Interview with Mr. Joan Goetz, PhD, Co-founder & CEO | PolyDtech

Poly-Dtech is a young company established by chemistry experts in research and development of fluorescent nanomolecules in the field of health and life sciences. The company aims to become a leader in terms of technical markers applied to medical analysis and imagery. Improving the detection of diseases in order to increase successful treatments and avoid side effects for patients is the vision and ambition of Poly-Dtech.

You can see the first interview with HK Dtech here: https://seiml.com/venture/interview-with-mr-laurent-koehler-co-founder-hk-dtech/

Script of Interview

Interviewee Mr. Joan Goetz (JG)

Position Co-founder & CEO

Company name Poly Dtech

Company website URL https://poly-dtech.com/en/home/

Interviewer John D. Evans, CFA (JE)

Date of Interview: 1 October 2021

About Joan Goetz

JE Okay, good afternoon to the viewers of SEIML Ventures and this episode of our Interview Series, where we are speaking with Mr. Joan Goetz, the Founder and CEO of Poly Dtech. We did a previous interview with one of his colleagues who is in Hong Kong, and viewers will be able to click on the link to see that prior interview in in this location. We’re going to use the same format we use for these interviews, it will be in four parts: we’ll start off talking a little bit about Joan and his background, then we’ll focus on the company, Poly Dtech, and get the details of exactly what it’s doing, its geographic markets and customers. Then we’ll talk, thirdly, about the industry that he operates in, the competitive environment and some of the other elements there. And then we’ll close off with Joan giving us his view about what are the critical upcoming events in the near term and the challenges the company faces. So that will be our overview. So, in that regard, welcome, Joan. Nice to have you here today.

JG Good afternoon, everyone. Thank you John for this interview. I am Joan Goetz, I was born in Strasbourg, I, I grew up in the same city, I did my study in the same. So, after I have a master’s degree in chemistry and biology, and after my master’s degree, I live one year in Australia and Asia. And after this experience, I start my PhD. It’s a joint PhD, I did 18 months in France in Strasbourg and 18 months in Hong Kong. After my PhD, I founded Poly Dtech first in Strasbourg, in France, and three or four months after I founded, HK Dtech in Hong Kong.

JE Okay, okay. So, you’ve been traveling a little bit, I didn’t realize you were in Australia. I know you had some background with Hong Kong and Laurent had mentioned that on the first interview. But tell us now are you fully focused on Poly Dtech, are you still involved in the operations of Hong Kong Dtech or any other activities. What is your full focus?

JG Focus, is 80-90% Poly Dtech, and for the rest for Hong Kong Dtech. And but after is, is very easy to work together because the work is the same. And we work together so in, in, in France, for Poly Dtech I have a team. And it’s for the research and for the business. And Hong Kong, we have a team and we copy a little bit in the same, we copy Poly Dtech that but we have some I mean, we are more advanced, but not a lot. So, for HK Dtech they copy a little bit the work of Poly Dtech. So, it’s very easy to manage between Poly Dtech and HK Dtech.

About Poly Dtech

JE Okay, let me just follow up on that and comparing and contrasting Poly Dtech and Hong Kong Dtech in terms of objectives. Is it that they are, in essence, doing the same thing but just serving different geographic markets? Or will they be doing slightly different things in the future in terms of the technical developments.

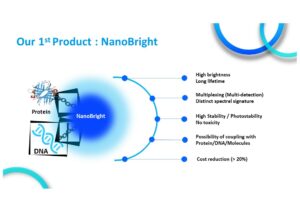

JG For the project, I mean, we develop a nanoparticle for the technology for the project is the same. It’s better after for the application, it is different. So, I mean in in France we work about concept of cardiac disease and with Hong Kong Dtech the work about chlamydia like a sexually transmitted disease, or like malaria. The application of the disease is different between Poly Dtech and HK Dtech.

JE Okay, so the core technology driving the two businesses is the same but they may have slightly different use cases which allows or requires you to make different applications in the two areas to suit the two different objectives of that. Okay, that’s clear to me. Okay, now Laurent told us a little bit about the people in Hong Kong and they were very small number but I think the staff in your entity in France is bigger. Who were the key persons there and tell us a little bit about the people, the numbers and those sorts of things?

JG So, yes, in France we are four persons. We have my director of my PhD, Loïc Charbonnière is a professor, is the CTO of Poly Dtech. He is a key person for the company because he worked with the lab and is the person for the technical or in the scientific parts. And also, we have Mohamadou Sy, he is also a CTO of Poly Dtech. He is the main yes is the main person for the ideas in Poly D-Tech because he manages and prepares a different project with the company. And after we have different persons, is more technical or some PhD student to work about the project. And after we have two persons for the business also. They help me to find a customer or company to make partnership or collaboration

JE Okay, okay. Now you’re located in in Strasbourg. So, and you’re just talking about the business side now, acquiring customers so what is your initial market? Is it France is it the whole EU, where are you focusing on now to develop the business?

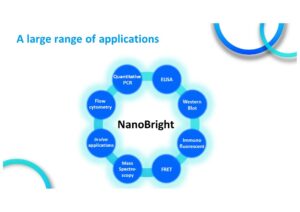

JG Yes to develop as a business we have different paths. So, the first one is we commercialize rapid tests. So, we have for COVID19 we develop and sell different tests for the COVID. After and for the future we continue to sell different rapid tests for different diseases. It’s a first part, the second part we sell the technologies nanoparticle by kits, so the customer is a technician of the researcher in the lab. So, it’s the company of public laboratories, they use this product, is more a biologist because they use a lot of nanoparticle or marker to use to detect disease or biomarker. And the 3rd path is it’s a service. So, for that we developed a test for new nanoparticles for our customers.

JE Okay, now I’m going to just follow up on something because when I first spoke to the Laurent he mentioned the rapid tests. So, I don’t have a science background I come from a business background but my interpretation is the rapid tests are really something quite different from the nanoparticles and the analysis that you’re doing there. Firstly, is that correct? And therefore, do you have sort of like two different business lines or technical lines that that may have a different strategy instead of customers?

JG For the technology is the same because in the rapid test, we have a nanoparticle. So, we developed the nanoparticles and after we add this nanoparticle in test, so we can make a test with our nanoparticles. So, the nanoparticle is like an alarm, just the nanoparticle send a signal and we can see the reality of the disease or not. So, we have the technology to see the disease and we have the materials the equipment to make the test. So, yes is two business but we can make one business together.

JE Okay, so my understanding from what you’ve just said is the rapid test was just one particular application of your core technology. Okay, I’m glad you clarified that, I thought they may be more fundamentally different but this is just one very specific application that you identified at the time of pandemic so it’s just identifying and exploiting a new commercial opportunity that I guess we didn’t anticipate before the pandemic started. Okay, so what sort of the strategy over the next three years for Poly Dtech in terms of the growth of its business, geographically, type of customers etc.

JG So, the first thing the first year The first step is to sell the nanoparticle inside the kit is just for the research, we can earn money and some revenue. And after that I think, in the same time, the idea is to find a different collaboration or partner with a big company in the in vitro diagnostics and to work together and the idea is to improve the test. Just to clarify my work because the company in the in vitro diagnostics they have already tests. The idea is to change the marker and we are the nanoparticle inside the test and we can improve the detection. So, the idea is to create or make a different collaboration and work together. And to improve this test and after this company can sell a new test with very good performance. So, for the company we have two parts, we have the part where we can sell the nanoparticle and this is for the short time, we can sell the technology and for the long time of the two or three year the idea is to work with a big company.

JE Okay. Now when I look at companies before they become mature and list on an exchange, I break them into four categories. Category one is pre revenue, when they’re still doing research or developing a prototype. Category two is when they start generating revenue, the first commercialization, but they’re not profitable. Category three when they become profitable for the first-time and category four when they have a history of profitability. Now I know you’re selling rapid tests, so you’re already generating revenue. So, your commercialization process has started. So how long do you think it will be before the company becomes fully profitable? How far away is that goal?

JG Yes for profitable, I think where we can any can be because these nanoparticles we have a good product to sell. And after I read the company Patronia is on is only six or seven months and after they can put the new project on the market. And after the revenue is very, very fast, very fast. So. So I think after two or maybe three year we can get to a profitable revenue. Yes.

JE So, if you’re not at the point of profitability now, then presumably you have negative cash flow. And does that mean, therefore, you will need to do another one or two rounds of funding? Is there any planning to plan to do funding in the short term?

JG Okay. For the funding? Yes. For the moment is not. I think, what I think that one-year and a half, we have, we have the idea to prepare, funding and raising funding. So, to boost the practical commercialization and collaboration. And yes, after one year and a half we did the first funding.

JE Oh, and when exactly did that happen?

JG What do you mean?

JE When did the first funding happen?

JG Because we did our first funding in the last year, is a very small funding. And now we propose is the second one. The second one for in one year, yes.

JE So, you will see your second fundraising, maybe in the summer of 2022. That seems to be the target date.

JG Yes, is right.

JE Okay. Of course, if you get a lot more revenue, it’s always difficult to predict funding, because if you can get much more revenue in a contract, then maybe you can go longer without it. But for the moment, you’re thinking maybe in another year’s time, you may look at a second round of funding.

JG Yes, exactly.

JE Good to know. So, have there been any fundamental changes in people? Other activities in Poly Dtech, or Hong Kong Dtech since March? Any anything significant happened in the last six months?

JG For Poly Dtech we got different public funding. And it’s very important for us to continue our work, public funding. We start different collaboration with a big company in Europe. For further lateral flow, and the process, public funding is two applications, two different application. So, we work with the two very big company about that. For income that actually we got to also the public funding. I don’t remember the amount so but we got public funding. And now we also we have labs in Hong Kong and we can start the R&D and the production part.

JE Okay, good. So, moving forward in all areas, public funding, the new lab in Hong Kong, new partnerships. So, it sounds like things are progressing well, in in all different areas.

JG Yes, of course. We, we continue our work. And we find a different solution. Example, in Hong Kong, the big problem is the space, the workspace and the lab space. And we find now a laboratory, now is the next the next step in Hong Kong is to find a partner or a company in China to work together and to prove the technology and the performance. So yes, we have a lot of work and we work about to find a solution or partner to grow the company.

JE Okay, now I’ve just taken note of your comment about China, I’m going to add a point which was not on the existing list, but I live in Suzhou and Suzhou is a center for Life Sciences, and healthcare operations in China’s it’s sort of where they’re looking to cluster the companies. So, in the next year, either Poly or Hong Kong Dtech, are you looking to open operations in or some research in mainland China?

JG Just to clarify, HK Dtech works about China and Asia. And Poly Dtech is more European countries, and maybe the USA or Canada. So yes, for the next month, the idea is to prepare and start to work in China for Hong Kong Dtech, yes, and we, for the R&D or for the research, we work together because in Poly Dtech, we have some part of the technology and we know more about the technology, and we help HK Dtech to develop the research and different field of the technology. But now we have a lab in HK Dtech and they can create a team for the for the research and production. And I think we can work together to change the challenge problem of the technology of application between Poly Dtech and HK Dtech.

About the Life Sciences Industry

JE Okay, very, very interesting. So, let’s move on to the third sector, which is talking about the industry. Now I would just generally classify you as health and life sciences. So, who are your main customers? And in terms of type, you mentioned research centers, but are they research in companies, research in hospitals? What is that sort of very specific customer type that that you’re looking to partner with?

JG Yes, for the customer, the main customer is the research person. I mean, because we know we don’t sell directly the nanoparticle tests, to hospital or pharmacy or doctor. We are just four people. So, we are just a part of the diagnostic and we sell this first before the research persons of the company, as a manufacturer, is a use marker or some markers to for the tests, for the kit.

JE Okay, so your immediate customer is a company who manufactures these processes, it might be a public sector or might be a private sector company, but they integrate your offering into a final product that they would then sell to hospitals or other medical organizations.

JG Exactly.

JE So, if you’re an input into another company’s manufacturing, who is your competition, as opposed to the competition of the company that is going to integrate your good and sell it to the hospital? Who is your competitor do you think?

JG We have different competitors. I can say some names or is not?

JE It’s entirely up to you. You’re welcome to mention names, but you’re not required to either, it’s entirely at your discretion.

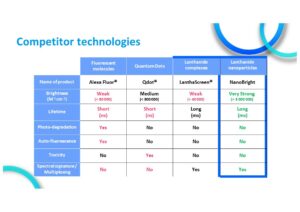

JG Yes, for the competitor, we have the old company as a competitor but we have a different project, I mean for the competitor. So, they have the old projects is now 10 or 20 years. They send these projects for the detection. And now we are a different company with a new product. And so, each competitor has different parameters and different advantage. But for Poly Dtech and HK Dtech we have more advantage because our nanoparticle can resolve the different problem for all other markers, is very technical. That that yes, for the competitor, we have found different competitors in Europe. In China, we didn’t find any yet. But you know that there are some competitors, two or three competitors. But we know for Poly Dtech and HK Dtech, we have a better performance vs. the competitors. Yes.

JE So that’s interesting. Let me let me summarize just to make sure I have this clear because I come from sort of a more traditional commercial background where two companies might be selling very similar things like an automobile, you know, do you want to buy a Volkswagen or do you want to buy a BMW? It’s a final product. And two car companies compete with each other. But as you’re an important input, that’s heavily R&D driven, into another person’s final product, then you’re not really competing at the product level, you’re competing in terms of is your technology better than another research department’s technology, so that you can help your customer provide the best product for them to sell to the hospital? So, it’s sort of like competing on different technology solutions, as opposed to companies selling similar things? Is that a fair analogy?

JG Yes. I mean, it’s similar, yes, very similar. Now the next project for this field is a nanoparticle we can define nanoparticles with the same performance or the same advantage. After the difference and the demand for the customer is the price, the performance and the stability. The problem is the nanoparticles is the stability and the price. Is compasses a competitor or the control. The price is a very big difference between the project because the center is the production of the nanoparticles sometimes is very easy, sometimes very difficult. And the price is high because the sample is defective.

JE Okay, so then you’ve been starting to talk about price. So, let’s let me go to the final point of this is this third section, the general business or revenue model. If you’re selling a technology to another company, for them to combine it to sell a product, how do you charge them? Do you charge them based on the number of final goods they sell? Do you just charge them as sort of a consulting charge and what is your general business or revenue model?

JG For the moment the business revenue is we sell a product. But for the future, the idea is to sell the technology for the company. So yes, if you want to work with a big company, we need to sell the technology for this company.

JE And in under that sort of business model, then you would get paid some royalty or annuity over many years for as long as your technology was used by them?

JG Yes, exactly. Then we get royalty. For different, the idea we can share the technology via disease, by biomarker and by application. So, for each reach path, we can ask a royalty if the company uses a technology. Yes.

Looking forward at the next 12 months

JE Okay. Very, very interesting. So let’s, we’re close to closing out, we’re going to the last section, which is just called looking forward. And, you said that maybe there would be funding by next year. So, let’s look at the next six to 12 months, just for Poly Dtech. What are the important things that you hope to achieve over the next six to 12 months?

JG It’s to launch the product on the market and prepare everything for the market. And the main goal is to sell a product in the next six months. The second order is through continuous collaboration and cooperation to find, to finish the work and after to find a collaboration with a company and to get a royalty. Now for the six months the more important is to get stable revenue. Yes.

JE Okay, so to in general terms, that as time goes on, relatively speaking, you’re going to be spending more energy on the commercialization of the business, as opposed to the research. So as the company moves forward in time and grows, the business issues will become a bigger proportion of the activity as you as you transfer into a more successful commercial organization.

JG Exactly. We transfer the R&D to the business. Yes.

JE Okay. Very, very interesting. So that that brings up all our points. I always close off with the same question about Is there anything else? important news about Hong Kong or Poly Dtech that I didn’t think to ask that you would just like to mention, before we close out

JG For Poly Dtech, yes, for both companies, we work together and the aim or the goal is to, to run up the company together in Europe and in Asia. And for that We, we put all our energy on R&D and the business, but we can transfer the R&D to the business now but the R&D is the main point also because we can find a new partner with the R&D, but now we need to transfer this energy and this technology to the business and to earn money and to continue to leverage both companies and to interest investors for the future also to increase the revenue and, and the business.

JE Okay. Okay. Well, that’s a good summary. I appreciate that. It will be interesting following your development over the coming months and coming years. I’m getting more and more companies in the interviews within the healthcare area, it’s quite fascinating. And certainly, where I live in China I think there’s absolutely huge growth potential for new solutions. But I guess that’s also true globally. So, I really appreciate you taking the time, Joan, good update, and we look forward to following your story over the continuing months and years. So, thank you very much and have a good day.

JE Thank you for everything. And thank you John for the this interview it was a pleasure for me.

End.