Using data-driven behavioral technology, Meditt* offers a secure service that automates clinical data and insights to provide a world-first digital healthcare service, streamlining the entire clinical journey. It’s set to transform the way we provide and access healthcare, for customers, insurers and clinics alike.

Script of Interview

Interviewee Ms. Gemma Whitehouse (GW)

Position Founder

Company name Meditt*

Company website URL https://meditt.co

Interviewer John D. Evans, CFA (JE)

Interview conducted on 20th April 2021

JE: Okay, good afternoon to the viewers of Venture Watch. And in this episode, we are speaking to Ms. Gemma Whitehouse, the founder of Meditt*. We’re going to talk about four different things today with Gemma. We’re going to get a brief overview of herself, then we’re going to look and talk about the company Meditt*, then take a look at its industry and then conclude with a brief discussion about the whole issue and relationship between the pandemic and the taking off of tele-medicine. So, we hope you find this enjoyable. So welcome, Gemma. Nice to meet you.

GW: Thank you for having me here.

About Gemma Whitehouse

JE: Okay, looking forward to it. Why don’t you start off and give the viewers a brief overview of yourself both sort of your personal background, where you grew up, where you live, etc., and also your professional background, where you’ve studied and worked.

GW: So, I’m a technology consultant and I’m the founder of Meditt*. I’ve worked for the last 15 years in technology and a range of different roles, across different countries, across different industries. And I guess I’ve mostly been focused predominantly on product development and delivery-based transformation kind of projects. However, the last few years, I’ve actually been working in new businesses and emerging technologies and new business development. But originally, I actually grew up in the UK and I actually studied classical music and I actually got a scholarship when very young. I’d had a current an entire, another career, by the time I was about 24 and then moved into technology after that. I then moved to New Zealand and worked there for some years starting out in broadcasting and then moving into finance, always technology-based roles. And now I’m based here for the last seven years, in fact, based and working in Norway.

JE: Very interesting. We’ve done lots of interviews with people in technology, but none of them have a background in classical music.

GW: So, I have found other people actually, I found a very successful CTO at Fujitsu who was actually a bassooner, so we do get around.

JE: Good to hear. So, you’ve told us a little about where you’re traveling. Where are you personally located now? And is that the registered address of the company Meditt* as well?

GW: So currently, Meditt* is registered here in Norway. Right now I’m based in Bergen but my intention is to move to Oslo, at least for the time being. In terms of where I see myself going, I mean, I see myself as being based in the Nordics and the UK. I mean, I’ve been here some years, I built out all these connections, all those relationships. I think in terms of being where I am right now, in Bergen, it’s quite a small town, I mean, there’s 250,000 people here. You really need to be in a bigger location in terms of connecting and evolving business propositions in this special sort of startup technology driven space. But I think really, in terms of the broader picture, my view is that you know, I’ve lived and worked internationally for years, and I’m sort of still excited about the sort of opportunities that are sort of out there in the wider kind of business environments and I think really the biggest business and possibly the most innovative opportunities in life probably are outside the Nordics in that sense. So, I think having come from a larger economy and having traveled pretty widely, I’m pretty open minded, I guess then in that sense, but I feel I have good knowledge of the markets here. So, my intention is to exploit that and build on that.

JE: Okay, so let’s turn to the second section now and talk about the company Meditt* and the Asterix is also formerly part of its name is that correct?

About Meditt*

GW: Yes, currently. It was just a sort of a branding kind of approach. I had some consultancy from a branding and strategy director, actually from the UK, based in UK and they helped me form the initial kind of kind of a brand approach and proposition in that way. So yes.

JE: Very interesting. So, tell us how Meditt* came to be and what your role in creating it was all about.

GW: So Meditt* originally started basically as my side project, also I was working for Tryg Forsikring. Now Tryg is a general insurer. They’re the largest in Denmark, probably around the fourth largest possibly the third now, after the recent merger here in Norway, and certainly the biggest now in the Nordics, in actual fact. I had been working there, developing new products and services, working on emerging technologies, focus actually on IoT, and looking at exploiting IoT for capturing of data in order to evolve the data driven underwriting and tailoring of insurance products, but also to evolve sort of new or innovative customer kind of toolkits and products and propositions, mostly focused on real estate in actual fact. While I was working on these sorts of product development projects, I actually had a terrible back injury. And through the whole experience of going through this sort of claim process of my injury and my rehabilitation, I realized that there was really a lot of things that could have been significantly improved. And I also started to think about how I might start to use some of the experience and the kind of tools and technologies that I’ve been exploiting within real estate actually to apply those to healthcare. And so that led me to then undertake a customer study. And from that customer study, there was some really clear pain-points that emerged, and this is all pre coronavirus pandemic, in actual fact. So, some of the things were, like physical travel distance to see treatment specialists. And I mean, I’m living in western Norway you know, we’ve got ranges mountains that get in the way that you can literally be driving 40 kilometers with a leg injury and just to see someone you know, so there’s some actual sort of practicalities for certain people in certain scenarios, in that sense. There’s also physical time to actually see someone and the waiting time and the amount of paperwork they might have to process or waiting for an appointment, etc. There are also some other very basic things like a customer who would struggle to follow their treatment plan correctly and, you

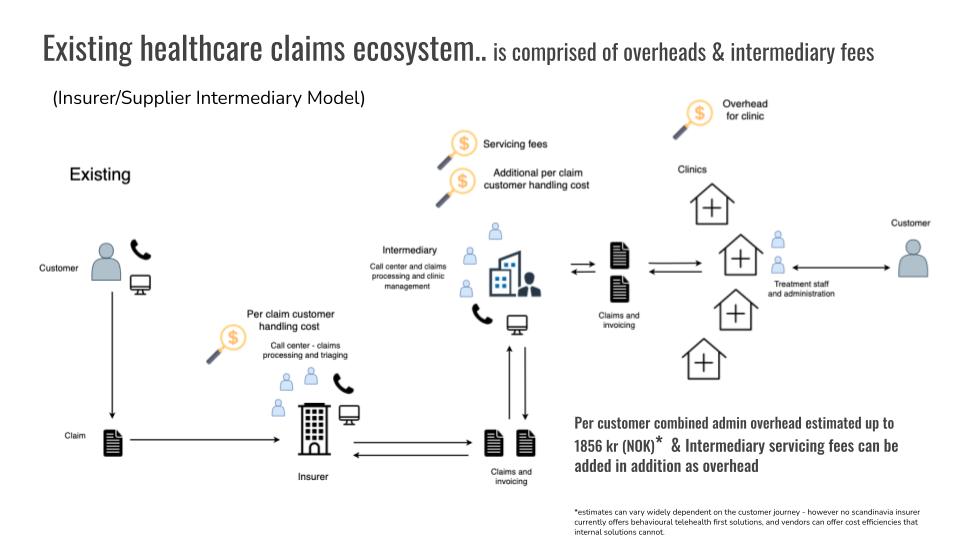

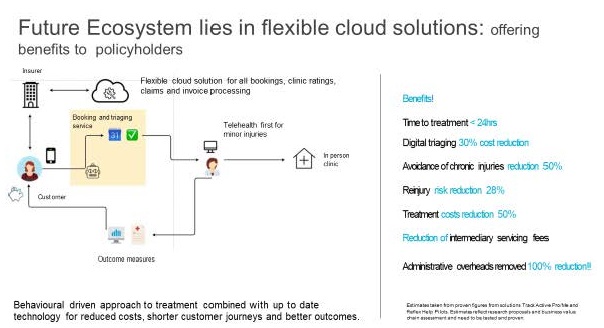

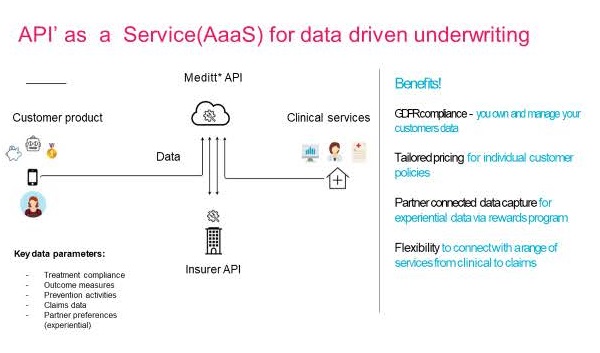

know, keep up their treatment plan every day, and being offered some kind of preventative treatment and support, post your rehabilitation, and have been encouraged also to sort of have those sort of healthy habits and injury prevention ongoing. And, of course, the customer is very, very motivated, they don’t want to be injured, and they certainly don’t want to be injured again, because they’ve been injured that’s a very motivating factor, right. And so there was a lot there, that could have been improved, I felt, and with all the new digital therapeutics that were coming out in the market, there was definitely technologies out there to offer customers, and offer people who experienced what I experienced to improve that significantly. So, the other thing really is also that the kind of entire value chain, I think, from my own experience, and also from my assessment of that professionally, the value chain currently is you have your insurance who are sitting at the top, then you have your intermediary services who handle the claim for the customer. And then underneath that, you will have your clinics, and many of them are very small, and the run on lots of local, you know, business level because their local for the customers and not nationwide. And then you have your customer underneath that has been treated by the clinic. And I think the nature of that whole process right now is fundamentally quite administratively heavy, and inefficient, ultimately, and the clinics themselves were often feeling that they are being squeezed by these larger sorts of providers who are sitting over the top of them. So, there was also possibilities to offer quite a lot of benefits to the clinics as well and as well as passing a lot of money back to both the customer fundamentally, but also the insurer. There was a lot it’s really to kind of, I guess, kind of solve into in terms of pain points at that point. So really, what I came out with ultimately was in terms of Meditt*, I kind of knew in terms of how to sort of approach to solve some of these issues. So right now, today if we take an example from what exists, so if I’m a customer and I have an injury and I call the insurer and then then that takes some days to process and that may be then sent on to an intermediary service to process that claim who then pass that on to, to the you know, to back to customers that they can book with one of the clinics that sits under this sort of umbrella service. Well, and so essentially what I’ve thought to do with Meditt* was to have a much faster and more efficient kind of proposition. So, as I’m on the customer, I have a claim and I can triage this claim through a sort of chat-based kind of chat-bot function. Because there’s quite a lot of sort of chat bot-based functions right now that have been implemented in several different sort of, certainly in public sector health and also some private sector health through the pandemic, for the sake of triage and patients quite quickly. And you’re taking an assessment and that assessment basically says, okay, you are in a injury category that could be suitable for a telehealth base treatment and service, your traffic thereby through to take a 30-minute assessment with telehealth assessments within 24 hours, that has a mechanism to assess that you are appropriate for that service. And that you don’t need to be physically seen, you know, that that’s quite important sort of mechanism to build in, and assuming that you are appropriate for that, that you are then offered your treatment plan, you have your APP that you can use to log your treatment that you’ve done your program every day, you have some automated reporting back to the treatment professionals that can see you’re following your treatment plan. And they have possibilities for intervention through that process. And you get benefits for sticking to that treatment plan for filling out things like outcome measures for taking preventative based treatments. And the idea is to build in these sorts of vitality, health-based benefits through that kind of that process, but focus on the rehabilitation as a sort of, kind of first proposition. And that plays in very nicely to what the insurance and the clinics and the customers do right now today but offers that sort of an additional kind of added hard incentive, I would call it actually, which I feel is kind of in terms of driving user behavior and driving that customer behavior that’s quite important to have those things built in. And then from a term of booking, and the sorts of clinical services, well, it’s certainly possible now to automate a lot of the sorts of invoicing, the claims management, and booking for the customer, sending that through directly in an automated manner to the clinicians. Also have a booking proposition which allows the customer first of all to assess much more appropriately because they will be given a list from the insurer, that will be the normal thing of different services. And maybe you’ve never had to book this setup or service before, right. So, you don’t know what to find on where we have a specific scenario where you want specific type of treatment. One use case scenario that came up were from some of the customer studies that I undertook was one guy who’d had a terrible sports injury and he wanted to find a sport specialist. Well, he ended up actually talking to people, in fact finding out on Facebook in order to find this person, right. So just for the sake of not having that information collected in one place, that he could actually search it, find it and find appropriate etc., in service. So that whole process is certainly something that can be improved. And then also the nature of complexity of people’s injuries, they often touch on more than one service within that. So, there’s quite a lot that you can automate in terms of that whole sort of customer journey, that whole sort of customer flow. So fundamentally, what Meditt* is, is sort of preventional toolkits and incentivizing kind of solution to offer behavioral based benefits to the customer, and then a marketplace in order for both the clinics to find their customers and manage that much more efficiently. But also for customers to be able to search and book rated services in a much easier and more effective manner. And then if you start to sort of think about some of the kind of possibilities for capturing data and how you might exploit this sort of experiential data you get through sort of that marketers use, but also underwriters use, as well as the kind of data that you that your clinicians will need and require. There’s quite a lot of possibilities as soon as you start to scale that type of marketplace proposition to actually offer a lot of benefits beyond the knowing the obvious cost reductions and the obvious kind of speed to treatment. And fundamentally, if you’re building in hard incentives for customers to come to complete kind of rehabilitation programs, if you’re offering a level of automation through that telehealth-based approach, you’re getting significant reductions in risk, re injury and cost. And are we seeing that through the studies that I’ve been collaborating with a couple of researchers on this proposition? And so there’s clear evidence that that actually has a reducing risk reducing effect.

JE: Let me ask a follow-up question just at this point, just to clarify it for me. So, you’ve mentioned the four parties in the chain, the patient, the clinic, insurance company, and maybe some sort of intermediary between the insurance company and the clinic? What is your revenue model and who is your paying customer? Who are you generating revenue from, or maybe there’s multiple customers?

GW: So predominantly, it’s the private health insurance market. So, it will be your health insurers, your general insurance with health insurance products, that are your sort of primary customer. Ultimately, they have all of the contracts and ownership over all of the contracts with the clinics, which sits underneath them. So, they are the primary kind of sort of starting point, I guess. In terms of also all the other tools and services and it’s certainly my intention to build in tool toolkits for the clinicians. So, there’s a possible revenue stream there at the moment that’s quite poorly handled in the market within Scandinavia. So, there’s certainly possibilities for that. In terms of the revenue model, it’s a per fee per claim, revenue model. So, every time a client transaction is processed by the solution, we would just slice off a fee for that. And as soon as you start to scale that up and then you start to volumize, of course, then the fee is, of course, go down. So that is obviously quite incentivizing in terms of your copy being effective and you’re cost optimization, I guess. The more of course, and more customers that you add to that, you’re getting an optimizing effect from that as well, of course. So, I think there are also other possible revenue streams from that but of course, then you need to start to start to scale before you get to that point. There are some sort of challenges I think from having worked within the insurance industry. I would say, a lot of people, people who were sitting within sort of pricing and product-based kind of disciplines within insurance, often you will see startups come in with wanting to take a fee for offering the customer their new exciting APP solution. And, of course, for most insurers, they will just add that cost on and pass that down onto the customer. Well, that makes that quite a difficult proposition to sell in. But if you’re offering those sorts of toolkits and benefits and the risk reduction, and then at the same time offering that kind of processing, which of course they already need, that’s already within the same ecosystem, you’re just offering an optimized sort of solution, that hopefully will become a much compelling proposition.

JE: Okay, very interesting. So, describe the company now. Its facilities, its staff, stage of development, where are you in the whole development process?

GW: So, development process, so I mean, I’ve done quite a lot of work. So, in terms of the kind of, in terms of the stage I’m at right now, I’m prototyping and testing, essentially, with customers. I’ve already had one prototype version out. And I’ve had certain rounds of feedback from that. I’m now in a redesign process for the clinical solution part. And in order that I can improve the incentives for them, I have a solution that it has a design, I just need to build it out. So, we’re very much in that sort of prototyping and testing kind of phase right now. In terms of all the service design and how that’s all been mapped out and isn’t doing a very thorough assessment of all of those clinical solutions that we could integrate with out on the market. I mean, I’ve been working with a researcher, here in Bergen who also owns a small chain of physiotherapy clinics. And we’ve done a pretty thorough job, I would say, of redesigning that whole kind of servicing provision. And in order to optimize, and we’ve actually done quite a bit of testing as well with her customers, in order to kind of really identify end solutions that we feel were really work. So now the challenge really is to get an insurer on board and actually start to scale up some of that prototyping and testing in order to evolve the product, the product and service offering further. So, it’s very early stage right now, I would say.

JE: So, I noticed on your website, there’s two of you, that’s you and the researcher you’ve mentioned, I guess, co-founders. And there’s an advisory board with three or four people. But I didn’t notice any IT people or others. So, have you been outsourcing that development?

GW: Yeah, I mean, quite a lot of that is I’ve got three or four developers that I work with. I handle all the UX and service design myself. I’ve taken UX and service design training. In terms of the kind of provisioning, I mean, currently, I’ve been picking up cloud engineering and solution architecture. So, I certainly do the provisioning myself as well, that’s no problem. So, and certainly some of the bills. But I have three new developers that I collaborate with and, I mean, I’m largely self-funded. There is local funding available for startup-based propositions here in Norway and it’s certainly my intention to apply for some funds for this next phase. And also threw my own capital, it’s evolving a proposition further to more prototype, prototype stage.

JE: At some point in time, you may need to add some people for business or market development when you start going out and trying to promote it. But it sounds like that’s not quite yet happening.

GW: No, I think so. So, the trouble with being in the healthcare and also in this insurance-based business is highly regulated. And there’s an awful lot of work that you need to do in order to sort of prototype and evolve that proposition before you’re kind of formally commercializing anything. And I’ve seen this in plenty of other businesses, I mean, it really does take some time. If, you know, if you have anything which touches on clinical services, there’s a certain amount of compliance there that needs to be assessed and formally ticked off before you can actually go out to market and really start selling. So, there’s a certain level of having to sell into the industry and before you can actually come out with a sort of commercialized proposition. And that is quite a process.

JE: And when do you think you’ll get there? What is this sort of like the start of next year, you’ll be ready for commercialization? What’s the time horizon?

GW: That time horizon, at the moment is that I will build up the new prototype over the summer. I need to confirm I’ve had interest from the insurance market, but I need to actually confirm one, a business to sort of collaborate with to evolve the proposition further. And then I will, I mean, in terms of the actual build, the build is relatively fast, in actual fact, is I don’t see this unless there’s some sort of horrible technical kind of roadblock that I haven’t anticipated, but I think it’s unlikely given my level of experience. I don’t see that as being a showstopper.

Really, I’m coming from a very sort of tech delivery-based perspective. So, I feel like I’ve got a really solid handle on that. So really, then it’s just the business mechanics, that and the speed at which that can move, that really is the thing that will kind of enable or kind of slow down any kind of commercialization. So, I would certainly hope that next year, I would be able to and will be out in the market, looking at that initial sort of public commercial pilot test. But that’s certainly my intention. But the moment I would certainly need to bring on another co-founder at that point. So yeah.

JE: So, the mention on your site of a potential co-founder that will be slightly in the future, and the co-founder maybe focused on the commercial development is that is that the alignment?

GW: Well, from my own experience, I have to say, I mean, I’ve got a look, I’ve got a number of sort of connections within the sort of startup environments. And I’ve met a number of people who’ve actually gone to full pilot, or in fact, even one who’s who runs quite successful, profitable business, and even he is looking for a sort of as a CTO. So yeah, and hadn’t thought and hadn’t actually hired some, I mean, took him five years to actually get to the point where he really needed to hire someone, and have someone fulfill that role. So, I think it can vary quite wildly depending on your specific situation as to how necessary that that person is. I mean, as far as I mean, in terms of my position, right now, what I believed was I can actually get through the pilot stage if I need to, and find that with other funding, kind of sources myself, and that, finding that the right person to come on board, and as support that process is more important than just finding someone to come on board that process. It’s important that they, you know, have the right experience and knowledge and skills to kind of drive that forward and have enthusiasm for the product in order to sort of take that forward. It’s a huge amount of work and commitment, and you’re possibly committed to that, of course, for years. So, you don’t really want to get that wrong. So, I think the answer really, is that the inevitability of starting business is that that is a slightly fluid proposition in that sense. And I will bring someone on appropriately as soon as I sort of reasonably can.

About the Tele-medicine Industry

JE: Okay. So, let’s combine, and let’s move to the third section about the industry. And let’s talk about the first two bullet points. What industry sector do you classify Meditt* in, and also, for your first stage of commercialization, what will be the extent of your geographic target market?

GW: So how it would normally run with an insurer, you’d be looking at me certainly here in the Nordics, you’d be looking at just testing with a few hundred people. If you’re looking at different bigger markets, I mean, that might be a couple of thousand, if it was the UK, for example. And so you would be looking to run a limited pilot, just to start with, how I see probably run that for around, I don’t know, six months, probably. And at that point, assuming that that was successful, you’d be signing a deal as a vendor, and then you’d be offering that out across the entire customer base, that would have been a normal approach, I would say, for this market. So certainly, that’s what I’ve anticipated in all the kinds of documents and planning and solutioning that I’ve had brought up the proposition so far. So, I immediately I could test out the service provision. That would be fairly straightforward to take that on initially. And then add in all of the automation as you get further through the project, and you’ve actually started to prove that you can achieve exactly what you’re selling in through that piloting process. So, I would say that.

JE: With a focus in the first stage on the Nordic countries, that’s going to be your original initial target market?

GW: Initial target market, yes, certainly. I mean, I’ve certainly also got a mind to take it and try and pitch it in the UK. I think the nature of the Scandinavian market, particularly if you’re looking in Norway and Denmark, it’s made up of a few big players who dominate the entire market. It’s not like I can go around 40 different insurers. I mean, there’s probably five here in Norway, you know. So, you might not necessarily have the flexibility when you’re trying to get that initial traction and just that initial engagement in order that you can thereby, you know, prototype that proposition out and move forward. In a bigger context at least,

JE: Is it hypothetically transferable to a very different market. For example, I speak with certain companies in the healthcare industry in the ASEAN countries, of Southeast Asia, there’s a lot of interest in telemedicine there. Could it hypothetically be delivered there with maybe a partner? Is it sort of a product that could work anywhere?

GW: In my view is certainly as I also had also considered even the public sector, but you have to be careful where you start, you have to focus on one area. To start with, I did see a very similar concept and approach in Taiwan, they’re certainly further on than I am. But they’re relatively early stage and have built out a marketplace proposition, doing a very similar kind of concept, conceptual approach to what I had thought, in actual fact. I thought it was very interesting that they had come up with a similar proposition, and a completely different kind of part of the world and completely different markets. I have no knowledge of that market. So, it’s very hard for me to sort of comment account further, but, yeah,

that was interesting that was that those possibilities out there? So, I can so I certainly believe it could be very relevant across different kinds of international markets.

JE: Okay. So, I think you’ve answered the next question. So, to the buyers, the customers are basically the insurance industry. So, let’s look at other aspects of the whole sort of Porter competitive strategy, your key suppliers, and main competitors, those two different sectors. What can you say about that, within say, the Nordic Region, where you are starting off.

GW: So, in terms of competitors, there is one kind of main intermediary service, which model the original concept on boards, Nordic Netcare. They are effectively an outsourcing based solution, they handle all of the claims all of the invoicing, they also have Customer Contact Center. So, if you’re an insurance customer, and you have a claim, and you can actually call into their center and be assessed by nurse or physiotherapist to assess whether your claim is, what sort of treatment or claim that you have. So, but my whole proposition is quite different really from their offering. I think the trouble with the Nordics is that because they are small markets, there isn’t significant amount of, well, from insurer perspective, there’s not a significant number of choices, of suppliers. If you’re just looking within your home market, you have to look broader than that. And I think also that there are a number of businesses, who are sort of looking in this sort of space, but they haven’t evolved their proposition into it just yet. So, I think there’s certainly a number of businesses that kind of there was one I think is it could lead to health, name is Lever Health. They have a sort of technology digital therapeutics-based solution. They are capturing that data and offering that back to the insurer. But the whole business model is completely different, they don’t touch on the claims, they don’t touch the invoicing and all that sort of business-to-business space, back- office processing. So, I think they’re certainly I think as those businesses evolve, of course, they will want to capture parts of that market, that’s inevitable. And in terms of where I am now, I’ve had some initial discussions with a business called Cloud Insurance, are based in Oslo. And my idea really was to be able to build my solution on top of their proposition. And they have already a growing customer base of claims and invoicing customers mostly within the insurance agent’s market. They have a big interest in the healthcare, insurance healthcare market, as well as a particular focus area for them. And it was certainly to work with a business like that, that would certainly de risk my proposition. And obviously, in terms of a, you know, the amount of capital you need up front for any sort of project based initial point of development, that also significantly reduces that is a huge amount of work, in terms of build to process all of those invoices, all the claims, that’s a lot of business logic to actually have to sort of create and build out. In terms of other businesses that I’ve been working with, propositions that we’ve tested out, there is a number of clinical solutions in terms of offering digital therapeutics for rehabilitation, and it’s certainly my intention to use my solution as a sort of mechanism to aggregate those other clinical solutions. One of the big challenges with the healthcare market is the fractalized nature of it, and the siloed nature of the how the market operates. You’ve got, at the moment, lots of small startups, doing lots of really exciting, innovative things. But as a customer, you may have a very specific needs and none of those things are sort of joined together. So really, any kind of marketplace based proposition should be ultimately connecting all those things together. So, we’ve listed out a couple of supply base propositions, Reflex Help who offer IoT based solutions for rehabilitation of knee injuries, specifically. Exorlive, who have a very heavy presence here in the Nordics. They’re the primary supplier of physiotherapy based and musculoskeletal exercise software, and a couple of others as well based in in the UK. So, all of these solutions have possibilities to sort of integrate and offer kind of benefits based on that as well. So.

JE: I’ve seen it in a lot of different industries, we deal with healthcare, FinTech as well, maybe some other advanced manufacturing, where there’s, as you said, a lot of big players, a lot of startups. And what we see is the big players starting their own ecosystem where they may support some interesting startups. And it’s sort of like, outsourced research and development. And if the startup really works, well, they may become a formal partner, or maybe even be acquired by the larger firm, because the nature of the industry means that it’s very dificult for, for startups to survive alone. So perhaps a strategic partner is going to be an important part of the future for you. So then, that comes to our last question in this industry to think about, where do you see Meditt* in three years’ time?

GW: So, I think, I certainly hope we will have run a successful pilot. I hope we will have been rolling with our first couple of customers, or corporate customers, I certainly hope that that will be the case. And, I mean, in terms of bringing that to markets and having to sell that sort of proposition, I certainly hope I would have a co-founding team on board to be driving that forward with me. So, I can’t, at the moment, it’s too early stage to forecast too far into future in a concrete way as you have to be iterating and you have to be testing things out. And you have to be justifying your position and your proposition at each stage in order that you can thereby sell it. And so I expect in three years, I certainly hope that I would be live with my first couple of customers and be looking to scale.

JE: It’s almost like they used to teach us in basic math about conditional probability. You can say, I want to be here. But you know, this end outcome, and this outcome has to happen first. And so I think you’ve defined your first key outcome, which is achieving the start of a commercialization process by the start of the next year. And then if you do that, then you set your next outcome. So, I often say it’s one day at a time. I guess, in your businesses, maybe one year at a time.

GW: Yes, it maybe doesn’t move as fast in very highly, highly regulated markets, unfortunately, is not really a case of move fast and break things. It’s not really the same speed to market that you would expect in a sort of direct, B2C based product proposition. So, it’s just the nature of it. So yeah.

Case discussion: The pandemic and tele-medicine

JE: So, let’s, let’s go to the final, the fourth stage, which is sort of a case study. I know in a previous conversation, you were talking a lot about the pandemic and tele-medicine. Give us some thoughts on that area, has it slowed down your business development? Has it given new opportunities? How does your business and the pandemic relate and impact each other?

GW: Well, I think it’s obviously been a complete game changer for telemedicine. Prior to the pandemic, it was slow to sell these sorts of propositions in and having met a lot of other businesses in the same kind of space. I mean, certainly, this is a broadly shared experience in terms of the initial traction prior to the pandemic. And of course, the pandemic arrived and now we’ve seen huge explosion in growth. However, I do believe there’s an awful lot of areas that simply haven’t been touched yet. And I also think that there’s still a lot of resistance to change, actually, and that people have this belief that okay, we still waiting it out and things are going to just go back to normal, at some point. It’s been interesting looking at the insurance market in terms of musculoskeletal injuries, particularly, which is where I started the Meditt* proposition. Meditt* fundamentally the whole kind of approach is that I needed to start with one kind of specific area and tailor my proposition to that, and then scale out across the course of other kind of injury categories and treatments and services. But in terms of musculoskeletal injuries, the insurers have seen a massive drop, actually in musculoskeletal injury claims. Now, this was an absolutely huge chunk of their claims base at something like 60% in the Nordics or something for orthopedic and musculoskeletal problems. It’s a huge amount of their outgoing costs in that that area each year. Now, it’s not to say that people aren’t still getting injured. That’s not to say that people don’t still have ergonomic problems. But they’re frightened, of course, stuck in lockdown to go to any kind of see a physician and they are worried about catching Coronavirus. And so there and lots of these, particularly small clinics, so often the majority who servicing people in these sorts of injury kind of categories, they have really struggled with finding the right sort of tools, technologies as they don’t have any kind of technical knowledge or background themselves; their clinicians. That’s their focus and their training and their expertise. And so there has been some real challenges actually, with them, even servicing people that have got injuries. So, I think there’s actually sort of bubbling time bomb in a way, particularly within the musculoskeletal injury category, that people have potentially got chronic injuries that they are sitting on, because they weren’t able to, or worse, you know, worried about sort of processing a claim or something like that. So, I think that’s quite an interesting, sort of industry kind of dynamic. And I also think that in terms of how the markets responded, we’re seeing big traction with platforms like Teladoc. But before it, well, for example, amongst many others, a huge explosion of growth across some of these sorts of startup-based propositions. But I think fundamentally, if I were just local, if I’m here in Bergen, where I am right now, I want to go and see the doctor or the treatment specialist, those local to me, that knows me, that I have that relationship with and Teladoc doesn’t offer that right now. They’re not offering mechanisms for local businesses. So, I wonder whether their post that post pandemic that we might see those sorts of businesses losing attraction, as some of the rest of the market actually starts to catch up on some of the stocks offering better tools and services for some of these smaller businesses. I think they could be quite an interesting industry shift. So, I think in terms of my, where I’m sat now, and what I’m thinking about in terms of the proposition, of course, I’m seeing all this. And I’ve identified these gaps. And I mean, I certainly have, I believe I’ve come up with a solution that would sort of fill some of those gaps and offer a better kind of proposition in terms of those sort of small local clinics and those kind of bit mechanisms, which fundamentally exist right now but aren’t being serviced well enough, even though we’ve seen explosive growth. So.

JE: Yeah, I think that’s a very interesting point. I mean, where I’m sitting in Asia and China, we’ve seen situations where very large, mostly technology companies, but not exclusively, who’ve got a lot of money, have decided that okay, we’ve got the technology we know technology’s important for healthcare and for finance. So, we’re going to jump into there, throw a lot of money, create some big platforms, but they’re not historically knowledgeable about the healthcare, the dynamics or the finance industries. And so, you get a lot of big platforms going out that, because the small ones don’t have the capital, or don’t have the time, so far, they put out these very generic solutions that are not ideally, what the customer wants. So, I think that there’s either room for smaller providers with real deep industry experience to go there, or these big tech companies need to partner with companies like yours, and others who really have the expertise so that they can take their capital and technology and really create something, as you’ve described, that the industry has really needed. So, I think there’s either room for new players to come in, or for startups to partner and really fine tune these big platforms into something that’s much more what the ultimate patient or clinic wants. That that’s just been my sort of impression so far.

GW: Yeah, I agree. I completely agree with that. Certainly, trying to deal with a lot of what I’ve seen out on the market as well. So.

JE: Okay, well, that was the end of my scheduled questions. And I always finish with the same question comment and that is, is there anything you would like to add that perhaps I didn’t think to ask you about a raise or comment on before we close out?

GW: Well, I just like to say thank you for the opportunity. And it’s been great to talk to you today and to talk about medicine. And so I mean, I’m very excited about and fascinating learning about new markets and possibilities, particularly out in places like Hong Kong, China, other parts of Asia. I mean, I haven’t lost my thirst and curiosity about the world and very excited about business and technology, of course, so. So yes, that’s great.

JE: So, we’ll be promoting this on a great number of social media, and hopefully, someone who will be watching it out in another part of the world and see some sort of potential collaboration. Because at the end of the day, this is to provide interesting news for readers. But also to expand the network of startups or SMEs, which by definition, tend to be a little bit more regional in their focus. So hopefully, this opens up some new doors down the road for us. So, thank you very much for your time, Gemma. It was, it’s always interesting for me, I have just a very general business background. So, learning more about healthcare, IT, is always fascinating, and I’m sure the viewers will find it as well. So, thanks for your time today.

GW: Thank you very much.

End.

If you have thought of operating a business in Asia, or already have one, then do not hesitate to contact us to see how we might be able to help you set up, raise private capital, and manage your company’s local administration.

©2024

Add Your Heading Text Here

Benny has worked in the financial markets of China with an emphasis on fixed income, currency and asset-liability management. He is currently Vice President of Longly Capital, a medium-sized, Ningbo-based private fund management company. The firm’s strategies include various types of fixed income portfolio management and convertible bond portfolio management. In addition, Benny offers financial investment services to professional investors such as Fund of Funds (FoF) of securities companies, enterprise investors and high net worth (HNW) individuals.

Benny has also been active on the commercial side of the securities business managing client business development strategies, marketing programmes and roadshows and developing and delivering financial markets training programmes for small and medium-sized banks and other financial institutions.

Benny is fluent in Mandarin, English and Japanese.

Since returning from graduate studies in France to China in spring of 2014, Jina has been continually working in the field of e-commerce and its applications to the financial, entertainment and automotive industries. She is a multi-functional talent and fluent in Mandarin, English and French.

Jina is SEIML’s key relationship manager between foreign clients and the Chinese administrative authorities and has held many responsibilities dealing with international companies and executives operating in China. As a result, she manages all of the company’s Business Process Outsourcing (BPO) activities with clients

With her graduate degree in economics and completion of the Investment Foundations certificate from CFA Institute, she has the knowledge to assist foreign companies in China market research, including reviews of potential customers, suppliers or other third parties. She is also quite savvy in the use of Chinese social media.

Jina is fluent in Mandarin, English and French.

John spent the first 24 years of his career in investment banking, first in Toronto, briefly in New York and then London. He was involved in DCM, ECM and strategic investment advisory to large funds in EMEA.

In 2004 he moved into academia and designed and ran MSc programs in investment management at universities in the UK and China. He also created and managed one of the larger financial professional training organizations in Europe while at the UK university (that was a JV partner in the training firm).

In 2016, John returned to industry to work with start-ups and various platforms and eco systems to support these early and middle stage companies. Initially he pursued this venture in the Shanghai region but then moved to Hong Kong in 2024 to build SEIML’s footprint in Southeast Asia. John is also a Director of the Hong Kong Founder Institute (FI) eco system and Program Director for the FI ASEAN Fintech accelerator.