internal controls of the company were not acceptable, money was mixed and customers lost their deposits when the firm went out of business.

Accounting for securities and asset reconciliation

I will not go into the importance of keeping proper records for both internal and external purposes; that should be obvious. What I will emphasise, however, is that accounting for cash and securities (intangibles), given the very large number of potential customers and transactions, the amount of record keeping is very great and has to be done very quickly – sometimes in ‘real time’. Thus, automation is essential to the financial industry in all its operations, including accounting and reporting.

Fast forward to Fintech

Fintech is an abbreviation of ‘financial technology’ and the most simple definition is: “computer programs and other technology used to support or enable banking and financial services”, which we see is a very simple and broad definition.

However, I am going to create a slightly different definition. At the start of the article, we differentiated the use of technology inside the firm, to improve efficiency and effectiveness, and the use of technology between different legal entities (supplier to financial institution, or financial institution to customer). So, my definition of a Fintech firm is one that uses financial technology to connect the entire supply-chain: the financial institution, its trading counterparties, the regulator, its suppliers and its customers the whole market.

The ‘connecting the market’ use of Fintech has proven to be very disruptive of the traditional financial institutions and markets. Suddenly, technology firms have become new entrants and strong competitors in the financial industry, as evidenced by the growth of ANT Financial. However, whether it is a traditional bank or a new Fintech firm providing your financial advice and services, the core activities of financial markets operations as described above do not change in concept, only in application. If you are running one of these new Fintech firms, I encourage you to study the reference book in detail to understand the core operational functions you will need to provide for both within the firm and in connections with counterparties, customers, suppliers and the regulator.

*****

Understanding financial market operations is essential to the safe and sound running of any financial institution. Understanding how financial markets operations can be extended to the whole supply chain (supplier – financial institution – customer) is essential in running a Fintech business.

John D. Evans, CFA (author) has over 24 years’ experience in the international capital markets working with issuers of securities and investors around the world. He has designed and taught Master’s programmes in investment management at universities in the UK and China. He was most recently Professor of Investment Management at XJTLU in Suzhou. He now manages SEIML, a consultancy to early-stage companies in China.

Jina Zhu (translator) did her Master’s in Economics in France and is fluent in Mandarin, English and French. She also works at SEIML supporting early-stage companies grow and raise capital in China.

11 March 2019

If you have thought of operating a business in Asia, or already have one, then do not hesitate to contact us to see how we might be able to help you set up, raise private capital, and manage your company’s local administration.

©2025

Snowdonia Evans Investment Management Limited (SEIML)

Benny has worked in the financial markets of China with an emphasis on fixed income, currency and asset-liability management. He is currently Vice President of Longly Capital, a medium-sized, Ningbo-based private fund management company. The firm’s strategies include various types of fixed income portfolio management and convertible bond portfolio management. In addition, Benny offers financial investment services to professional investors such as Fund of Funds (FoF) of securities companies, enterprise investors and high net worth (HNW) individuals.

Benny has also been active on the commercial side of the securities business managing client business development strategies, marketing programmes and roadshows and developing and delivering financial markets training programmes for small and medium-sized banks and other financial institutions.

Benny is fluent in Mandarin, English and Japanese.

Since returning from graduate studies in France to China in spring of 2014, Jina has been continually working in the field of e-commerce and its applications to the financial, entertainment and automotive industries. She is a multi-functional talent and fluent in Mandarin, English and French.

Jina is SEIML’s key relationship manager between foreign clients and the Chinese administrative authorities and has held many responsibilities dealing with international companies and executives operating in China. As a result, she manages all of the company’s Business Process Outsourcing (BPO) activities with clients

With her graduate degree in economics and completion of the Investment Foundations certificate from CFA Institute, she has the knowledge to assist foreign companies in China market research, including reviews of potential customers, suppliers or other third parties. She is also quite savvy in the use of Chinese social media.

Jina is fluent in Mandarin, English and French.

John spent the first 24 years of his career in investment banking, first in Toronto, briefly in New York and then London. He was involved in DCM, ECM and strategic investment advisory to large funds in EMEA.

In 2004 he moved into academia and designed and ran MSc programs in investment management at universities in the UK and China. He also created and managed one of the larger financial professional training organizations in Europe while at the UK university (that was a JV partner in the training firm).

In 2016, John returned to industry to work with start-ups and various platforms and eco systems to support these early and middle stage companies. Initially he pursued this venture in the Shanghai region but then moved to Hong Kong in 2024 to build SEIML’s footprint in Southeast Asia. John is also a Director of the Hong Kong Founder Institute (FI) eco system and Program Director for the FI ASEAN Fintech accelerator.