Article 12: Real estate – a good or bad investment?

Introduction

This is our twelfth Article and looks at real estate as an investment, from the perspective of an individual investor as opposed to an institutional investor. We will start off with some background information on the role real estate can potentially play as an investment asset.

The growth of real estate as an investment asset

As we discussed in our first article, investing originally revolved around three ‘traditional’ asset classes:

- Cash – usually short-term deposits at a bank or, perhaps, money market fund

- Bonds – longer term debt instruments, either issued by a government or a company, that promises to repay the principal after a certain time (say, ten years) and to pay a periodic (often annual) coupon or fixed rate of interest

- Equities – perpetual (no maturity date) securities that may pay a dividend depending on the profitability of the company

But, during the late 1970’s, due to the large amount of money being held in institutional investment funds, there was a search for ‘alternative investments’. Some of the more important alternatives are:

- Commodities – precious metals as an example

- Private Equity – unlisted common shares

- Real Estate – residential and commercial

Over the last forty years, real estate has become a very large and important part of the investment world. There have been many reasons for this and we discuss a few of the key drivers below.

Real estate and institutional investors

Though our focus will later turn to the individual investor, it is important to understand the role of institutional investors in helping to develop this market. The real estate market can be broken into two segments:

- Commercial real estate (CRE) – large office buildings, hotels or multiple single-family units (whole apartment blocks being professionally managed)

- Residential real estate (RRE) – single family homes (houses or apartments)

The institutionalization of money; money is now invested more through funds than direct investments by individuals of institutions. This ‘pooling of money’ has made funds very large with a very large investment appetite. As CRE is very expensive, investments are now achievable given the very large scale of investment funds.

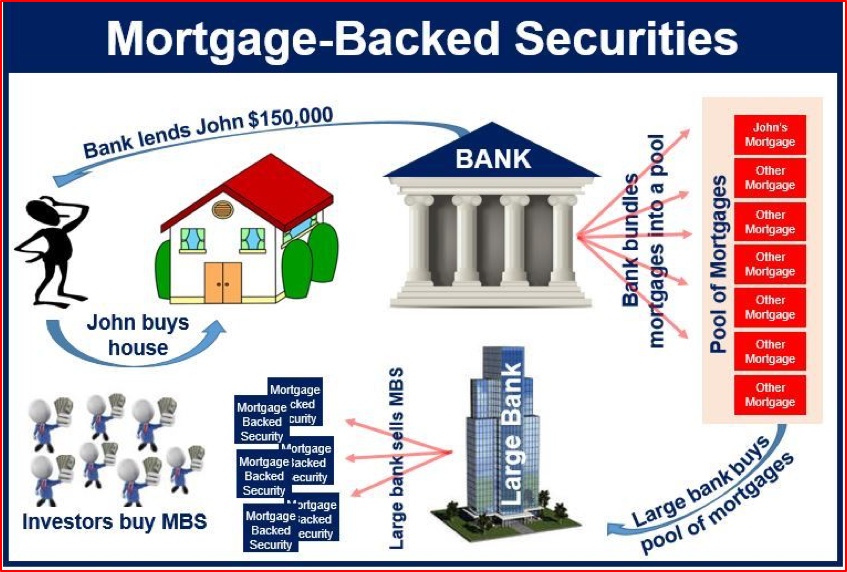

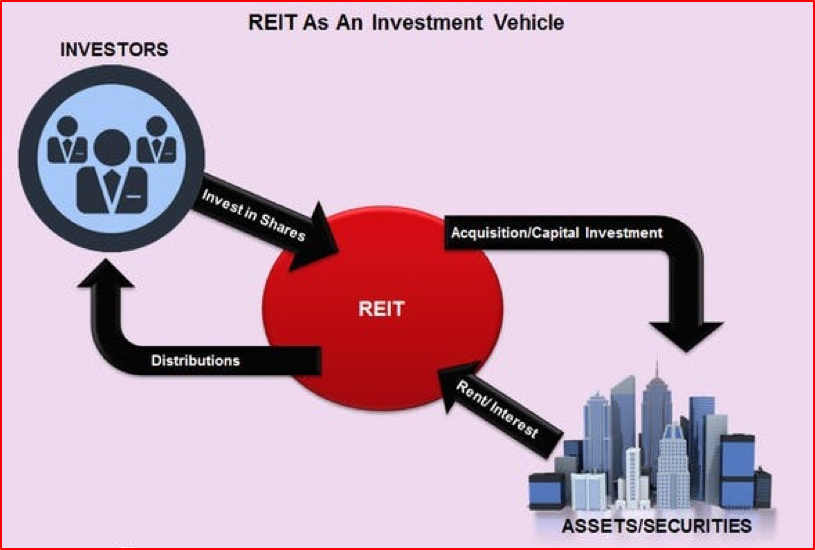

The securitization of assets; as we talked about in earlier articles, both liquidity and diversification are important principles in investing. Securitization allows investors to achieve better liquidity and diversification by making these investments ‘exchange traded’ or at least trade over-the-counter (OTC) and being able to buy small units of the real estate asset (instead of the whole asset) provides diversification. Real Estate Investment Trusts (REITs) achieve these goals for CRE and securitization of RRE helps achieve these goals in this sector.

We have also seen a change in corporate mindset that ‘focuses on its core competencies’. Real estate, which ties up a lot of capital, is not seen as the best focus of industrial or other companies. A classic example here is the hotel industry. In the 1970’s, large hotel chains owned most of their hotels (real estate). Today, hotel chains are mostly hotel management and service companies that rarely, if ever, own the hotels they serve. The individual hotels are owned by institutional investors.

We have also seen a change in corporate mindset that ‘focuses on its core competencies’. Real estate, which ties up a lot of capital, is not seen as the best focus of industrial or other companies. A classic example here is the hotel industry. In the 1970’s, large hotel chains owned most of their hotels (real estate). Today, hotel chains are mostly hotel management and service companies that rarely, if ever, own the hotels they serve. The individual hotels are owned by institutional investors.

Real estate and individual investors

There is a ‘trickle-down-effect’ in new investment trends. These new trends usually start with the institutional investor (who is viewed as the most sophisticated), then they are copied by high net worth (HNW) individuals and then to the population at large. This is particularly the case when wealth is increasing among the general population of a country and there is more savings for investing. However, as CRE is typically of very high capital cost, individual investors (in most countries, not just China) have a preference for RRE. This is also reinforced in China by two further trends: the country’s wealth is growing quickly meaning more people can afford RRE and China has less investment market alternatives than western countries, so real estate is even more of a focus.

Market size rose in 2017. The size of the professionally managed global real estate investment market increased from $7.4 trillion in 2016 to $8.5 trillion in 2017.

(Source: MSCI Real Estate Market Size June 2018)

Even though RRE is much less costly than CRE, it is still often the largest single investment a person or family makes in their lifetime. Thus, making good real estate investment decisions is very important for the population at large. We will examine the two most common real estate investment decisions a person has to make, which are:

- In terms of an adult or family looking for a place to live, should they buy their property or rent?

- For a person or family unit that has more money, should they look to buy a second property as a form of investment.

These are two very different situations that require a different analysis. We will evaluate the choices using our traditional investment approach: risk versus return and evaluating the constraints of liquidity, tax benefits, etc.

Case 1: The single-family home

All around the world, for the majority of people (who are not super-rich) thinking about buying a home is one of the most important decisions they will have to make. Often, decisions are influenced by emotion and family or social pressure. But, as the investment will likely be the largest in the person’s life, it has to be evaluated in terms of its financial risk and return. On the surface, there seems to be two elements to the decision. First is that a person needs somewhere to live (that term that economists call ‘shelter’). Second, it is a financial investment that you can sell in the future (perhaps at retirement) to ‘take out cash’ when you buy a smaller residence to live in.

From the perspective of ‘shelter’, most developed economies offer two alternatives: first is to buy a home and the second is to rent a home. Many countries have substantial regulation to ensure that renting a home can also give you security (as long as you meet the financial payments). In the last two years, China has introduced new regulations to try and improve the market for rental accommodation. So, let us work on the assumption that a person can either buy or rent.

From a risk and return perspective, the two choices are very different. It is only with ownership that you can gain if the price of the home increases in the future. The last ten years in China have been a decade of high economic growth and increases in the value of real estate. But, as we have seen many times in other parts of the world, real estate prices can go down as well as up. In 2008, some homeowners saw their homes lose 40% of their value and many lost their homes to bank foreclosure. But, risk and return go together, you buy in the hope of it going up in price, but you will also suffer the loss if it goes down in price. Thus, buying (versus renting) is the ‘higher expected return, higher risk’ strategy of these two alternatives.

There are other important financial items in the decision. Liquidity is one and transaction costs are another. ‘Liquidity’ means being able to sell something quickly at what you think is its ‘right price’. It is generally much more easy to end a rental agreement than to sell a property, if you are required to move. Why might you be required to move?

- A new and better job opportunity comes up that requires you to move to a new city

- You get divorced and have to sell the home

- And there are many other possible reasons

Selling a home can often take a very long time, though times will vary greatly from location-to-location. In ‘hot’ property markets, homes can sometimes be sold within one week. In more remote locations it can sometimes take years to sell a home. So, if you cannot sell your home does that mean you cannot move to take that better job? Or does it mean that you don’t have enough money to buy or rent another property in the new location until you sell your current one. Thus, renting (versus buying) has much superior liquidity.

Many people like to trade, many like to buy and sell real estate. But, many underestimate how much ‘transaction costs’ reduce their investment return. Many homes are sold via real estate agents who charge a commission for each buyer and seller. This can be a lot of money on an expensive home. But, there are many other transaction costs. For a home, there are a great many finishing and furnishing you must pay for. Many of these are unique or attached to a home and cannot be taken to another home. Thus, if you spend a lot to finish and furnish a home, this will (likely) be lost when you move. Frequently (but not always), rental properties are both finished and furnished. It is normal that the owner pays for these costs. Thus, renting (versus buying) will often have lower transaction costs.

There is no ‘right answer’ to buying or renting. Like any investment decision, it depends on your unique circumstances, expectations of future events, and what is best for you.

Case 2: Buying an additional property for pure investment

This is a more simple investment decision than Case 1, it is a pure investment, as it is not somewhere you are going to live. So, you consider buying a home versus buying stocks, bonds or gold. I will just contrast this decision with a few financial variables and comments.

There have been several studies in America and Europe that conclude returns from real estate are quite similar to returns in the stock market, over the longer term. But, there are two caveats here. First, real estate indexes have largely been unlisted (non-REIT) investments and prices are often estimated whereas stock prices are recorded ‘real prices’. Also, real estate has far less liquidity than stocks listed on major exchanges. So, for me, to invest in real estate instead of major listed stocks, I would need to have a much higher return to compensate me for the loss of liquidity.

Then there is the important decision of diversification. If you own a home and your only big, second investment, is going to be another home, then you have all your wealth concentrated in real estate, no diversification. This is a risky strategy and made more risky by the lack of liquidity. Many people who own a second (investment) home rent it out to earn income. But, this means it is not a passive investment (like holding a stock) but an actual business that you have to manage (or pay someone else to manage). So, owning and managing a second home is not a direct comparison to buying stocks or bonds.

In Conclusion

For many individuals (who are not professional investors), decisions about investing in real estate can sometimes be biased with emotions. This is perfectly understandable for the person or family that owns just one home. But, for most, it will be the biggest investment or their life and so the investment (buying) decision has to be based on sound principles – or you are putting your savings at risk. A few final comments to reflect on and leaving you to come to your own conclusion.

- House prices have been rising for a long time in China. But, as we see elsewhere, prices can go down as well as go up

- Housing is a very illiquid asset and that limits your freedom to move to another city or make other significant changes in your life

- Buying and selling house has large transaction costs associated with the sales and these are often under-estimated by the buyer

- Renting (in a market with good rental regulations) can be a much lower risk way of living – but you will only make a profit from real estate if you are an owner

There is no right or wrong answer for anyone. Everyone is unique and has to carefully evaluate their own circumstances and make the choice that is right for them and that choice may change over time.

John D. Evans, CFA (author) has over 24 years’ experience in the international capital markets working with issuers of securities and investors around the world. He has designed and taught Master’s programmes in investment management at universities in the UK and China. He was most recently Professor of Investment Management at XJTLU in Suzhou. He now manages SEIML, a consultancy to early-stage companies in China.

Jina Zhu (translator) did her Master’s in Economics in France and is fluent in Mandarin, English and French. She also works at SEIML supporting early-stage companies grow and raise capital in China.

5 July 2019

**********