We have gone through over a dozen years of very high economic growth and massive market appreciation; some would argue, largely debt-fueled. But with several big ‘shocks to the system’, zero-COVID policies, Russian invasion of Ukraine, Brexit and, now, Fed tightening, could it be that we are entering a sustained period of recession? Time to revisit ‘the bezzle’.

There are a variety of views on this topic, so I summarize a few of these taken from different reports, referenced by the article link.

“In a famous passage from his book The Great Crash 1929, John Kenneth Galbraith introduced the term bezzle, an important concept that should be far better known among economists than it is. The word is derived from embezzlement, which Galbraith called “the most interesting of crimes.”

“Unfortunately, the bezzle is temporary, Galbraith goes on to observe, and at some point, investors realize that they have been conned and thus are less wealthy than they had assumed. When this happens, perceived wealth decreases until it once again approximates real wealth. The effect of the bezzle, then, is to push total recorded wealth up temporarily before knocking it down to or below its original level. The bezzle collectively feels great at first and can set off higher-than-usual spending until reality sets in, after which it feels terrible and can cause spending to crash.”

“Yet another way the bezzle can confound GDP calculations is by artificially lowering the cost of capital. When equity or debt has been bid to higher prices than will ultimately be justified by future returns, this reduces the cost of capital for businesses by effectively transferring a portion of the cost to owners of equity or debt. These lower capital costs encourage more commercial activity—including investment that otherwise would not be considered productive—than might otherwise be justified. Such lower capital costs also feed into higher business profits, which in turn boost the value-added component of GDP calculations.”

https://blogs.cfainstitute.org/investor/2019/09/12/the-bezzle-and-the-central-banks/

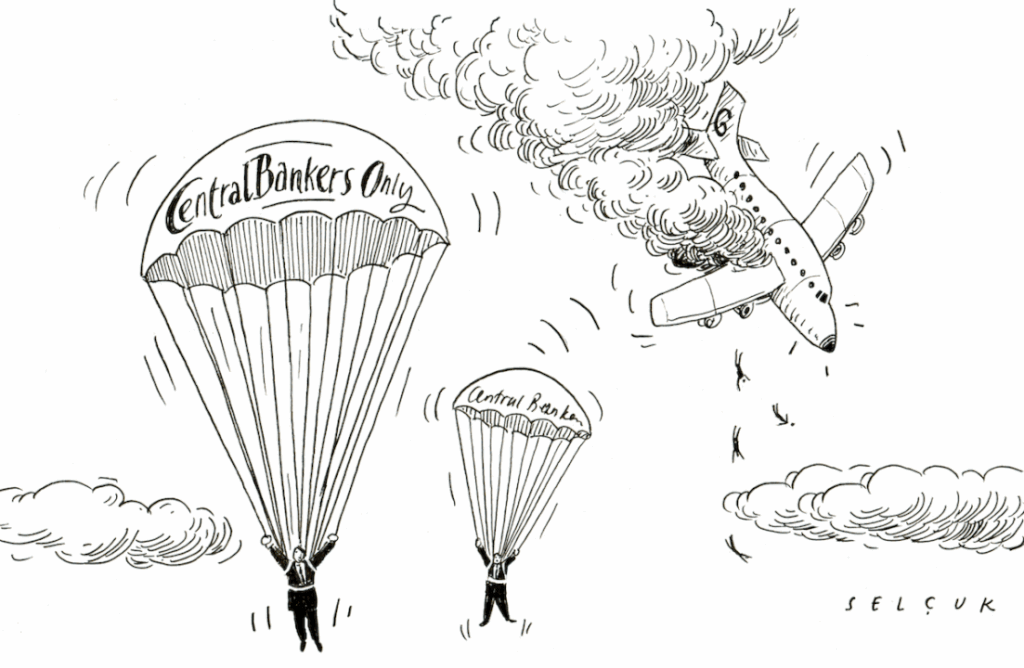

“The bezzle of the current bull market isn’t stocked with Ponzi schemes and outright frauds in my view. Rather it is built on the notion that risky assets have become practically risk-free thanks to central bank policies.”

https://www.axios.com/2022/05/09/bull-market-bezzle-end

“Bull markets engender trust that verges on complacency, or even gullibility. When they start to drop — as they are doing right now — there is a sharp rise in mistrust, as frauds are uncovered and shady dealings condemned.

Why it matters: Regulators have signaled they’re more serious about cracking down on financial criminals than they have been in decades. Such activity is unlikely to be hard to find.

Driving the news: Federal prosecutors in New York last month charged hedge fund manager Bill Hwang with federal racketeering charges that could send him to prison for the rest of his life. The Department of Justice is reportedly using big banks as its informants on Wall Street. And the SEC is doubling the size of its division devoted to prosecuting crypto fraud.”

Concluding comment:

‘The Bezzle’: is it about fraud, is it about runaway monetary policy, is it about investor naivete, inadequate regulation of our markets? Or is it a combination of all of the above? Whatever, the next few years are going to be both interesting and challenging. Secondo me.

John D. Evans, CFA

If you have thought of operating a business in Asia, or already have one, then do not hesitate to contact us to see how we might be able to help you set up, raise private capital, and manage your company’s local administration.

©2025

Snowdonia Evans Investment Management Limited (SEIML)

Benny has worked in the financial markets of China with an emphasis on fixed income, currency and asset-liability management. He is currently Vice President of Longly Capital, a medium-sized, Ningbo-based private fund management company. The firm’s strategies include various types of fixed income portfolio management and convertible bond portfolio management. In addition, Benny offers financial investment services to professional investors such as Fund of Funds (FoF) of securities companies, enterprise investors and high net worth (HNW) individuals.

Benny has also been active on the commercial side of the securities business managing client business development strategies, marketing programmes and roadshows and developing and delivering financial markets training programmes for small and medium-sized banks and other financial institutions.

Benny is fluent in Mandarin, English and Japanese.

Since returning from graduate studies in France to China in spring of 2014, Jina has been continually working in the field of e-commerce and its applications to the financial, entertainment and automotive industries. She is a multi-functional talent and fluent in Mandarin, English and French.

Jina is SEIML’s key relationship manager between foreign clients and the Chinese administrative authorities and has held many responsibilities dealing with international companies and executives operating in China. As a result, she manages all of the company’s Business Process Outsourcing (BPO) activities with clients

With her graduate degree in economics and completion of the Investment Foundations certificate from CFA Institute, she has the knowledge to assist foreign companies in China market research, including reviews of potential customers, suppliers or other third parties. She is also quite savvy in the use of Chinese social media.

Jina is fluent in Mandarin, English and French.

John spent the first 24 years of his career in investment banking, first in Toronto, briefly in New York and then London. He was involved in DCM, ECM and strategic investment advisory to large funds in EMEA.

In 2004 he moved into academia and designed and ran MSc programs in investment management at universities in the UK and China. He also created and managed one of the larger financial professional training organizations in Europe while at the UK university (that was a JV partner in the training firm).

In 2016, John returned to industry to work with start-ups and various platforms and eco systems to support these early and middle stage companies. Initially he pursued this venture in the Shanghai region but then moved to Hong Kong in 2024 to build SEIML’s footprint in Southeast Asia. John is also a Director of the Hong Kong Founder Institute (FI) eco system and Program Director for the FI ASEAN Fintech accelerator.