Addor Capital Management Co. ranks at the forefront of the industry in China in terms of industry research capabilities, asset management scale, and investment specialization. It is the most influential venture in China One of the investment institutions. As of the end of March 2020, Addor Capital’s management team has accumulated a total of 106.6 billion yuan in capital under management, has invested and supported 810 start-up companies, and helped 179 of them enter the domestic and overseas capital markets.

Script of Interview

Interviewee Mr. Heiki Wang (HW)

Position Investment Manager

Company name Addor Capital Management Company

Company website URL http://www.addorcapital.com

Interviewer John D. Evans, CFA (JE)

Interview conducted on 8th March 2021

About Heiki Wang

JE: Okay, we’re starting. It is Sunday 7th of March 2021. We are here speaking to Mr. Heiki Wang, who is the investment manager in the TMT section for Addor Capital Management Company a very large financial institution in China. We’re going to do this interview in three sections. The first section about Heiki, the second section about Addor, our third section about the venture capital industry in China. And then we’ll finish off with Heiki giving us a brief description of one of the cases he’s been working on. So good evening, Heiki. Nice to have you on online here. Start off by giving the audience a brief personal overview of yourself, where you’re living now, where you grew up and then also a brief professional overview, your studies and specialization. Take your time.

HW: Okay. Good evening, everyone. I’m Heiki Wang. I’m 28 years old, and I was born in Suzhou, Changshu, which is a city of Suzhou and I have studied in Singapore for four years. And in Singapore, I study financial management, after that went back to China and study in XJTLU, which has Liverpool University exchange, Xi Jao Liverpool University. And when I was in Master year, I studied Investment Management. And I learned private equity knowledge and some financial analysis, which is related to my job this moment. Yeah.

JE: Okay, let me just make a quick follow up question on that. You’ve got two degrees in finance. Were they very relevant to the job you’re doing? Or did you find you had to learn a lot of new stuff in private equity?

HW: I mean, in industrial area, I learnt a lot of new knowledge and the area which I never learned in Master and on and, and the degree and, but for the financial part, like, for example, financial analysis, and some like, the banking side knowledge, I learned a lot and which is very related to my job, which is private equity. Right?

JE: Okay. That’s good to hear. Now, you mentioned your location. You’re in Changshu, which is technically part of Suzhou the large city in Jiangsu Province. So, you’re staying there. But are you traveling around? Where is your office? And do you go into the office a lot? Or do you do travel mostly?

HW: For my job at this time, at this moment, my company office is in Suzhou and the mother, I mean, the center of the offices is in Nanjing. And I travel a lot like, for example, Monday, I will travel to maybe Nanjing or Suzhou, we have an early meeting with group members. And for the rest of time, I will stay in Changshu, but for the meeting, I will take a taxi and then and go to Suzhou. And join the meeting. Yeah.

JE: Okay, good. Now, the fourth bullet point and I’m interested because I think maybe things are a little bit different in China than in Europe or in America. Is Addor Capital your only activity or do you have other projects investments like you know, do you work or sit on the board of any of the companies you invest in? Do you do anything different than your principal role at Addor Capital?

HW: I think I do I only do the investment in Addor capital and I take like 100% work for the company. Yeah.

JE: Are you allowed to also take a working position or a board position in the companies you invest in or is that not allowed in China?

HW: If the company will, if my company for example, if Addor capital invests in a company and we have the right to have a board position in company. The group member maybe me, for example, if I invest a company and the case is in charge by me. And if Addor Capital have a board position as a director, which is my company, will have the right and ask me to join the company board. Yeah.

JE: Okay. Have you joined any company boards so far? I, I know you only started last August so I guess it’s fairly early days.

HW: Yeah. Right. Not right now. No, but for the for the future, I think I will have the have the chance. Yeah.

JE: So, what are the key tasks an investment manager does at Addor Capital? Do you specialize in one area or do you do all aspects of business development, financial analysis and oversight, how are the tasks structured?

HW: I think for me, I stay I belong to the TMT though which we which we the working time we are always searching some TMT companies which are technology, media or have telecom, which was the other ‘T’ category.

JE: Telecom.

HW: Telecom, yeah. So, I think I will focus on the TMT part. And for the key task for investment manager in the firm, I think he’ll judge the growth of the enterprises. I think you need to know this company will grow up well in the future or in the future as in the other time in maybe three years, five years later.

JE: So, if you’re working with a company, will you always be working with it as a part of the team or might you be going out to see a company by yourself and doing some of the analysis by yourself,

HW: When we are doing the private equity we always go out go to the company like two people because my group have five people have if I have connection with the founder of the company. Most of time we will put two people and go to the company first time.

About Addor Capital

JE: That’s sensible and exists in any important relationship management, it’s always good to have more than one person and for a lot of different reasons, so I can understand that. Okay. Now let’s go to the second part of our discussion, which is about Addor Capital, give a brief history of the company when it was founded, by whom was it founded, any relationship it has or had to government entities or other large corporations? Just tell us a little bit about Addor Capital Management.

HW: Okay. Addor capital started in 2008 and it was made into a firm in 2015. And as a founder of the Addor Capital, it is Jiangsu Province, Jiangsu government. And after like, starting in 2008, the Jiangsu government think about the investment cannot be in charge by the government, they some group guys focus on this on this invest side. For the government to do that this decision, it was very hard. So, they put in place this new firm decision. So, right now Addor Capital is a total private company. And we have several guys who take over the management level. And right now we still have a very real close relationship with Jiangsu government.

JE: Okay, and just for my information, it’s the Jiangsu provincial government, which is headquartered in the capital city of Nanjing that’s where it started out. Is that correct?

HW: Yeah, exactly.

JE: Yeah. And so is Nanjing still the head office, even though I know you’ve got a lot of offices in China.

HW: They are the head office in my company.

JE: Okay, okay. Well, I was I was looking at your website, and we’ll be putting in one of these slides when we put the transcript out. But you seem to have many regional offices, I think there’s 16. How does the company work? Are these 16 offices all very independent doing their own thing? Or is it a very integrated 16 offices where people are working together in lots of different offices together?

HW: They’re all controlled by the head office. And for the smaller offices, maybe Addor Capital hires the local guy. So, they give the local guy an office, maybe a small room. So, it’s their own office. So, the local guy in the daytime can stay in the office and do some company analysis and do some report. Yeah, it’s very helpful. Yeah.

JE: How many people in total work for Addor Capital?

HW: 250 persons.

JE: 250 persons, so I mean, these 16 offices, we’ll put the Nanjing one aside because it’s the headquarters. Are really most of those 250 people in Nanjing and all of the other offices are just small with a few people, or are there other big offices outside of Nanjing in terms of lots of people?

HW: The head office is still Nanjing. For Nanjing, we got like, like, nearly 200 people in head office and the rest of the people like 50 maybe in the several offices, other places office.

JE: Okay, so the large proportion of the people working for Addor are in the head office in Nanjing, all of the other offices are much smaller. Okay. Now, I think you’ve answered this question, but I’ll just repeat it in that there are 16 offices listed on your website and you’ve said that the ones outside of Nanjing are smaller, but I noticed that of the 16, eight of those offices are in Jiangsu province. Now. I know you said it started in Jiangsu province, but because you’ve got eight of 16 offices in Jiangsu, is most of your business or at least half of it, still very much focused on Jiangsu province?

HW: Exactly. We still focus on Jiangsu province.

JE: Okay. So, you’ve got offices, I noticed that in Beijing, Shandong, Anhui, Zhejiang, Fujian, Shanghai, Hong Kong and Guangdong, but you’ve got eight offices in Jiangsu province. What about the Hong Kong office? I mean, are they doing anything different? It’s a different currency in Hong Kong.

HW: Because I’m a new guy in Addor Capital, so I have seldom heard about Hong Kong ofice. I will go back. I will recheck the information for the Hong Kong office.

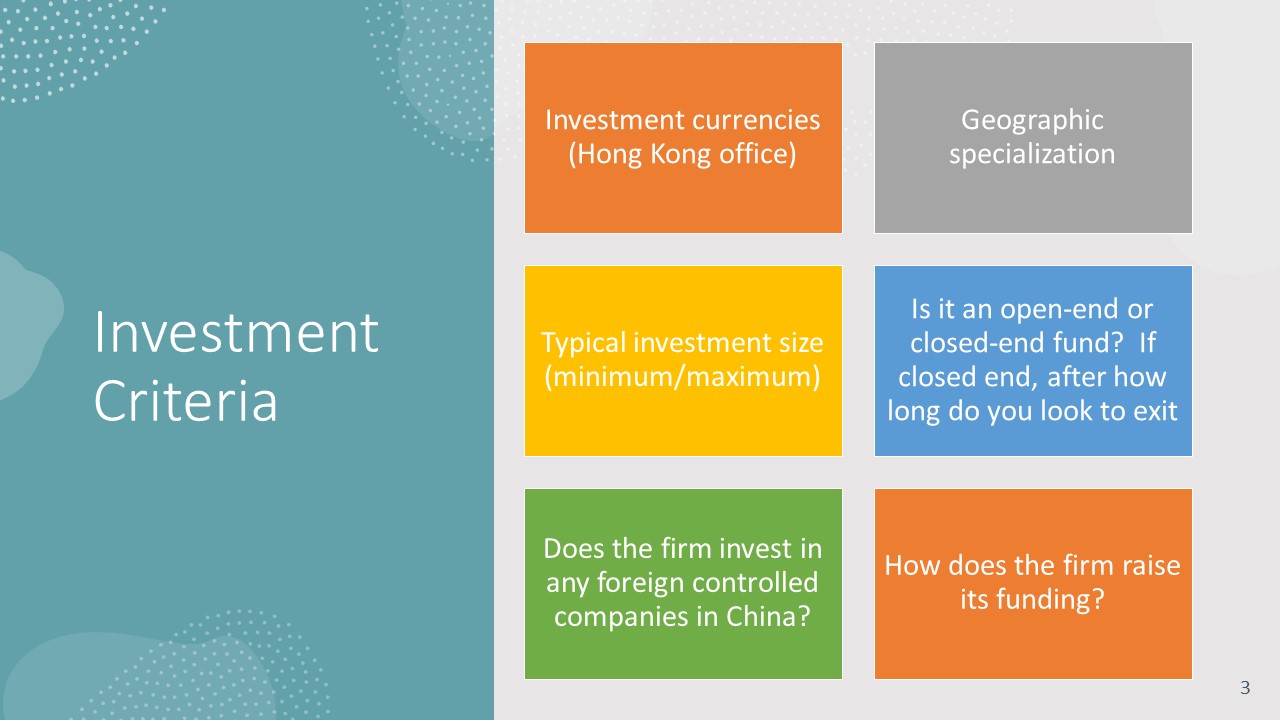

JE: Okay. But I think you said that almost all of your activity, or maybe all of it is providing financing in Renminbi. Is that correct? Not in any other currency?

HW: Yes. It’s still our RMB fund. Yeah.

JE: Okay. Is Addor Capital, one of the biggest companies in China? How would you characterize it: a large company, medium size or what?

HW: I think we are top five, I think Addor Capital is in the top five in China for RMB fund. We always get some award for top five. He has like top five. Yeah.

JE: Okay. So, a very, very large firm. And I guess venture capital is a very big business in China, as we both know. Okay, good. Turning to the next slide that the viewers will see, where we talk about business focus. Now this is at the company level. And I see there are four different business activities. There’s venture capital/private equity, that’s obviously your division. But there’s also M&A, real estate, and fund-of-funds. So, do these other three areas interact with your venture capital, or are they all quite sort of separate business lines?

HW: It’s like separate part of business in my company and maybe we have like 20 people around running the real estate and maybe ten people just take over the fund-of-fund, but the most people still focused on the VC and PE.

JE: Okay, I think there was a little bit of difficulty with the audio there. Can you still hear me okay?

HW: Yeah, John, I can hear you. Yeah.

JE: Okay. It just we just have a little bit of flutter. Could you just repeat that last sentence? Because you’re fine again now.

HW: Okay. Three other business is divided by different group and take over by different take over with, with other groups like for the real estate, maybe have we, our company have 20 people, doing this kind of job. And for the fund-of-funds, maybe we have the 10 people is always doing the fund-of-funds.

JE: So, we were talking about the four different areas, you’re in the venture capital and private equity. It’s somewhat independent from the other sectors. Addor Capital is a big company so it’s got a lot of different business lines. Okay. So, we’ve talked a little bit about the company, its offices, facilities, number of staff. But let’s now talk about the sector focus, which is the next slide that the viewer will see. On this now you are or your company I’m sorry, is involved with seven areas: clean technology, health industry, cultural industry, consumer goods and services, TMT which is your specialization, new materials, and advanced manufacturing. So, you’re covering a lot of different industries. Tell us a little bit about your specialization, TMT telecommunications, media and technology? What sort of companies have you been dealing with so far? Not just in the industry, but also in the size and where they’re located.

HW: Okay, we are looking, we are right at the time I deal with some companies, yes, have a good industry focus in their own area. And the industry. And the company of the industry is growing very fast in China. And maybe the business has its own technology and compared to the other companies in China they have they are very good. And there’s a good, that does have a higher percent growth, more than other companies. I mean. Okay.

JE: So, you’re looking for industry leaders. You’re very TMT focused and you want companies that have sort of their own unique IP is that also an important aspect of the selection?

HW: Yes, yes, the unique IP is very important. So, this company will have their own when he grows, their business has this advantage more compared to the other companies. Yeah.

JE: How old are these companies? Are some of these brand-new startups? Or are these more mature SMEs that have already become profitable? What sort of phase are the companies that you’re looking at; early-stage middle stage pre-IPO?

HW: Oh, we were looking for every stage, like early stage we can look for, or follow up follow up for some later stage, like new IPO company we try to invest in because it’s almost to IPO and we can make a good profit in the future maybe like one year after our invest.

JE: The companies that you work with when they are getting ready to IPO what exchange do they go to Shanghai, Shenzhen or the or the third board in Beijing?

HW: It depends, but the third board we will see, we will give a suggestion, don’t go to the third board because the third board for me as a financial investment investor, we have a very less profit if you go to the third board in Beijing. I always suggest them to go to Shenzhen or Shanghai and in the future, we have a good profit.

JE: Yeah, I think the liquidity in Shanghai and Shenzhen is much higher, although I’ve not had a lot of dealings with the third board, I get the feeling it was targeted at much smaller companies that don’t have the same growth potentials that go to Shenzhen or Shanghai.

HW: Right. Right.

JE: So, you started I think last August how many companies in total have you spoken with? Not necessarily provided financing, but how many have you approached? Do you go through a very small number each month or is there a very large number of firms that you’re visiting?

HW: Every week we will book like three companies I will meet. I will have the first ‘knock knock’ on every company.

JE: So, three brand new companies. And so, what is your ratio of actually going through and making an investment into one of these companies is it one company in every 20 that you visit one company in every 50? What is the ratio of companies that that you find attractive versus all of those that you visit?

HW: Ratio means, our ratio means profit?

JE: No, the number that you will actually provide financing to. Is it one company in every 20 companies, in every 50? How many of these companies you visit do you actually end up providing finance to?

HW: When visiting I think I will deal with the founder of the company. I think it’s equal, I think we I will talk to them all equally I mean, I because it’s a new brand new company for me I will I need to learn a lot what he has your business and how about your marketing and the growth of the future? I will unlock new knowledge. So, when I deal with these companies, I will equally deal with them.

JE: How many companies since you started have you actually invested in yourself?

HW: In Addor Capital I just have one case.

JE: Okay. So therefore, you’ve been there six months. That’s about 26 weeks. You found one investment that you liked. So that means so far, one company out of 25 you’ve invested in so far? Yeah, yeah. In in rough numbers. Yeah. Okay. That’s not surprising. You must have to visit an awful lot of companies before you find ones that you’re satisfied to invest in. So, the one company that you invested in so far, was that very recent or did that happen in 2020?

HW: Happened like two months before.

JE: Is that January or December?

HW: January of 2021.

JE: Yeah. So, you started in August, you have been visiting a lot of companies, and you found the first company you liked and invested in, in January of this year. Okay. What about your TMT? team? How many people is that group? And do they do different things in the TMT sector?

HW: Do we have the same job in TMT? We were just looking for good company to invest and around we have like 15 guys, yeah ’15’.

JE: Okay. And therefore, are some of them sort of older and more experienced and others sort of more junior doing sort of financial analysis to support? Is there a wide range of ages of the people in your group?

HW: The investment managers, our age is from like 25 to 35. Yeah, this age area.

JE: Okay, so a fairly young group.

HW: Yeah. Yeah, a young group. Yeah. Because we are managers, not the CEO.

JE: If it was the UK, it would be more likely 45 to 65. So, everyone’s younger in China in the financial industry is what I’m discovering here. Okay. Let’s now go to what is the fourth slide and talk about investment criteria? Now, you’ve already said that you are only making investments in Renminbi, no other currency. You’re in the in the Suzhou office. But you specialize in TMT. So, do you potentially visit TMT companies anywhere in China? Or do you specialize just in Jiangsu province?

HW: We put like 50% time in Suzhou and we have like 20% chances to visit other companies maybe in Shanghai, maybe in Zhejiang. So, it’s like this, we divide like this.

JE: Okay, so in theory, you can do business anywhere in China, but just because of the firm and the opportunities you’re spending a lot of your time in Jiangsu province and Suzhou in particular. What about a typical investment size? Sort of the minimum amount of Renminbi and the maximum amount of Renminbi what is the general range of investment size for Addor Capital in the TMT sector?

HW: Okay, for Addor Capital, we invest like 5 million to 100 million.

JE: Okay, so quite a large range. And you already said before you invest in firms at all stages: startup, revenue generation, profitable firms. So presumably the smaller amounts are more for startups. And as a company grows, gets bigger and becomes profitable, you’re prepared to invest larger amounts up to 100 million. Do you do multiple tranches for the same company? Let’s say, let’s hypothetically say, you invested 25 million in a company in maybe an A series round or something, if they needed to raise money two years later, might you invest in a second tranche? I know some firms only will invest once but other firms will invest multiple times. What approach do you take?

HW: We can follow up invest. So, if we make for example, if we invest in a company this year, maybe after three years, we can still invest and as a company prepare to go into IPO we can still invest a large amount of money into it.

JE: Okay, so there is in some cases, the longer-term relationship working with a company and maybe providing capital to them several times before they finally IPO. Yeah, do you have a strict time limit in when you want to exit? I mean, do you say, if I make an investment, I have to exit in say, seven years or is the time to exit much more flexible?

HW: For our fund, because we need to take care of the fund money and I need to give the good the response to our LP. So, the year of the fund is seven years. So first three years is invest years and the four years, we call the coming-out year. Then we need to give to the company: one option is IPO, one option you buy out or to buy out to a big company, and we can make profit from the dealing. Yeah.

JE: It’s been my impression that the seven-year time horizon is a very common number for

Chinese venture capitals, it seems like seven years is really the maximum for a lot of funds.

HW: Yeah, exactly. Seven years is a very normal number here.

JE: Whereas in some other markets, it’s 10 years and occasionally 15. But as people keep reminding me things move faster in China.

HW: Yeah, because we all want to make money quickly.

JE: Yeah, I understand the feeling. So that’s very interesting. You’ve had a closed-end fund, seven-year time horizon to exit, and you’re flexible on the exit, it could be a listing an IPO, it could be an acquisition by a strategic investor, or it could be a management buyout, if the firm is generating a lot of internal profits. So, there’s flexibility on that. So, for the investment criteria, that brings me to my last question, how do how does Addor raise its funding? I mean, does it have a lot of individual investors or a small number of very wealthy investors? Where does the funding for Addor Capital come from?

HW: When we’re doing the fund raising? I think most, like 50%, is raising from the government side. I think, like 50%, and the rest of the 50%, maybe some rich guy rich me and other financial industry, maybe we’ll give him some money. And for and this year, a very good year to do the fund raising because the China have given some new guidance, the guidebook, it’s the insurance money can give the insurance money. I mean, the insurance company will give their money to the fund company and help them to do the private equity. This year, there is very big amount money that we can raise from. Yeah.

JE: That’s interesting. So, there’s two very interesting points you’ve just made. The first one is that, even though the Addor Capital is a private firm now, it still gets 50% of its funding from the provincial Jiangsu government. So, there’s still a government relationship. And secondly, the new regulations that allow insurance companies to greatly expand their involvement in private equity is proving to make it a good year for fundraising. I mean, I talk to some of the insurance companies and some of them were still waiting for their individual approvals to go ahead. But it sounds like the insurance industry in general, is already starting to make a lot of investments in venture capital in China. Is that correct?

HW: Yes, that’s correct. And as well and the other good to know and a very important information is banking society also can give the money out of the banking. So, this year has also started in like this and maybe next year, the Chinese government will give new regulation give us a guidebook or maybe give a policy to help us in some funds. Some private equity company can very easily raise money from the banking side, the insurance company and from the government side.

JE: Okay, now I’m fully aware of all the developments on the insurance side. So, the deregulation you’ve just mentioned on the banking side, so banks are already able to provide money for private equity, that’s already started.

HW: We have cases already. Yeah.

JE: Okay. That’s, that’s very interesting. That’s following on in the path of the relationship between insurance companies and private equity in Europe and America where insurance companies because they’re so large and have so much cash are big players in venture capital. And it sounds like that trend is just starting in China now. Okay. We’ve talked about the relationship with the government, obviously, from a funding point, banks and insurance companies are becoming important funding partners for you. Does Addor have any other key external strategic partners associations with other companies, other individuals, you know, are there other big venture capital firms that you collaborate with? Are there other strategic partners for Addor that are important?

HW: Key, the key working partner?

JE: Yeah, are there any others? I know, you obviously have a remaining relationship with the provincial government, insurance companies are providing funding, but is there any other company or wealthy individual historically that is also actively involved with Addor, or is Addor so big it really operates by itself?

HW: Yeah, yeah. We do have some very close partner, like because before we are government company. So, we have some companies called brother companies, they all belong to below and maybe they are founded by the Jiangsu province. So, we are brother companies, we have a good relationship with other brother companies, maybe they are doing the insurance. Maybe they are doing the equity, maybe they’re doing the second market, or maybe they are doing the banking side. They all belong to the Jiangsu. Yeah. We have a good partner relationship with

them.

JE: Okay, so for example, Bank of Jiangsu, Bank of Suzhou. They have lots of branches, do you work with either of those banks?

HW: We have some connection with bank. But if we have you, do we have a good relationship? I think we have a good relationship. But the relationship is like, high level guys will have the good relationship. Maybe the CEO of the Suzhou bank, or maybe CEO of Jiangsu bank, they have a good personal relationship with our company board.

JE: Okay. And there are a lot of big financial institutions in Jiangsu province. And the one other thing I just wanted to ask, it’s a little bit of a deviation, but, you know, Shanghai is right, surrounded by Jiangsu province, and it is a financial center. So, is Addor also quite active in Shanghai?

HW: We have several group guys, they are local guys, they are Shanghai people. And they work for Addor Capital, they are searching the good companies in Shanghai and maybe have a chance to invest. They are doing this kind of job.

The VC Industry in China

JE: Very interesting. Okay, so let’s move on now to the third section, which is a discussion about the venture capital industry in China. So, the first point was, give us your impression, the general overview of the VC industry in China. Are government sponsored funds a big part of the VC market in China or are they more private in the way that Addor was privatized many years ago?

HW: Most of the VC companies, long ago they were belonging to the government and they make the reform maybe five or six years before and I think the VC industry in China is growing very fast. Looking back 20 years, we don’t have VC industry in China 20 years, I mean 2000, maybe 1998? We don’t have the VC industry and we don’t know what kind of and because the VC industry or maybe we call PE industry is founded from UK or more probably, I think the USA, I think. America is doing very good private equity job in in America and then, this kind of job. I mean, this kind of industry move to China. And we learn a lot. And how to do.

JE: Okay. I’ve been reading a lot of news headlines about the potential financial deregulation. One component being letting more foreign firms get involved in the domestic financial markets. Are you seeing any indication so far of foreign venture capital firms setting up or expanding in China? Is that happening at all?

HW: Yeah, I think I mentioned last time the one of the American funds is called Sequoia. Sequoia. Yeah, it’s a very, very big company in China right now. They’re doing a lot of investor. Sequoia is founded in America. And they have a Chinese partner in China and raising money from the Chinese government or maybe other industrial, other financial industries, institutions, and they do they doing the same things as Addor Capital, private equity investing.

JE: I know Sequoia has been in China for a long time, they’re probably the most well-known foreign firm in China venture capital. But are there new things like I mean, do you see the big financial institutions like Goldman Sachs, UBS, they’ve got financial licenses for China, not exactly sure what they’re doing completely? Are they entering, these big financial investment banks? Are they entering venture capital in China?

HW: Are they doing? Yeah, Goldman also doing the private equity in China. I have some cases like one case in Nanjing, they are doing the coffee. They are very good, they are very popular coffee brand in China. The Goldman company, you mentioned invested this Chinese company. And we also want to invest by the week, but we did not compete. Okay.

JE: This this is I put this in as the fourth point, it’s a little bit different from venture capital. But I want to ask you, because it’s being talked about a lot. There have been many newspaper articles, saying that China may liberalize the capital account, and perhaps allow Chinese individuals to invest internationally. It’s not certain it’s going to happen. But if it does happen, is that going to change anything at Addor? Or might you start looking at doing international business? Or is this just too early to respond to these headlines?

HW: Oh, I think for the other companies, maybe they already invest in international company. For Addor Capital, I didn’t see any case we invest the international companies. For Alibaba, they’re doing a lot of international invest in ‘BAT’. B for Baidu, other doing the international invest. ‘T’ as the as the one call Tencent. T is like WeChat mother company has called T.

JE: Tencent.

HW: Yeah, Tencent also do international invest. Yeah. Okay.

JE: Tencent, so the big, big financial institutions, Baidu and Tencent, but not necessarily the venture capitals going off for and I guess, since you’ve said that so many of the big venture capitals, once upon a time, where associated with a government entity, I guess that also gives them much more of a China focus and less reason to go offshore. So that seems to make sense. Okay, I’m coming up to the last point about the venture capital industry and we started off at the very beginning, you talking about all of the studies you had in financial industry? So, I’m going to ask this last point, what are the key skills or experience a person needs to become investment manager in venture capital? So, if you were advising a young university student today who wanted to get a job like you have now in the future, what would you encourage them to study? How would you suggest they try to get a job in the venture capital industry,

HW: If you want to enter into private equity industry, I suggest you guys can learn some knowledge from what kind of industry you like. I mean, if you like electrical, you need to learn some electrical knowledge in school in the final year of your school. I think it’s very helpful when you enter the industry, you need to talk with the founder of the company, very focused on the industry knowledge. And you need to make the connection with the founders, I mean the company boss, the founder of the company. And I think you also have the skills like human resources, you need to know several guys from the industry, you can ask them some questions. And they know the industry very well. And they are, I mean, they are an old guy in this industry a long time. Like, they focus on the industry, like 15-20 years in this industry, it’s a human resource. And you also need to have a skill, yes, industry and analysis and of course, if you are a financial student, you need to do a financial analysis in order to the company as well. So, three sectors, I mean, human resources, industry analyst, and as a financial analyst, he has the three, I think this is a very good key point, the key skills you needed to know when you decided to join them to work in this industry.

JE: Yeah, that’s a very interesting point, because my first 24 years in the financial markets were all not in venture capital, they were all with listed companies, government borrowers, banks, highly rated, and people would go into that industry with a pure financial background. But as you’ve said, and as I’m discovering in the industry, you know, if you’re working with a healthcare company, or if you’re working with a fully automated robotics plant, you need some non-financial knowledge. If you go into Industry 4.0, you need to have some engineering knowledge. If you go into health sector, you need to have some knowledge about the area you’re going to focus on, whether it’s pharmaceuticals, or medical devices, etc. So that’s a very good point that I hadn’t thought of before. If you’re going into venture capital, you have to know your industry and have some non-financial knowledge about that industry, engineering, medical or things. And that’s a good point to highlight. I hadn’t thought about that before.

HW: It’s very popular in China as some of the other companies they require when they hire the investment manager, they require you need to have some background from maybe electrical, maybe robotics, maybe you say this, as a financial and financial knowledge you can, when you enter you will you get to the job or you can learn right at the beginning, but the knowledge of the industry, I mean, the background of your industry is very helpful when you doing the analysis when you can judge this industrial well growing, this company will grow up very quickly in the future is very helpful.

The First Investment (January 2021)

JE: Yeah, no, that’s a very good point. Very good point to highlight to any future students who are looking at industry. Okay, so we’re coming up to the very last section now, we’ve almost been 50 minutes. And this is a case study. So, you’ve made one investment. Now, I appreciate maybe you can’t mention the name of the company because there’s confidentiality rules, but give us just sort of a brief two or three minute overview of how the process went. When did you first meet them? How long did it take? What did you need to do before you made the investment? Now that you’ve made the investment, how do you monitor them? Just give us a little overview of how you’re managing that client.

HW: Okay, this case is I invest in like two months before. This company is doing the terminal interface material, it’s very popular and very useful in electrical and some other areas we call 5G. And they also offer a product to Honeywell, it’s a very big company in the world. And even though it’s an early startup companies, they can offer the product to Honeywell. It’s very unique in China in a start-up company. And so, when I looked, when I first started connection with this company, as the founder of the company, we call Mr. Lee, okay. You’re very, very familiar in the materials, material industry. And I think I, when I look looking at their group they are working together for a very long time, like, five years before

they work in here. They already work in a very big international company together, and they jump out the international company, and they start to have their new company in Changshu. So, I think this is a very unique or very, very good group to invest. So, I see this group, Okay, very good. And for the industry side, I think the terminal interface materials, they are very popular in China. And for this period, I mean, our Chinese companies still use a lot of international materials from other, maybe from USA or from UK. So, I think it’s time to get a chance to give a chance to Chinese company to do this kind of job. I think this company have maybe have the chance to grow up in the future. So, I decided to invest, to give an investment to them. I think we, our group, our TMT group invest like $5 million RMB and choose this company and hopefully they will IPO in maybe five and maybe seven years after we invest. Yeah, yeah.

JE: When did the company first start? How old is this company?

HW: Two years. Two years.

JE: Okay, so a very young company.

HW: Yeah, yeah, very young.

JE: Is it already profitable?

HW: No, they are losing the money.JE: Okay. So, they’re still in what we call the revenue generation phase, trying to convert revenue generation into a profitable company. But if it’s only two years, you know, many people will say that, really, it needs at least a minimum of three years before a company can become profitable, particularly one where there’s a lot of capital investments for manufacturing. So that’s very interesting to see. So, you invested it in January of this year and so, you’ve got another four years to exit, to make it profitable and IPO.

HW: Yeah. Hope the hopefully is four years, but I think maybe five or seven years exit.

JE: Okay, that’s very interesting. Okay, well, that comes to the end of all of the recorded points I have. We’re about 54 minutes, which is just about right for these things. So, I want to thank you Heiki on this Sunday evening, because I know you’ve got an early meeting tomorrow in Nanjing, for taking the time to speak with me and record this.

End.

If you have thought of operating a business in Asia, or already have one, then do not hesitate to contact us to see how we might be able to help you set up, raise private capital, and manage your company’s local administration.

©2024

Add Your Heading Text Here

Benny has worked in the financial markets of China with an emphasis on fixed income, currency and asset-liability management. He is currently Vice President of Longly Capital, a medium-sized, Ningbo-based private fund management company. The firm’s strategies include various types of fixed income portfolio management and convertible bond portfolio management. In addition, Benny offers financial investment services to professional investors such as Fund of Funds (FoF) of securities companies, enterprise investors and high net worth (HNW) individuals.

Benny has also been active on the commercial side of the securities business managing client business development strategies, marketing programmes and roadshows and developing and delivering financial markets training programmes for small and medium-sized banks and other financial institutions.

Benny is fluent in Mandarin, English and Japanese.

Since returning from graduate studies in France to China in spring of 2014, Jina has been continually working in the field of e-commerce and its applications to the financial, entertainment and automotive industries. She is a multi-functional talent and fluent in Mandarin, English and French.

Jina is SEIML’s key relationship manager between foreign clients and the Chinese administrative authorities and has held many responsibilities dealing with international companies and executives operating in China. As a result, she manages all of the company’s Business Process Outsourcing (BPO) activities with clients

With her graduate degree in economics and completion of the Investment Foundations certificate from CFA Institute, she has the knowledge to assist foreign companies in China market research, including reviews of potential customers, suppliers or other third parties. She is also quite savvy in the use of Chinese social media.

Jina is fluent in Mandarin, English and French.

John spent the first 24 years of his career in investment banking, first in Toronto, briefly in New York and then London. He was involved in DCM, ECM and strategic investment advisory to large funds in EMEA.

In 2004 he moved into academia and designed and ran MSc programs in investment management at universities in the UK and China. He also created and managed one of the larger financial professional training organizations in Europe while at the UK university (that was a JV partner in the training firm).

In 2016, John returned to industry to work with start-ups and various platforms and eco systems to support these early and middle stage companies. Initially he pursued this venture in the Shanghai region but then moved to Hong Kong in 2024 to build SEIML’s footprint in Southeast Asia. John is also a Director of the Hong Kong Founder Institute (FI) eco system and Program Director for the FI ASEAN Fintech accelerator.