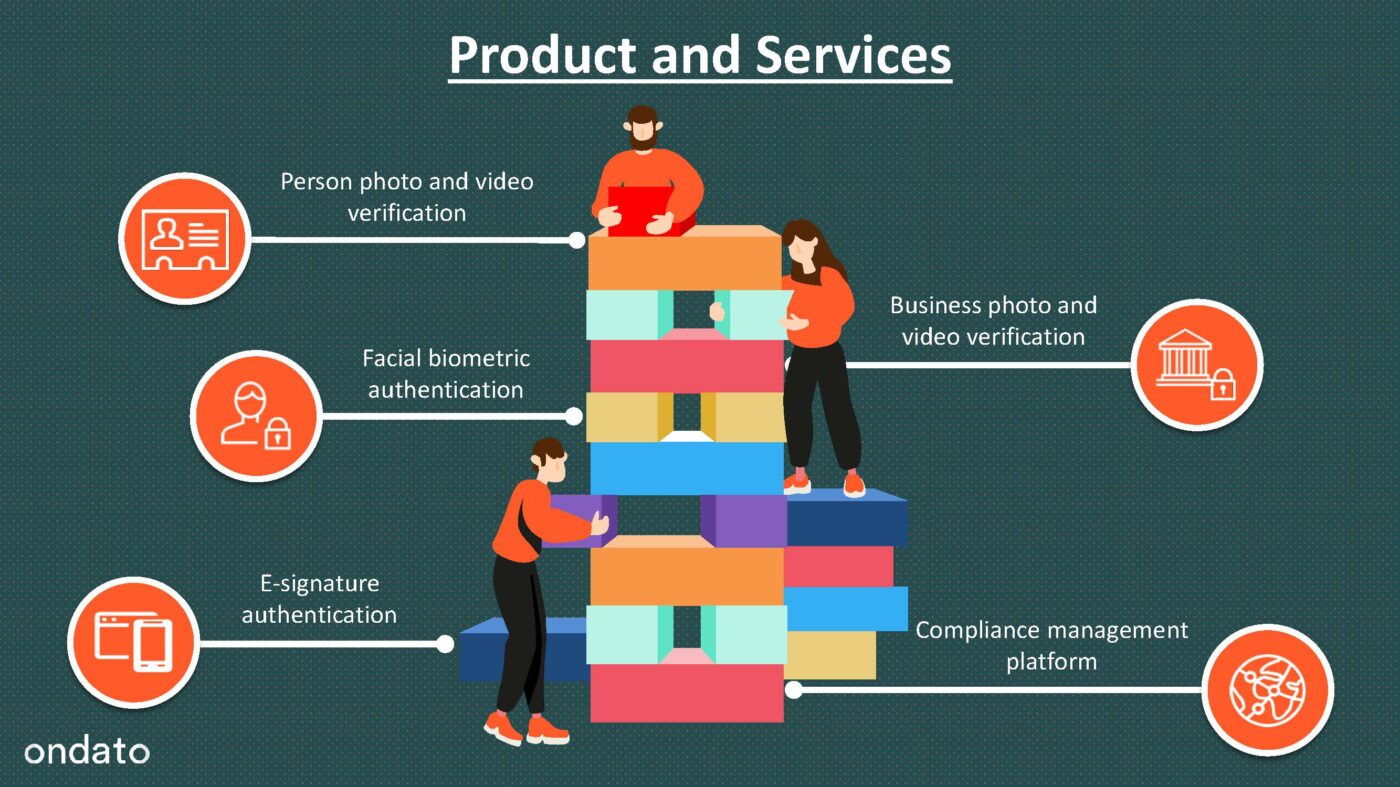

Ondato provides a complete compliance management suite in regard to KYC procedure. Starting from both photo and live video identity verification, data monitoring, screening, due-diligence, risk scoring and case management all in one place.

Script of Interview

Interviewee Mr. Liudas Kanapienis, (LK)

Position Co-founder & CEO

Company name Ondato

Company website: https://ondato.com/

Interviewer John D. Evans, CFA (JE)

Interview conducted on 28 October 2021

About Liudas Kanapienis

JE Okay, good afternoon to the viewers, this another episode of SEIML Ventures Interview Series and today we’re speaking with Mr. Liudas Kanapienis who is both co-founder and CEO of Ondato. Just a bit of background, Ondato is a company that provides a complete compliance management suite in regard to know your client, or KYC, as it’s abbreviated. It offers everything from photo and live video identity verification, data monitoring, and all of these and other services through a single point of service. With everything going digital in the world today, this is no doubt a very important aspect of business administration and compliance. We will have our normal structure of four parts. We’ll firstly talk briefly about Liudas, get a bit of his personal background, then we’ll talk about the company Ondato. Then we’ll talk about the industry and some of the dynamics going on there and close off with Liudas’s views of his key objectives for the next 12 months. So, without further ado, welcome, Liudas, nice to see you today. Okay, so let’s kick off and give the viewers a little bit of background about yourself. Maybe we can combine the first two bullet points, give us a brief, brief personal overview of yourself where you grew up, other things you’ve done, and professional overview that that led you to Ondato today.

LK Yeah, so I was born and raised in Vilnius, I was born still in the time when Lithuania was the part of Soviet Union. And I was really lucky that in my early childhood we became independent country, you know, and, of course, having that in mind, so that timing had its own issues on how people’s mindset had to change during time, and what they were able to achieve. So, of course, I was raised in an environment that everyone has to take care of themselves on their own. And for that, we have to actually start delivering the value to each other to be able to survive, and to live our wealthy lives. So, that’s this change experience was always like, leading, leading me and always like, curiosity of what new things can come was always my partner in all of the journeys. So, basically, I’ve studied in a really good school. Mathematics was one of the core topics in my school, although, since I was actually delivered to the school quite early and to the second grade, from the very beginning, so I finished the school a bit too early, with my classmates. So, I didn’t know what to what to do, actually, what to study. So, I’ve chosen the studies of medicine and that was quite an interesting part of my life actually. So, to know, what is happening in that field and basically, to feel the real, the real life of the doctor. I had the opportunity as well to work in the hospital. Of course, you know, just helping the doctors and all this stuff, not making decisions there. But that was a really good experience. Of course, in the meantime, I had some, let’s say small businesses going on and basically just always keeping me up to another part of the life and the possibilities. So that’s where I had just to make the decision. So, you know, if to go to the public sector or to go and to develop the business. So, I made the decision, I left the business so then I moved to study the economics, again at Vilnius University, and that’s what I finished quite a few years later, actually, because in parallel, I was I was just working and doing the stuff and my studies were in parallel with it, with work. And, because again, in the changing environment that I was living, everything going a bit more digital, internet fared, all the websites, all the stuff so I was like always a bit of at the frontier from that perspective. I was very involved in the website developments, in the service administration part that was really like interesting for me. So, I’ve started also selling some computers, when we were just at the beginning, then completing those from different parts. And that part was always like very, very interesting for me, you know. And to be honest, I don’t know how it happened, but then I moved a bit to just not the website development part or something, but the with the websites, but even do some traditional businesses. I was running a, a cleaning business and example, I was doing some exports of the goods and, and like literally different stuff. And at one point, when with the exports, it was very challenging that since we lived in Lithuania in a small country at that time, I was living in UK in London, for those like export activities, and the money transfers, were just literally, you know, insane. We had to pay at that time for the money transfer, like 30 euros per transfer that took like, three days or more. And that was from that perspective sounded like a bit of crazy. So, we decided to challenge that. And I had a friend in living in Lithuania, that was running a very small like financial activity, within more with the payment collections field, and we discussed a bit if we can actually solve this issue of money transfer. And that’s how we started this money remittance business from like UK to Lithuania and vice versa. And of course, very quickly that expanded to international company, with different locations, jurisdictions and other stuff. And that’s how I was like involved in in the financial business. Of course, that evolved a lot, so we first acquired the payments institution’s license then the electronic money institution license, then we started offering different products for end users, companies, all these first, like banking apps, you know, like their so-called challenger banks or digital banks. You know, at that time, we were just calling you that a bit of different names. So then at one time, the word fintech appeared, that was like a buzz and all this other stuff. And that was a really interesting part of journey for myself. And, of course, giving me lots of the background and experience in the field. And at one point, I realized that I don’t want to just be another like, competitor in the retail sector chasing for the end customers, but maybe I can bring them my knowledge and experience to the whole sector as such, and to help others basically. So, and that’s how we started Ondato with the with the mission of turning the compliance into the business benefit, basically, that helps not only just to fulfill the requirements, but actually to create more and bigger things and to focus on the business in the meantime, while being compliant with the regulations and all this stuff. So, that was a very organic growth from my perspective, how I gained the experience itself and seeing what are the actual needs in the various sectors to be honest. So, from the simple or within called simple industries, because, you know, every business is a really tough business in general, but like from various fields and from the various sectors, and then ending up with the financial, financial sector and financial technologies as such.

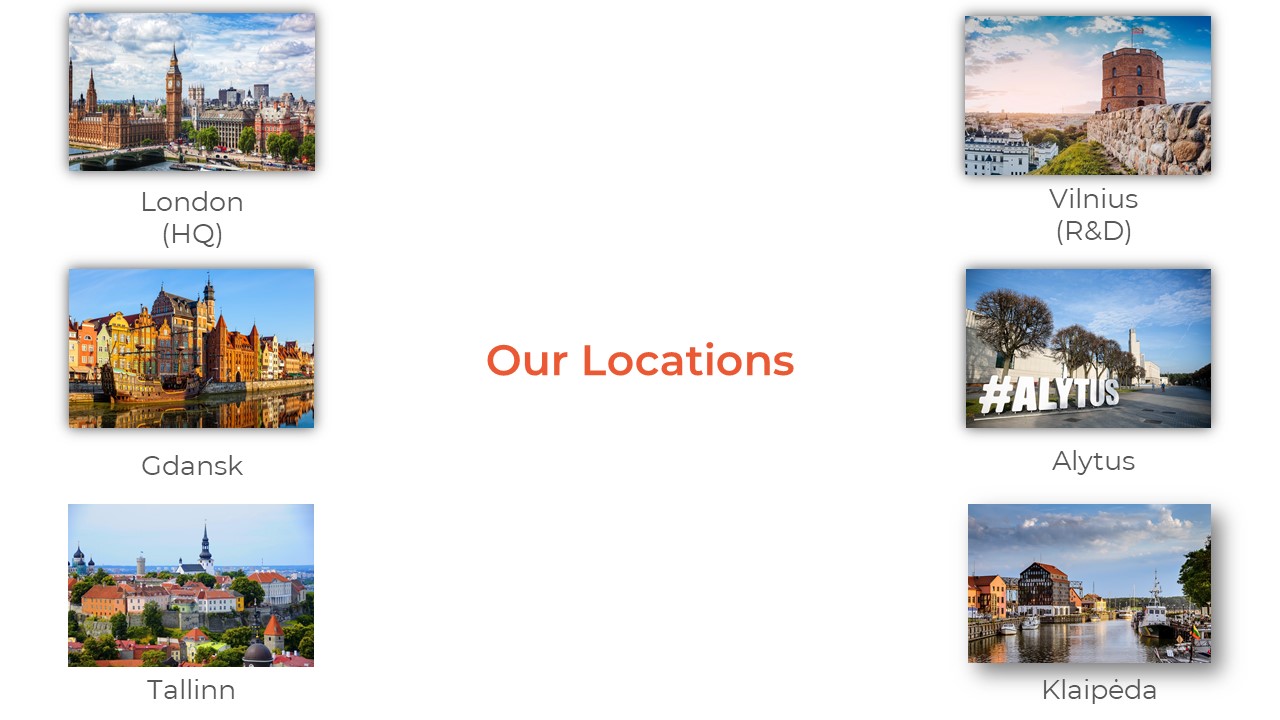

JE Okay, so you, you grew up in Vilnius. I didn’t realize you had previously lived in London, but you’re back to Vilnius now. I read a news release that’s Ondato head office has moved to London. So do you see yourself moving to the London again,

LK You see that might happen, for me physically to move London. Of course, today, if we’re talking about today’s economy and world in general, we are now all global people. So, for us to actually run the business in London or a Vilnius or whatever other place, it’s not necessary physically to live there. Yeah. So that’s a bit of changing environment that we have at the moment. So currently Ondato is based in six locations, we have six offices and expanding. So, it might happen that, myself, I will be moving maybe more to the US as an example or maybe to some kind of eastern part of the world, like Middle East or whatever. For more the business development itself. So, yeah, of course, now, the targets are more dedicated to UK developments and that part, but never know, to be honest. I’m really, always now being open to the challenges that we have in today’s environment.

JE I moved, I moved to China for three years, 12 years ago. So yes, always hard to predict the future. But we’ll come back to Ondato in in much more depth in a minute. But I’ve seen your bio, you’ve got a very entrepreneurial background. Are you 100% focused Ondato now? Or do you still have any other outside interest directorships, board members, that are different from Ondato?

LK Today, currently, 100% focus on Ondato, because this is just not yet the size for the challenge we’re solving.

About Ondato

JE Okay, good. So, on that note, let’s turn and talk a little bit about your company Ondato. You’re both the CEO and co-founder. So, tell us how Ondato came to be, your associations, maybe your other co-founder, just give us a little bit of the origins.

LK Yeah, so you see that, as I mentioned, that was really like organic growth as such, and then basically, the involvement itself, how we how we decided to establish this company and basically to move forward. So, with all the co-founders, we worked together before, with the majority of them in that financial institution, and with others, we were having some common projects, like CTO get the BNS example or, or the front-end feed Ulis was, we’re just creating the banking infrastructures and huge banking systems. So that’s how we knew each other from the previous experience, and we knew what everyone else can deliver. So, it just, like, to be honest, it was like an easy part, to collect the team. It just was they knew what kind of things I am delivering, and how I’m looking at the development of the companies and everything. So, I just introduced the idea, we discussed a bit of, what we want to achieve, and what kind of vision we have, and decided to take this opportunity and this challenge and to try to deliver what we what.

J And how many of these key co-founders were there? It sounds like there was a few.

LK Yeah, so we are we are five people, like the co-founding partners as such. So, at the very beginning, we were four of us. And then the fifth one, joined, when we started interacting with the clients and basically then moving to the market.

JE Okay, very interesting. So, for those of us, what does, how did you choose the name Ondato and what does that mean?

LK It’s coming actually from the purpose and from the vision that we have. And it’s just two words like, ‘on’ like, enabled, and that part and ‘data’ itself. So, because our focus is on the KYC or Know Your Customer data management. So, and with the vision that and mission that we want to turn this into a business benefit. So, we want to enable that data to work for our customers. So, and that relates actually with this. So, and this playing around the, you know, ‘on’ itself, so it’s then, enabled compliance, enabled data and everything around that. But yeah, but from its core, we just don’t rely on everything that is provided by the end user consumer. But we also validate that with the rest of the data that comes behind that. So that’s why the data is the centric in our infrastructure, in our product.

JE Okay. Now, I think the company started out around 2016, about five years ago, you seem to be very successful. To get where you are today, was there one or two key events that that made you very confident about the company? What’s sort of the most important things that have happened so far?

LK You see, it’s not so easy to answer that, from the perspective like, to give that kind of example to cite for someone. I think it’s a combination of like, literally dedicated to hard work, because, of course, we had so many situations that, you know, that feeling, sometimes maybe even on how to say, like, unknown situations, and how what kind of expectations we should have, or something. But whether that’s a combination of, also, I would say, luck, you know, that the timing was also good, when we started, because to be honest, when we started, again, you were dealing with quite a lot of, in the industry players and founders, and you know, that, especially when talking about some kind of data-keeping the sensitive data, which means the know your customer data keeping in the cloud, that a few years ago, that was a bit of insane I did to be honest, you know. So, and everybody, all the banks and all the financial institutions required to have that locally placed and everything, and that was a bit of, let’s say challenging to do to oversee that it is possible that everyone will be ready to move to the cloud, and that will be not an obstacle or something like that. And as well, with the changing environment, with the regulations and all the stuff. So, it’s always a bit of, you know, challenging to foresee if the current situation, and the legislation coming in, everything will actually have enough space for your products. It doesn’t mean only for us or simple like that. So, but we were lucky enough to go through that and through those different stages. I think it’s because of the like, we have, like this strong vision that we have and what we want to achieve. But we were also lucky enough that the timing in general in the market was really good, everyone was cautious about the you know, the new type of possibilities, new technologies come into the field, especially in the regulatory technologies and that part. And that’s where, you know, we had the opportunity to participate in different programs, like MasterCard Live Host Program was a really good point for us, because we had the good interactions with the bankers to see their view and they’re understanding and on the things that we are developing and where we are focusing. Then, of course, we had the chance to participate inside of Wiseguys acceleration program. That again gave us a wider view and wider understanding of or from the market and different market participants on the things that we’re developing. So, I would call that is just a combination of like, you know, experience that we have and the timing itself, and then of course the environment as the market itself in the regulatory changes and push from the users and consumers to, you know, to enable everything digital. And, and, of course, even the COVID you know, to be honest, that happened for us at a really good time, because we were already ready to deliver the things and products and everything and we had an established team. And that was not a challenge for us to gather that or to do something be in the timing when everything is like limited with the physical stuff. So, we just have to deploy the things in our systems.

JE Okay, we’ll come back to the COVID a little later on, but that certainly accelerated a lot of things in the digital world, I can understand that. So, what about the company and funding? I mean, has this been funded by the founders? Have you gone and raised any external capital? How has that worked?

LK So yeah, it did at the very beginning, of course, we had to deliver something to see if that’s possible and in general it can work. So, that was funded by the founders. And of course, from the very beginning, we bootstrapped quite a lot, we also had some help with the angel investment. At the very beginning, of course, with the you know, with it with a smaller amount and all the stuff. And then when we had some traction and we saw that the things might work, so, of course, we got this pre-seed investment with the startup Wiseguys from going through their acceleration program and getting the pre-seed investment. And then, of course, we got the seed investment. And with this with later extension with the seed with OTB and later joined with, with Lithcapital. So, but from day one, we actually focus on the on the product and result delivery. And, in the funding, only used for growth as a growth capital and scale capital, but not for delivering the ideas itself.

JE Okay, very good. Very good. So, for the viewers who have not gone through your website, can you explain in just sort of simple generic terms, what is your core offering? And is it just for business, or is it also for consumers, just a very general overview.

LK So, we are a B2B service provider. We deliver the software, usually for financial institutions, but that can be used for in other verticals that needs to know more about their customer than just email address or phone number. And that we take care on all the processes related with customer onboarding, data validation, ongoing due diligence and data monitoring. So, we are your know-your-customer data management platform, with all the tools enabling different types of processes like customer account opening, customer onboarding, ID verification, live video call with the customer with the identification possibilities, as well as on ongoing due diligence, and of course, screening and action task list and whatever other type of databases when needed. And that works both for the private individuals and business customers. So, we automate the dashboard.

JE So, when you deliver this system to a customer, do they run it all by themselves, or is Ondato staff playing an ongoing role in helping them operate it from day to day.

LK So, it really depends on the processes that we’re helping with. But in general, from day one, like from the onboarding, of course, we help to set it up, you know, from the very beginning. Then of course, giving all the instructions and everything, how to use that and how to use it in the most efficient way for setting up all the environments and everything. And of course, in some of the cases, when the due diligence has to be made or supports of the processes has to be like supported, so we give that support as well for them. Our focus is mostly like on the on the software side. So, what we do is usually we help to use the system and to use the software and to use that in the most efficient way. So, but for sometimes it requires some interactions from our side. So, maybe some types of integrations, maybe some types have data gathering from the customer’s internal system so then we ensure those type of integrations or sometimes just to put the data after all the screenings are done to some other infrastructure the client has of course we do help to do that part.

JE Okay, but when all is set up and done, it’s something that the customer largely operates on an ongoing basis by themselves.

LK Of course.

JE Okay. So, you talked about financial institutions. Let’s talk a little bit about geography. I mean, are you focused on Europe? You mentioned America. What’s your target market at this stage in your development?

LK Yeah, so since we’re, we understand our position as still relatively small player in the market. So, and we, there’s still quite a lot of things to achieve and in the markets that we operate in. So current, looking about the short-term goals, and the current focus, of course, is European and the American markets. Because of the environment, and the markets that are in those jurisdictions and the value that we can bring to those markets.. So, that’s the, let’s say, the core from the client’s perspective. But having said that, we have to understand that in today’s world is global and companies that we’re helping, they’re operating all around the world. And if looking about the customers that they are onboarding, or managing the data, so they’re, like, truly global, so they’re from different jurisdictions and we recognize all the documents from all the globe in and of the private individuals and the business customers. So, we are automating a lot of this stuff there. But from the client’s perspective, that we are working with, it’s still mostly related, let’s say with the European and US markets. It’s just because of the, the capacity, let’s say that we have. But on the other hand, we have, like inbound customers that are coming to us and asking us to help with one other challenge or process handling, and we are more than happy to help with. And that’s why we have clients from like Jamaica to Japan and working with them and working closely.

JE Okay, and from an industry perspective, you talked a lot about the financial industry, but I know, on your website you highlight a lot of other industries. So are financial industries, sort of the core segment or are other segments becoming a big part of your business?

JE Okay, now I know the three offices, Vilnius, London and Poland, where are the other three offices?

LK So other two are in Lithuania in Vilnius, and then one is in Tallinn, Estonia.

About the Compliance Industry

JE Okay. Interesting. Just a little bit north of you. Okay. Let’s turn to the third section now and talk about the industry. And you know, I put this down as the compliance industry, but is that how you categorize it? What industry do you consider Ondato to be in?

LK So, well, we still of course, state ourselves as being participant in the compliance industry or more particularly in the regulatory technologies industry. So, of course, since it’s you know, especially when talking about some financial sector and where we are helping with, so sometimes we are stated as fintech company. But I wouldn’t say it’s a real category for us because we’re more like regulatory technology company. So, because there’s always like a target on meeting some requirements. So even the simple solution like age verification, an example, so you know, to rent a scooter, in Netherlands, the people renting a scooter has to be more than 18 years old. So, even the simple solution, you know, age verification, just, without any kind of document or something, or that kind of management, it’s still meeting the requirements of regulation. So, the regulatory technology would be, I think, the best answer to that.

JE I get the sense that so many manual processes, and I’m going to say, within business administration, which is a really wide field, are being digitized, and I got a feeling that in five or 10 years, maybe the biggest industry around will be digital services provider, because there just seems to be so much of that going on. And maybe FinTech, which has become a part of the digital services provider, in the future, everything seems to be just going digital in this world. Okay, so as you’ve defined the company, as you’ve defined your industry, who is your major competitor, or competitors? Are there a lot of them, are there few of them? What’s that landscape?

LK Yeah, so you see, you mentioned the drive to digitization, in general, you know, is just an insane speed. And, of course, there’s lots of different initiatives around, like solving the same challenges or looking at the same challenges. So, and of course, we, our market is not exceptional, there’s really lots of players around with a different approach, you know some of them, they’re definitely one or other type of process or other type of one other type of, let’s say, the challenge they’re solving. Then there are some older players that are participating in the market. And, you know, in both in different parts of the processes, and sometimes, of course, having lots of the manual work behind that for the customer, but still, you know, we have to have to say that this is the part of competition. And the other part is the internal processes and the procedures that the clients have, because, you know, that sometimes this this is like being afraid of change, is even the bigger competitor, then then some kind of competition in the market, offering some kind of solutions. And that was still we see happening, because, especially in the compliance field was literally lots of the manual work, that is still done within the companies. Sometimes for the client it’s easier just to add extra resource or extra human power into one or another type of process, then giving that to some kind of system and because that is what they see as the losing of the control. No, and, of course, which is not right, but you know, that’s really a change in the mindset and within the company itself. And that’s what we also see as the challenge. But if looking at the general competition from the market participants, so, of course, you know, it’s big competition. You see, also a lot of funding happening within the industry and with the huge amounts that are provided as capital to different companies. Yeah, and it’s just a booming market, to be honest, so there’s really lots of the challenges that needs to be solved within this industry. And this, the competition, of course, is rising, you know, from all the perspectives.

JE I mean, I’m just going to have a follow up question, just a little bit different. I see a big element, certainly in the setup of your system, as sort of a consulting function. So do the big consulting firms, are they looking to compete in your space develop these digital solutions in house these, these big, long-established players like the PwC’s the McKinsey’s in that?

LK Yeah, so that’s a really good question. And myself, I saw some initiatives, let’s say, on developing the systems or something like that. But usually they’re using players like us, and then for us, that’s really good partnership, actually, what we can also deliver to them, because they have a good knowledge and understanding within the field and with the environment itself. So, and then we can bring the tools to make it happen. So, we are not competing in the from that perspective, it’s especially with such as the consultancy of the client, so usually it works that we are then enabling them to not only the consultancy, but actually to implement the real solutions to make that work. So, for us, it’s more the, you know, win-win situation for both of us, rather than just the competition. And you see, again, to develop these kinds of things, it’s really hard work, and lots of the stuff has to be done. So there has to be some focus, you know, if you’re, like a software development company, or the consultancy company, so, so we’re a software development company.

JE Okay, fair enough. Now, you’ve mentioned how regulation is such a big part of the world of your customers, and I’ve seen on your website, your GDPR compliant, the ISO certification. Are you as an individual company heavily regulated and if so, who regulates you? Or does that happen?

LK So, we are not regulated as such, you know, from that perspective. However, in some jurisdictions, we have to be either approved by the regulator as the service provider, to go through some kind of process of a license. So, and that’s where it requires, let’s say some of the regulatory responsibility from our side. So, it really depends on the jurisdiction, to be honest, and even in the European Union now, although it’s kind of a single market, but there’s a bit of a different understanding of that kind of players like us. However, from the general scope, and you so you know, we are a software provider, accepting the rules of the financial institution or other client into the system, and then our client is actually regulated and controlled, but not us as the company.

JE Okay, that’s understood. So, you’re providing solutions for your customers. I mean, this this is an overgeneralization, I know, but I mean, is your technology sort of all in place? And, other than maybe some tweaking, it’s more just about business development going forward? Or every year, is there a major R&D spend by your company and fundamental changes? How is it happening internally is that it’s not ever changing?

LK So, it is ever changing, and we don’t see a possibility to be honest to stop with the R&D in the nearest future. Because the environment itself is changing, and especially when we are talking about the good part of the world, so like you or me just opening the account at any bank and doing that, you know, remotely so of course, we expect things to go smoothly, and then basically just you know, to, for us to have the chat with the consultant or just to do that with the self-service, to take a photo of the face to show the document and everything is fine. But we also have to take care of the bad actors that are like evolving day by day, and every day and that’s where the challenges are also coming from. You know, and this part is like never stopping to be honest, so even not counting some like, simple things like you know, document changes and all the stuff because you know, we are accepting the documents from all around the globe and every day, there’s kind of a new type of document issued somewhere, or there’s some kind of changes or something like that of the information, the type or whatever, and that’s what needs to be, you know, implemented within the system, that’s to make sure that it works fine. On the other hand, there’s lots of the initiatives around with it with different ones, like electronic IDs, all the stuff so it’s always changing environment and constantly moving forward environment from the development side, and, of course, from the bad actors’ side, you know, and there’s like, fraud attacks, cyber-attacks and all this other stuff. So, means that has to be constantly developed and developed with a big team, to be honest. So, at the short term and middle term, we don’t see that, that changing. And I really believe that in the technological business, it’s impossible that it wouldn’t be changing, to be honest.

JE Okay. You mentioned the term ‘bad actors’ a couple of times. So, I would guess that continuously enhancing your cybersecurity must be a very important part of your role.

LK Absolutely. So, from the day one, and as an added score, that’s, that’s the main target, you know, so that to offer the services that our clients could offer the services to those that are actually eligible to get it, but, but also to take care that the others that are not eligible to get those services, would not pass through this system and would not pass into their internal systems. So that’s for sure.

JE Okay. Now, my next question was about COVID, but you mentioned that earlier, so I’m going to just vary it a little bit, because I’m involved with a number of healthcare industries and there’s been a big push for telehealth, remote diagnostics. What is the application for your service in the healthcare industry, what do you see as sort of the, the biggest opportunity there?

LK So, like, same related within digitalizing and replacing the physical meeting. You know, so our system is actually designed for that, so to take care on the customers and data behind the customers that are coming offline, but also enabling the same processes online. So, the offering for the healthcare, and what we have there is actually about the same, so just to ensure that the doctor is speaking to the person that says that this is John, coming to the doctor, so to ensure that this is actually John, and then you can prescribe some medicine to John. So, and it’s more related to that, because there’s challenges within the healthcare and remote healthcare, that are actually again, so not only about getting the service now, so that to see your doctor and then to make an appointment with him, but also to ensure that there’s no other type of risk. So, if talking about the financial sector as in money laundering, or the fraud risk. In healthcare is the same fraud risk, where it’s the drug abuse issue. So, it’s more or less, the same challenge, to be honest.

Looking to the Future

JE Yeah, I can see that. And I’m going to be thinking about those applications going forward, because they impact me directly. Okay, so that brings us to our final section, which is just a looking forward piece. So, looking at the period from now to say the end of 2022, what are your top few priorities and or goals?

LK Yeah, so if looking, let’s say from company’s perspective, where we are now and what we want to achieve during the next year. So, you know, of course, our product roadmap is like fully packed with the things that we want to deliver to our clients. Because we see the improvements and developments that have to be made within the sector in general. So, of course, the first target is just to deliver those and to make those happen to make those happen and available for our clients. And then, of course, we have some ideas in the R&D center basically, and what we want to like test and try out to see if that might work. And, of course, you know, the target will be just to just to see if that is possible and, and to try that during the next year. And, of course, in terms of, sales and business development, so, basically the next year will be dedicated more for having a strong footprint in European and a bigger footprint in US markets as such, as being like a player in the market, and becoming a bit of a standard on how companies are managing the KYC data. So, these are the kind of perspectives that we are looking from, from today’s perspective. But, you know, we also understand that we are in the really quick and fast changing environment, so we always have to be ready for accepting the new, you know, new waves or new ideas from outside, and, of course, to see if that would be beneficial for our clients. Because, you see, to be honest, we have the scope and the field where we are working with, and where we are helping with our clients. But the main target is actually to bring the value to them and to make their work easier, so whatever does that and gives the opportunity to achieve that, then that is implemented. So, for us first, the most important part is when growing with the company, and, you know, scaling quickly, to ensure that we don’t lose this attitude. So that’s the targets.

JE Okay, very, very good. I always close out with the same comment or question and just say, is there anything else, you’ve given us a very comprehensive overview of the industry, your company, and your background, is there anything else you’d like to add or say, that is perhaps important, from the perspective Ondato that I might not have thought to ask about?

LK I think, really, we went through quite a lot of things, so and, and I also gave my view on those. So, I’m pretty sure we touched quite a lot of quite a lot of questions. So, as the final remark, maybe this, as I’ve already said that, so main task is just not to forget the actual targets that we want to achieve, and delivering that, you know in the value chain to our customers, consumers, or whatever, you know. So, we example, our B2B business, of course, our focus is to deliver in the value to our business customers. But on the other hand, it also relates with their customers, because always the target is to make their customers happy. And that’s even more tricky, because them becoming quite B2C you know, and in some points, we have the interactions with their end consumers or customers. But, yeah, I think we really touched quite a lot of things during the discussion. So, I’m really thankful for that.

JE It’s very interesting for me, because I’m seeing that digitization is just exploding in the world around us. I see regulation and compliance, exploding in the world around us. So, when you put those two together, you no doubt have a very big market in the future. So, I wish you the best of luck and thanks for the time that you took to speak about this. It was very interesting in digital services are something that I think every business needs to learn about. So, thanks for your time.

LK Thank you, John.

End.

If you have thought of operating a business in Asia, or already have one, then do not hesitate to contact us to see how we might be able to help you set up, raise private capital, and manage your company’s local administration.

©2024

Add Your Heading Text Here

Benny has worked in the financial markets of China with an emphasis on fixed income, currency and asset-liability management. He is currently Vice President of Longly Capital, a medium-sized, Ningbo-based private fund management company. The firm’s strategies include various types of fixed income portfolio management and convertible bond portfolio management. In addition, Benny offers financial investment services to professional investors such as Fund of Funds (FoF) of securities companies, enterprise investors and high net worth (HNW) individuals.

Benny has also been active on the commercial side of the securities business managing client business development strategies, marketing programmes and roadshows and developing and delivering financial markets training programmes for small and medium-sized banks and other financial institutions.

Benny is fluent in Mandarin, English and Japanese.

Since returning from graduate studies in France to China in spring of 2014, Jina has been continually working in the field of e-commerce and its applications to the financial, entertainment and automotive industries. She is a multi-functional talent and fluent in Mandarin, English and French.

Jina is SEIML’s key relationship manager between foreign clients and the Chinese administrative authorities and has held many responsibilities dealing with international companies and executives operating in China. As a result, she manages all of the company’s Business Process Outsourcing (BPO) activities with clients

With her graduate degree in economics and completion of the Investment Foundations certificate from CFA Institute, she has the knowledge to assist foreign companies in China market research, including reviews of potential customers, suppliers or other third parties. She is also quite savvy in the use of Chinese social media.

Jina is fluent in Mandarin, English and French.

John spent the first 24 years of his career in investment banking, first in Toronto, briefly in New York and then London. He was involved in DCM, ECM and strategic investment advisory to large funds in EMEA.

In 2004 he moved into academia and designed and ran MSc programs in investment management at universities in the UK and China. He also created and managed one of the larger financial professional training organizations in Europe while at the UK university (that was a JV partner in the training firm).

In 2016, John returned to industry to work with start-ups and various platforms and eco systems to support these early and middle stage companies. Initially he pursued this venture in the Shanghai region but then moved to Hong Kong in 2024 to build SEIML’s footprint in Southeast Asia. John is also a Director of the Hong Kong Founder Institute (FI) eco system and Program Director for the FI ASEAN Fintech accelerator.