Introduction

This is our sixth Article and looks at private equity (PE) – as opposed to public equity, which is listed on exchange and subject to various public disclosure requirements. PE is a large and growing part of the China market but has great differences to public markets that investors must understand if they are to make PE investments.

The company life-cycle

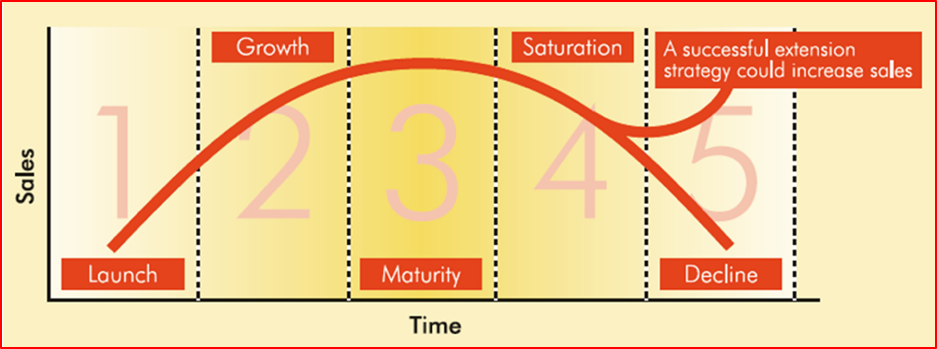

An important starting point in understanding the difference between private equity and public equity is to understand the company life cycle. A new company comes into existence when a person decides they want to Launch a new business. It may start off with just a few persons and an idea. But, if successful, it will grow large, hire more staff, invest in property and equipment and might even become international in its operations. Successful new companies will be Growth companies, but as they get larger their growth will slow down. Growth is an important input into equity value and so companies growing quickly (but only if they are profitable) will see there share price grow more quickly than slowgrowth companies. These companies are pictured in categories 1 and 2 below.

But, over time and as a company gets larger, its growth will slow down due to increased competition and other factors. The company moves into the Maturity phase and its share price may be high but not increasing much anymore. Some companies eventually become unprofitable and Decline because new technology comes along and disrupts their business model.

The above company life cycle is looking at the business operations (sales) of a company. But, another important aspect of the business is how it finances itself. A very small number of companies are started by wealthy people and they do not need to raise external financing. However, most new companies will search out investors to support the Launch and Growth of their business. External finance is where the distinction of private and public equity exists. Companies with a long history of profitability and listed on a stock exchange (thus providing regular financial reports reviewed by the exchange) are invested by a large number of individual investors. But, companies in the Launch stage do not have a long track record and will not meet the criteria for listing on an exchange. So, these early stage companies will have to seek other, private sources of external financing or private equity. In China, individuals are not allowed to invest in PE funds unless they are classified as ‘Qualified Investors’. Individuals are allowed, however, to invest their money directly (not via a fund) into another company as PE and so understanding this market is important for all investors. Also, sometimes companies in the Launch phase will give staff equity options or actual equity in exchange for accepting a low salary. This is also PE and so these employees must know the risks and rewards of PE to make a good choice about what company to work for and the compensation package.

The Start-up Life Cycle

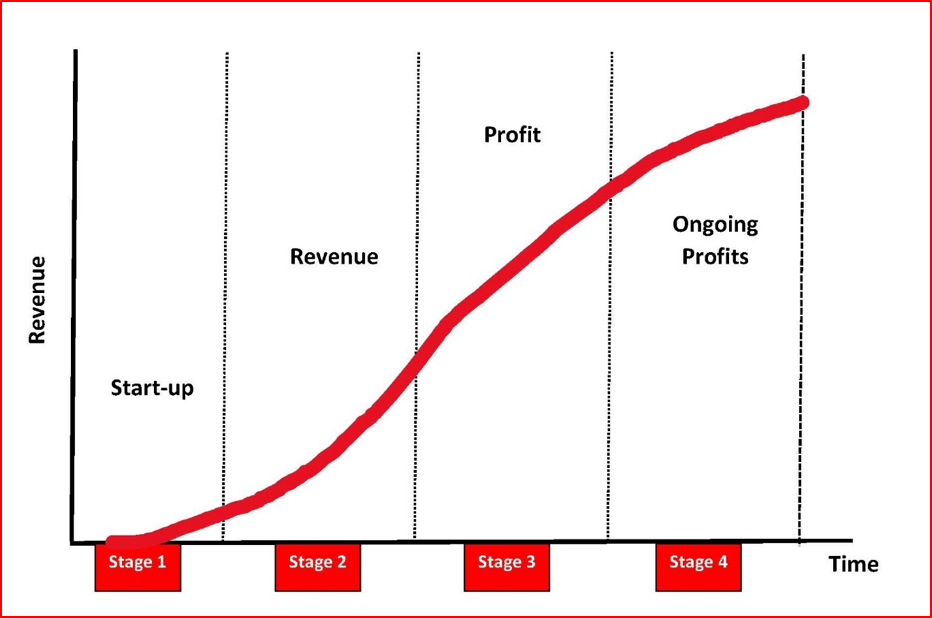

In our teaching and business consulting to start-up companies, we break the Launch phase down into four subcategories; things change quickly for new companies.

The company that successfully reaches Stage 4 (Ongoing Profits) will then look to exit the private equity market, either by an initial public offering (IPO) on a stock exchange or by being acquired by a strategic investor. If it IPO’s it then moves into the public equity market.

The Risks of Private Equity

I refer back to Article 1 – Understanding Financial Markets and Investing and the sub-section where we talked about return and risk. If you own an equity investment (private or public) you have two sources of return:

So, we can see that one aspect of risk is that the company does not become profitable and cannot pay you a dividend and the value of your investment declines or, perhaps, gets wiped out if the company goes bankrupt. This risk applies equally to private and public equity.

But there is another big risk we face in the securities market – liquidity risk. Simply put, liquidity is the ability to sell a common share quickly and at a price close to its true market value. Large companies listed on major stock exchanges see many of their shares traded each day. This allows investors to know exactly what their share is worth at a point-in-time and if that is a price they want to sell at. Unless they are selling a huge number of shares they are quite likely to sell at a price that the share most recently traded at.

A common share is worth absolutely nothing if you cannot sell it.

In private equity, liquidity – or the lack of it – is another very big risk, sometimes as big as the basic business risk of the company. Firstly, PE is not listed on exchange and so it is almost impossible to know what the shares might sell at. Secondly, it is easy to find buyers on an exchange as there are many brokers at the exchange each day trading for clients. Who might be interested in buying the private common share you own might be very difficult to ascertain. Thirdly, many private companies are Limited Liability Companies (LLC’s) and not a Company Limited by Shares (CLS). LLC’s provide a percentage ownership to investors (or staff who receive equity in place of compensation) and that is much more difficult to transfer than shares (even private equity shares of CLS’s).

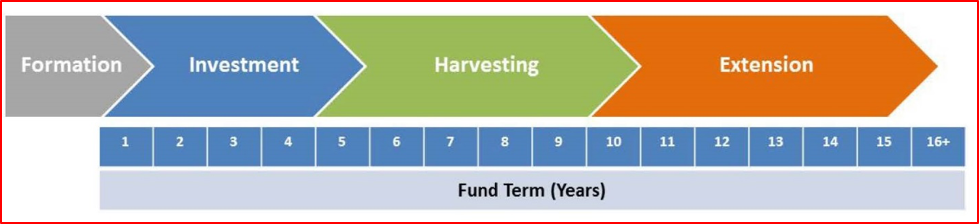

Private equity (PE) is a ‘long term hold’, perhaps as much as ten years, before you can exit your investment.

A PE fund is typically a closed-end (fixed term) fund with the most common maturity being ten years, though extensions can be made. New companies are financed by the PE fund as part of the fund’s Formation phase. During the Investment phase the fund managers will provide assistance and consultancy to the invested firms to help them become successful. When the companies become profitable then the Harvesting phase is when the fund attempts to exit the firms from the fund, either by an initial public offering (IPO) of shares on an exchange or by a strategic acquisition. When owned by the PE fund, the private equity shares of the companies are almost never sold to another party (traded) as they have no liquidity; they are ‘buy and hold’ investments.

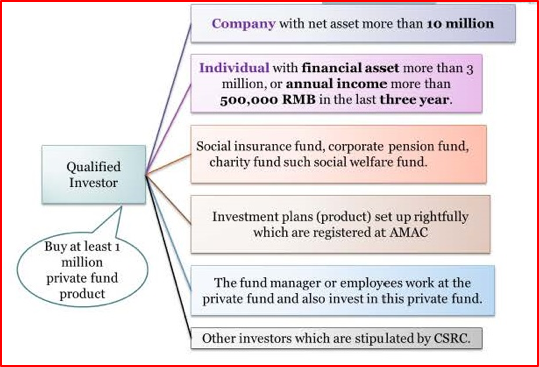

Qualified Investors and Risk

One important objective of regulation of financial markets is to protect the investing public. Government often restricts individuals, without specialized experience, from highly risky investments or ones that are very complex and difficult to assess the risk thereof. Qualified Investors are those individuals or entities allowed to invest in PE funds as they meet certain criteria as summarized below.

We must emphasize, however, that these restrictions and criteria only apply to PE funds, non-qualified investors can still invest directly into private equity and many people do. Also, as mentioned, some employees end up holding private equity as it is given to them as compensation for taking a low salary. But the fact that regulation tries to restrict the general public from PE should be a warning that this is a very risky area in which to invest.

Concluding remarks

There are good reasons to invest in PE. PE is what supports the growth of new businesses and this is essential for the economy to continue to grow. Also, new private sector companies contribute a lot to creating new jobs. Also, if you are starting a company it may be a long-term source of business for you and other founding shareholders. There are lots of good reasons to invest in PE. But, always remember two things: 1. PE is very risky, many new companies fail and the founders lose all their money, 2. PE is a long-term investment, it is not something where you can plan to get your money back on short notice.

*****

Understanding the differences between public and private equity is essential. PE, over the long term, can provide higher returns than the more mature companies listed on stock exchanges. However, anything that has the potential for higher return means – by definition – that it also has greater risks.

John D. Evans, CFA (author) has over 24 years’ experience in the international capital markets working with issuers of securities and investors around the world. He has designed and taught Master’s programmes in investment management at universities in the UK and China. He was most recently Professor of Investment Management at XJTLU in Suzhou. He now manages SEIML, a consultancy to early-stage companies in China.

Jina Zhu (translator) did her Master’s in Economics in France and is fluent in Mandarin, English and French. She also works at SEIML supporting early-stage companies grow and raise capital in China.

27 March 2019

If you have thought of operating a business in Asia, or already have one, then do not hesitate to contact us to see how we might be able to help you set up, raise private capital, and manage your company’s local administration.

©2025

Snowdonia Evans Investment Management Limited (SEIML)

Benny has worked in the financial markets of China with an emphasis on fixed income, currency and asset-liability management. He is currently Vice President of Longly Capital, a medium-sized, Ningbo-based private fund management company. The firm’s strategies include various types of fixed income portfolio management and convertible bond portfolio management. In addition, Benny offers financial investment services to professional investors such as Fund of Funds (FoF) of securities companies, enterprise investors and high net worth (HNW) individuals.

Benny has also been active on the commercial side of the securities business managing client business development strategies, marketing programmes and roadshows and developing and delivering financial markets training programmes for small and medium-sized banks and other financial institutions.

Benny is fluent in Mandarin, English and Japanese.

Since returning from graduate studies in France to China in spring of 2014, Jina has been continually working in the field of e-commerce and its applications to the financial, entertainment and automotive industries. She is a multi-functional talent and fluent in Mandarin, English and French.

Jina is SEIML’s key relationship manager between foreign clients and the Chinese administrative authorities and has held many responsibilities dealing with international companies and executives operating in China. As a result, she manages all of the company’s Business Process Outsourcing (BPO) activities with clients

With her graduate degree in economics and completion of the Investment Foundations certificate from CFA Institute, she has the knowledge to assist foreign companies in China market research, including reviews of potential customers, suppliers or other third parties. She is also quite savvy in the use of Chinese social media.

Jina is fluent in Mandarin, English and French.

John spent the first 24 years of his career in investment banking, first in Toronto, briefly in New York and then London. He was involved in DCM, ECM and strategic investment advisory to large funds in EMEA.

In 2004 he moved into academia and designed and ran MSc programs in investment management at universities in the UK and China. He also created and managed one of the larger financial professional training organizations in Europe while at the UK university (that was a JV partner in the training firm).

In 2016, John returned to industry to work with start-ups and various platforms and eco systems to support these early and middle stage companies. Initially he pursued this venture in the Shanghai region but then moved to Hong Kong in 2024 to build SEIML’s footprint in Southeast Asia. John is also a Director of the Hong Kong Founder Institute (FI) eco system and Program Director for the FI ASEAN Fintech accelerator.